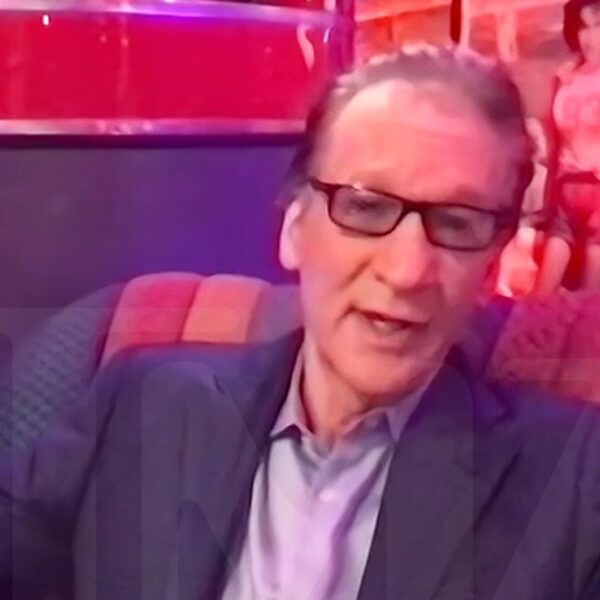

Mark Spitznagel has developed a reputation as a pessimist over the years. But it’s a distinction the co-founder and CIO of the personal hedge fund Universa Investments has earned for good motive. If you warn, repeatedly, that the Federal Reserve has helped blow up the “greatest credit bubble in human history” and all bubbles finally pop, traders—and the media—will are likely to concentrate on the bearish a part of your outlook. Plus, Spitznagel’s patented technique, known as tail threat hedging, seeks to revenue from sharp market downturns, and he’s employed Nassim Taleb, the statistician and educational who popularized the idea of the rare and unexpected event known as a “black swan,” as a “distinguished scientific advisor.”

However, Spitznagel says he’s a bit misunderstood, and so is his technique. Tail-risk hedging is supposed to guard traders when issues go improper—an “insurance policy” of kinds, the Wall Road veteran tells Fortune—however the true worth of that’s it permits Universa’s purchasers to speculate extra of their portfolios in shares with value appreciation potential; to tackle extra threat, not much less. As Spitznagel put it, “the entire point of it is that they can be longer.”

Nonetheless, most media headlines about Spitznagel, together with ours right here at Fortune, are likely to concentrate on his bearish forecasts. And whereas there’s a clear reason for that—in spite of everything, Spitznagel lately told Business Insider that he believes the “worst market crash since 1929” is coming—the hedge funder has certainly been bullish in recent times. He argued in his 2023 investor letter, seen by Fortune, {that a} inventory market rally was coming, and has stated publicly on a number of events that till the Fed begins slashing rates, markets will seemingly hold rising.

“I’ve talked with a couple of people and it always comes away that I’m some permabear. Which is fair, because my entire life I’ve been skeptical…of monetary interventionism and just the destructiveness that it has on investors, on the economy, and on capital,” Spitznagel stated. “But at the same time, clearly, I’m not a permabear. I’ve been as positive on this market as I could possibly have been in the last year and a half.”

Even now, after a virtually 10% year-to-date run for the S&P 500, Spitznagel stays, let’s say, cautiously bullish. With the Fed placing its charge hikes on pause in July 2023 and company bulletins round AI receiving all types of hype, markets have been in a sentiment-induced “Goldilocks zone,” in response to the hedge funder. “And we have a bit more to run on this,” he instructed Fortune.

The Goldilocks zone

Regardless of his considerations in regards to the long-term affect of our rising nationwide and personal money owed, and the lagged affect of the Fed’s charge hikes on the financial system, Spitznagel argued that traders are ignoring these negatives and driving markets increased for now. That’s as a result of “sentiment was so bad in ‘22, we thought we’re in the ‘70s, and that sentiment had to flip both in the markets and even in the economy,” he stated.

For Spitznagel, the present inventory market rally is solely based mostly on a comparatively dovish Fed and bullish investor sentiment, “both of which are just basically juice.”

However like every Goldilocks zone, this one gained’t final eternally. Traders’ constructive sentiment alone can’t carry markets increased indefinitely; fundamentals like earnings and financial progress will finally grow to be related. And Spitznagel nonetheless believes that increased rates of interest are weighing on the financial system, which suggests the basics gained’t maintain collectively eternally.

“The Fed did a lot. And now it’s sort of jawboning its way out of it. But it can’t take back what it did,” he stated. “Markets follow fundamentals at the end of the day, but you can have these little Goldilocks zones where it can get sort of untethered.”

We could also be in a Goldilocks zone now, however when the Fed begins slicing rates of interest, which many on Wall Road count on to occur this 12 months, Spitznagel argued that it will likely be an indication that the financial system is feeling the load of years of rising borrowing prices in an period of surging private and non-private money owed.

The fallout from the “the fastest, greatest tightening ever, by some regards, into the greatest credit bubble of human history” can’t be prevented, he added, arguing “that’s when things are going to be really bad—and at that point, it’s probably also too late to get out.”

Okay, however what about being bullish? I believed Spitznagel stated he was bullish? And sure, “again, I’m sounding like a permabear right now,” the hedge funder admitted.

However with AI hype rising and the Fed “sort of apologizing” for elevating rates of interest so aggressively ever because it paused its hikes final July, in response to Spitznagel, we’re in one in every of “these zones where everything feels really good, where there’s sort of this middle ground.” So he’s no less than bullish within the near-term, even when he nonetheless fears a disaster may hit sooner or later.

However bear in mind: ‘Cassandras make terrible investors’

In Greek mythology, Cassandra was a princess of Troy who had the curse of with the ability to see the longer term—however not being believed by anybody she warned. (This was notably fateful in her warning to the Trojans that the well-known horse the Greeks gave them was not a present, however a trick.)

Traders reserve the time period “Cassandra” for individuals who make prophetic forecasts which are ignored by the plenty. However the factor is, in the case of managing cash, those that purely preach doom and gloom, with out understanding the ability of the markets and the American financial system over the long run, don’t find yourself doing too effectively, in response to Spitznagel.

“I can’t say this strongly enough: Cassandras make terrible investors,” the hedge funder stated, repeating himself for emphasis and including: “with no exception.”

The remark, which could be seen by some as a critique of fellow hedge funder Michael Burry of Large Quick fame, who goes by Cassandra B.C. on X, is admittedly a bit odd coming from Spitznagel—a person who, once more, has warned simply this previous 12 months about “the greatest credit bubble in human history” and “the worst market crash since 1929.”

However on the identical time, Spitznagel does at all times keep on with one in every of Warren Buffett’s key bullish ideas: Don’t wager towards America. The Wall Road veteran stated that—even with a brewing debt disaster and mounting odds of a inventory market crash—over the long run, American companies will proceed to innovate and increase. “You can be very, very long term positive, but understand nevertheless that there are crises ahead,” he defined.

Spitznagel believes traders would solely harm themselves by attempting to time market entries and exits. And he warned that skilled traders who inform the plenty to flee shares typically achieve this on the worst doable time. These doomsayers have the posh of with the ability to wait a very long time for a payoff, however most People don’t have that point or capital.

Now, as traders’ euphoria over AI continues to develop, Spitznagel stated that “what’s going to end up happening is all those Cassandras are going to finally buy into this market at the highest, which probably isn’t too far away.”

Too typically, he stated, traders find yourself shopping for at market highs, after which promoting when there’s a crash. As an alternative of that, Spitznagel recommends the common investor hold some additional money readily available, making certain that when there’s a market dip, it gained’t drive them to promote on the worst second.

If all you do is purchase and maintain the biggest American companies, a market crash is merely a possibility to load up for the long run, he argued. Even the reputed permabear who fears a debt disaster is coming believes the most suitable choice for the common investor is to easily purchase and maintain the S&P 500 for the lengthy haul, including to your place when the market falls.

“If I was only allowed to make one trade for the next 20 years, and I had to do it today, and I [could] not touch a portfolio for 20 years, I would buy the S&P [500],” he stated. “Because remember: Cassandras make terrible investors.”