Key Notes

- BitMine increased ETH holdings to 1.15 million tokens within one week, boosting treasury value to $4.96 billion total.

- Fundamental Global purchased 47,331 ETH tokens as part of ambitious $5 billion acquisition fund targeting market dominance.

- Technical indicators show bullish momentum with potential targets at $5,000, though record open interest creates liquidation risks.

Ethereum

ETH

$4 251

24h volatility:

1.2%

Market cap:

$512.86 B

Vol. 24h:

$42.39 B

price crossed the $4,360 mark on Monday, August 11, setting a higher daily peak for the fifth consecutive session. The latest surge is primarily driven by BitMine’s aggressive treasury expansion, as the Nasdaq-listed company disclosed a massive ETH accumulation spree that added over 316,000 tokens to its holdings within just one week.

BitMine Immersion increased its ETH holdings from 833,137 tokens to 1.15 million, boosting its treasury valuation by $2 billion to reach $4.96 billion total. This corporate buying pressure has coincided with derivatives market activity reaching unprecedented levels, as ETH open interest climbed to nearly $60 billion, signaling intensified institutional and retail interest in Ethereum’s price trajectory.

“We are leading crypto treasury peers by both the velocity of raising crypto NAV per share and by the high trading liquidity of our stock,” Thomas Lee, Fundstrat Chairman and BitMine Board Director said.

According to Yahoo Finance, BitMine stock (NASDAQ:IMMR) ranks among the 25 most actively traded US equities, with a $2.2 billion five-day average daily dollar volume, surpassing JPMorgan and Micron Technology.

Meanwhile, Fundamental Global (Nasdaq: FGNX) also announced its first ETH purchase of 47,331 tokens, just days after launching a $5 billion acquisition fund targeting 10% of Ethereum’s total supply. The company aims to become one of the largest ETH treasury holders globally.

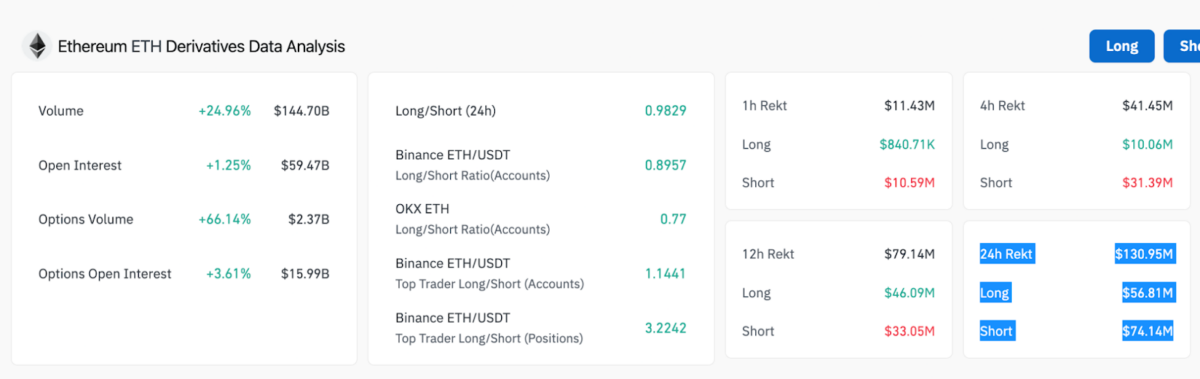

In the derivatives market, ETH open interest rose 1.25% to $59.47 billion, its highest level yet, while 24-hour trading volume climbed 24.96% to $144.7 billion.

Ethereum Derivative Market Analysis | Coinglass

According to Coinglass data, options volume surged 66.14% to $2.37 billion, signaling heightened speculative positioning. Liquidations totaled $130.95 million, split between $56.81 million long positions and $74.14 million shorts.

If corporate treasury demand for Ethereum persists as hinted by Standard Chartered analysts, and derivatives traders continue to place more aggressive bullish positions, Ethereum price could be on the verge of reclaiming all-time highs above $4,900.

However, with Ethereum bulls clearly over-leveraged at record open interest levels near $60 billion, a downturn in market sentiment could trigger rapid liquidations.

ETH Price Forecast: Will ETH Hit All-Time Highs Above $5,000?

The daily ETH/USDT chart shows a strong bullish structure, with price trading above the upper Bollinger Band at $4,287. The recent breakout from $4,000 support is backed by expanding Bollinger Band width, indicating increasing volatility in favor of buyers.

MACD lines remain well above the zero level, with the blue line (MACD) widening over the signal line, reinforcing bullish momentum. The last five daily candles have all closed in green, signaling strong buying pressure.

Ethereum Price Forecast | ETHUSD 24H Chart TradingView

If ETH price closes above $4,360 with sustained volume, the next upside targets sit at $4,500 and all-time highs above the $4,891 mark last seen during the 2021 bull cycle. A breach above $4,800 could open the path to $5,000 psychological resistance.

On the downside, failure to hold above $4,287 could bring a retest of the mid-Bollinger Band level at $3,796. A daily close below this would invalidate the near-term bullish setup and expose ETH to deeper pullbacks toward $3,400 support.

Best Wallet Presale Crosses $14 Million as Ethereum Corporate Adoption Accelerates

With Ethereum corporate treasuries pulling billions in inflows over the past month, ETH-compatible crypto wallets like Best Wallet (BEST) are positioned for major gains. As ETH’s adoption accelerates, Best Wallet aims to become the default gateway for both institutional and retail ETH holders.

Best Wallet Presale

Having raised over $14 million in its presale, Best Wallet offers early participants exclusive benefits, including reduced transaction fees, high-APY ETH staking, and priority access to upcoming decentralized applications.

The presale’s rapid growth reflects increasing demand for secure, multi-chain wallets optimized for Ethereum’s DeFi ecosystem. Investors seeking early exposure can visit Best Wallet’s official site before the next presale price tier unlocks.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.