Key Notes

- The company now controls over 2% of Ethereum’s total supply following aggressive Q3 accumulation strategy.

- BMNR stock gained 41.7% over the past month as Ethereum delivered its strongest third-quarter performance on record.

- Chairman Tom Lee aims to acquire 5% of ETH supply while courting AI firms and Wall Street at Token 2049.

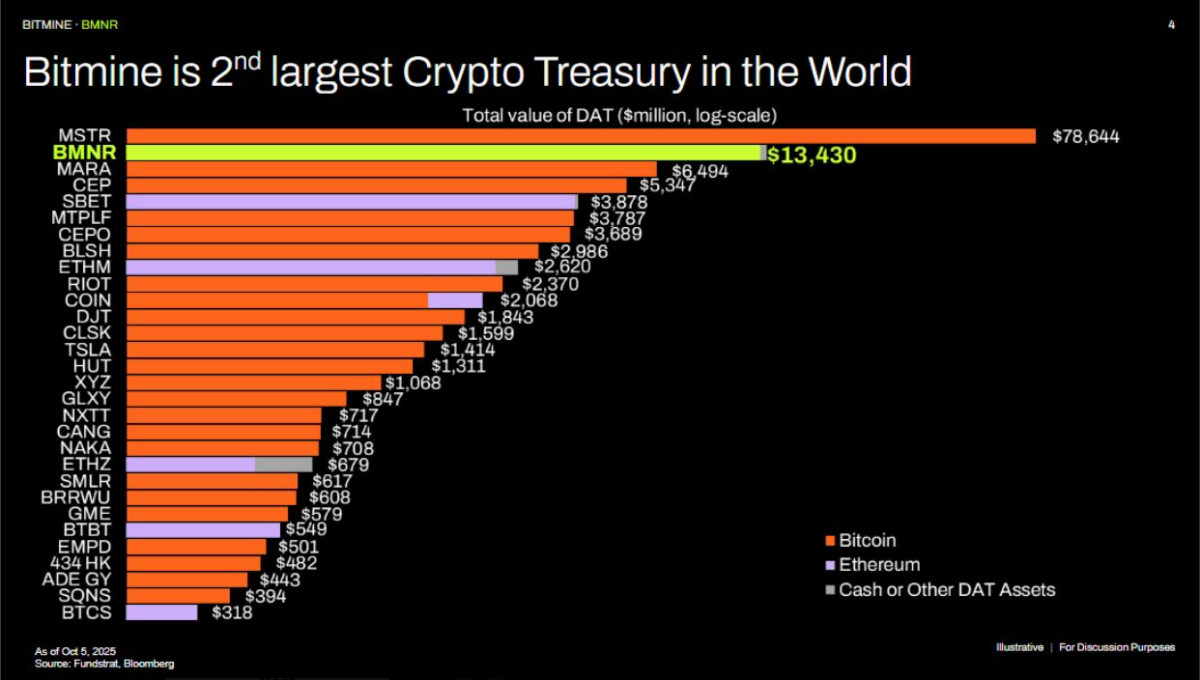

Ethereum treasury investor Bitmine Immersion Technologies (BMNR) has achieved a historic milestone, surpassing Marathon Digital to become the world’s second-largest crypto treasury holder.

According to Bitmine’s official press release on October 6, the firm’s combined crypto and cash holdings now total $13.4 billion, including 2.83 million Ethereum

ETH

$4 708

24h volatility:

4.6%

Market cap:

$567.79 B

Vol. 24h:

$37.66 B

, $456 million in unencumbered cash, and minor Bitcoin

BTC

$125 787

24h volatility:

2.4%

Market cap:

$2.51 T

Vol. 24h:

$66.00 B

and equity stakes.

Bitmine overtakes Marathon Digital as second largest crypto treasury |Strategy Inc. (MSTR) Source: Fundstrat

At current market prices of $4,535 per ETH, Bitmine’s Ethereum reserves are now worth approximately $13.4 billion, giving it control of over 2% of the total ETH supply.

Bitmine’s rapid ETH accumulation in Q3 propelled it ahead of Marathon Digital, whose $6.5 billion holdings remain largely Bitcoin-based.

Only Michael Saylor-led Strategy ranks higher globally, holding 640,031 BTC valued at $80 billion.

As Ethereum delivered its best-ever Q3 performance, Bitmine’s aggressive accumulation has impacted its stock performance positively. BMNR rose 41.7% in the past month and was trading at a market cap of $17.7 billion at the time of this report.

Bitmine (BMNR) stock price performance as of Oct 6, 2025 | NASDAQ

Backed by prominent investors including Cathie Wood’s ARK Invest, Founders Fund, Pantera, Galaxy Digital, and DCG, Bitmine continues to pursue Chairman Thomas “Tom” Lee’s long-term goal of acquiring 5% of Ethereum’s circulating supply.

Tom Lee Woos AI and Wall Street Players for Ethereum at Token 2049 in Singapore

At the Token 2049 conference in Singapore, Bitmine Chairman Tom Lee reaffirmed the company’s long-term commitment to Ethereum, citing fresh talks for AI integration.

“Tom Lee Ethereum thesis is retarded.”@fundstrat responded,

In the crypto world being retarded is a good thing. I took it as a compliment. I’m ETH-tarding!

This is why I love Bitmine and Tom.

Their humor perfectly aligns with mine! $ETH / $BMNR pic.twitter.com/cOUlLPatLA

— Kodi (BMNR) 📌 (@SweatyKodi) October 5, 2025

“We spent the past week in Singapore at Token2049 meeting with many leaders in the crypto and blockchain industry. The BitMine team sat down with Ethereum core developers and key ecosystem players and it is clear the community is focused on enabling Wall Street and AI to build the future on Ethereum,” said Lee.

Lee emphasized Ethereum’s 100% uptime, established developer community, and deep liquidity as potential value drivers for AI infrastructure.

Ethereum price surged 4% intraday, climbing above $4,719, its highest level since mid-September. This marks the strongest single-day rally since October 1, signaling renewed optimism as investors anticipate bullish reactions to the US shutdown to spill over into the week ahead.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.