In 2021, the COVID-19 pandemic pushed the world authorities to inject liquidity, positively impacting Bitcoin and legacy markets. Right now, the monetary world is perhaps on the cusp of experiencing an analogous capital injection, doubtlessly setting the stage for a crypto bull run.

China’s Play Might Profit Bitcoin And Crypto Costs

Based on a report from Bloomberg, Chinese language authorities are exploring injecting capital into their inventory market. Chinese language equities have been on a downtrend for a number of weeks. The bearish momentum has pushed authorities within the nation to take “forceful” steps, per a high-ranking authorities official.

In that sense, Bloomberg claims that China might inject round $300 billion to create a “stabilization fund” to revive investor confidence. The Chinese language authorities might additionally spend round $30 billion shopping for onshore shares.

These measures spotlight the emergency confronted by the Asian big. Its CSI 300 Index, which tracks the most important firms in China, reached a five-year low. A disaster in the actual property sector has been driving the downward value motion.

Through the COVID-19 pandemic, governments had been pressured to inject billions of {dollars} to stop an financial catastrophe. This “Stimulus Package” translated into larger costs for Bitcoin and the crypto market as individuals sought mechanisms to generate revenue.

If China follows its technique, Bitcoin and legacy markets may gain advantage from the elevated liquidity. The co-founders of the crypto analytic agency Glassnode said the next on China’s determination and its potential to catalyze the costs throughout the nascent sector:

The Liquidity surge begins. China will attempt to prop up its markets by huge liquidity. It is rather to be the catalyst that may make crypto and fairness markets soar into the primary a part of 2024.

Nonetheless, not like in 2021, right now, there’s a danger of heating inflation, which led the US Federal Reserve and world central banks to tighten their financial insurance policies. On the chance that the Fed follows China in offering liquidity for the worldwide market by printing extra {dollars}, the Roscongress Basis added:

US authorities will be unable to start out the “printing press” once more this 12 months, as a result of this could result in one other spherical of inflation (…)

All About Liquidity

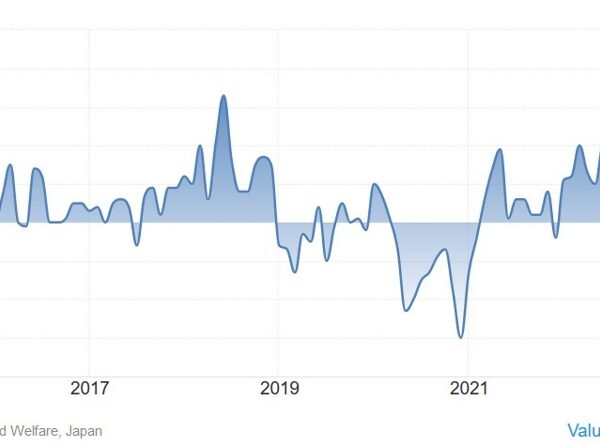

In a separate report, the co-founder and former CEO of BitMEX, Arthur Hayes, noted the decline in liquidity within the crypto market. Following the launch of a number of spot Bitcoin Alternate Traded Funds (ETFs) within the US, the sector skilled a spike in promoting strain.

Consequently, the Bitcoin value decoupled from conventional markets within the brief time period. Based on Hayes, the promoting strain within the value of BTC hints at “hiccups” for US greenback liquidity, as seen within the chart under.

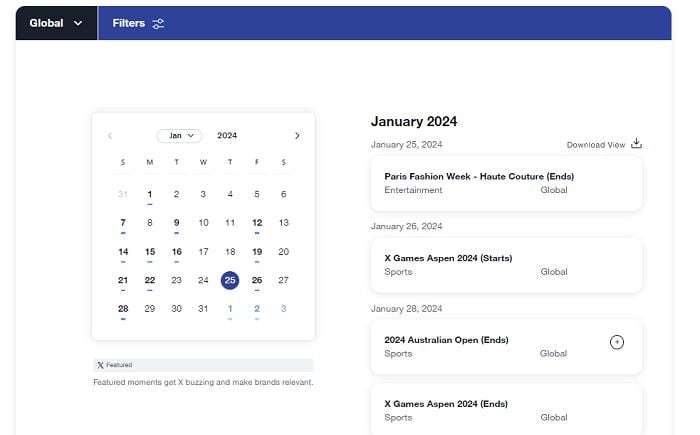

In different phrases, on low timeframes, the crypto founder expects hurdles for the bullish momentum till the following macroeconomic occasion within the US, set for January thirty first, when the Secretary of the Treasury, Janet Yellen, will give a speech. Hayes famous:

$BTC appears to be like mad heavy. I feel we break $40k. I went lengthy some 29Mar $35k strike places. I feel we dump into the 31 Jan US Treasury qtly refunding annc (announcement). Is Janet Yellen or Talkin’?

Cowl picture from Unsplash, chart from Tradingview