On-chain information exhibits the Bitcoin whales have continued to carry onto their cash even if BTC has gone by bearish motion just lately.

Bitcoin Whales Have Participated In Internet Accumulation Since March 1st

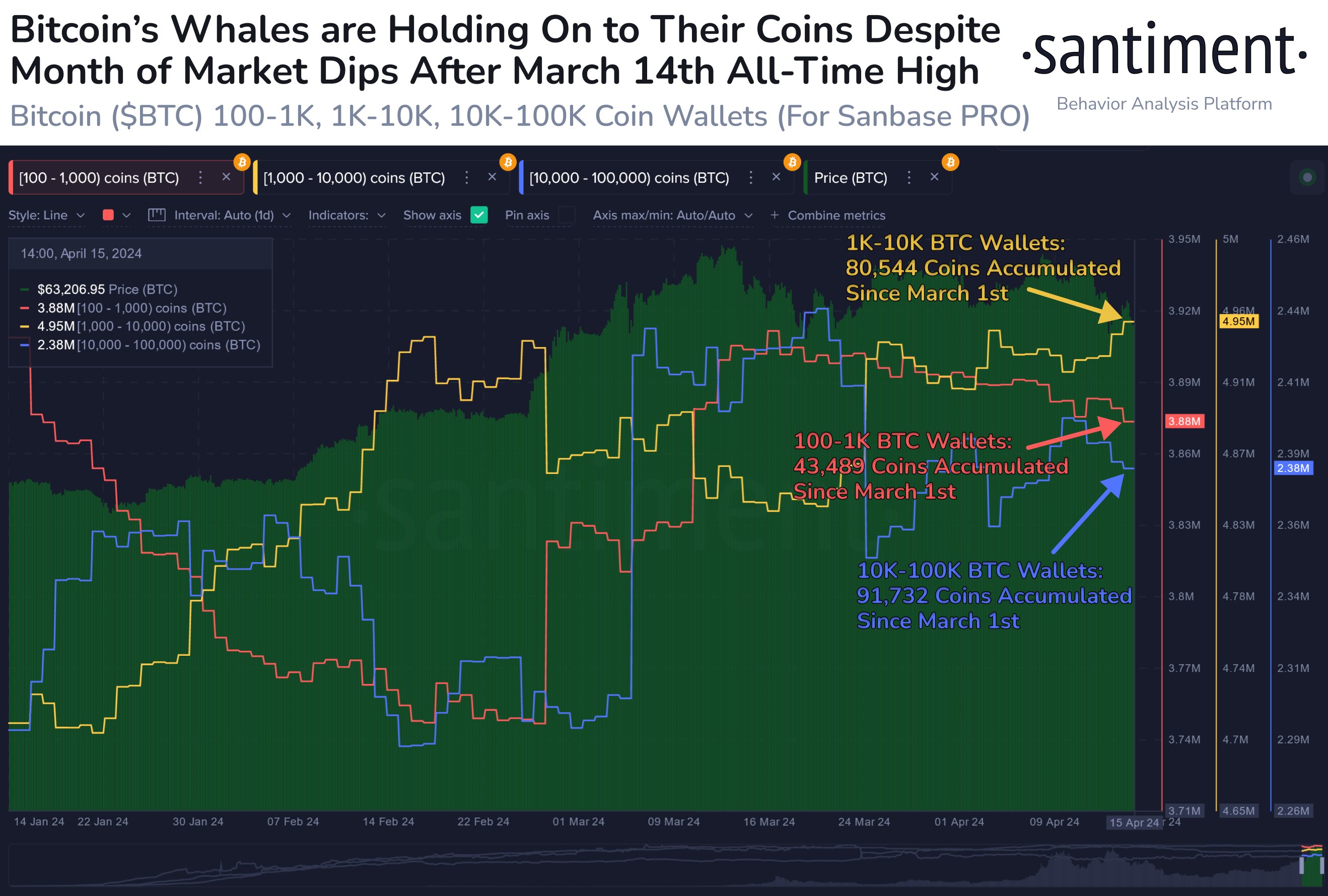

As defined by the on-chain analytics agency Santiment in a post on X, the massive BTC holders out there haven’t been shaken by the latest downturn within the worth.

The indicator of curiosity right here is the “Supply Distribution,” which tells us in regards to the whole quantity of Bitcoin that the varied pockets teams within the sector are holding proper now.

Addresses are divided into these pockets teams based mostly on the variety of cash they presently carry of their steadiness. The 1-10 cash cohort, as an illustration, consists of all addresses or traders who personal no less than 1 and at most 10 BTC.

Within the context of the present dialogue, three cohorts are of relevance: the 100-1,000 BTC, 1,000-10,000 BTC, and 10,000-100,000 BTC. The primary of those correlates to the “sharks.”

The sharks make up for one of many key elements of the market, though they aren’t fairly as influential because the 1,000-10,000 BTC traders, referred to as the whales. That is naturally as a result of distinction within the scale of holdings between the 2.

The final one, the ten,000 to 100,000 BTC cohort, consists of the biggest of the entities within the sector, that are greater than even the same old whales. Generally, they’re popularly known as the “mega whales.”

Now, here’s a chart that exhibits the pattern within the Bitcoin Provide Distribution over the previous couple of months:

How the provides held by the varied key investor teams have modified for the reason that begin of the 12 months | Supply: Santiment on X

As displayed within the above graph, the Bitcoin Provide Distribution of all of those key holders has gone up for the reason that begin of March, suggesting that they’ve been collaborating in some web accumulation.

To be extra particular, the sharks have purchased 43,489 BTC (equal to $2.72 billion on the present trade price) inside this era, the whales 80,544 BTC ($5.04 billion), and the mega whales 91,732 BTC ($5.75 billion).

As is seen within the chart, although, the timing of the buys wasn’t fairly the identical between these cohorts. It might seem that the mega whales participated in some wholesale aggressive accumulation in the beginning of final month, which led to the rally in direction of the brand new all-time excessive (ATH) worth.

The whales bought into this ATH and solely purchased as soon as the drawdown had completed following this peak, whereas the sharks constantly purchased because the rally in direction of the ATH occurred after which stopped buying additional.

Given this pattern, it might seem doable that the ATH rally was fueled by large purchases from the mega whales. These humongous traders bought some after the preliminary worth drawdown however have since held tight.

On this identical window, the sharks and whales even have roughly seen sideways motion of their holdings. That is even if bearish worth motion has continued for Bitcoin.

BTC Value

On the time of writing, Bitcoin is floating round $62,600, down greater than 11% during the last seven days.

Seems to be like the value of the coin has seen some web decline over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Todd Cravens on Unsplash.com, Santiment.web, chart from TradingView.com