After a false start on Tuesday, the Securities and Trade Fee on Wednesday lastly accepted spot Bitcoin ETFs.

In a filing, the company introduced that functions for 11 issuers, together with BlackRock and Grayscale, had been accepted—the end result of a course of that started in 2013 when the Winklevoss twins unsuccessfully sought approval for the primary Bitcoin ETF.

With the SEC approving the ultimate types from the issuers, buying and selling is about to start on Thursday.

“It’s a moment of traditional finance finally having broad-based, convenient access vehicles,” stated Robert Mitchnick, head of digital property for BlackRock, in an interview with Fortune.

Pipe dream

ETFs, or exchange-traded funds, have grown in recognition over the previous 20 years, offering buyers entry to a basket of property equivalent to shares or commodities that may be traded within the type of shares on main exchanges.

A spot Bitcoin ETF, which tracks the present worth of the favored cryptocurrency, had lengthy been a pipe dream for the crypto business, with the hope it might open new flows of funding from wealth managers and on a regular basis merchants who in any other case wouldn’t purchase digital property on exchanges like Coinbase.

Beneath successive administrations, the SEC rejected functions for spot Bitcoin ETFs, citing the immaturity of the market and the potential for manipulation. Even after the company in 2021 approved a Bitcoin futures ETF, which trades derivatives on Commodity Futures Buying and selling Fee–regulated exchanges, the SEC continued to disclaim functions for spot ETFs.

That dynamic modified when Grayscale, a outstanding crypto asset supervisor that runs the biggest Bitcoin belief, sued the company in 2022 for permitting futures-based ETFs however not spot automobiles. In anticipation of a victory, BlackRock filed for a spot Bitcoin ETF in June 2023—a sign to many who approval was inevitable. After Grayscale won its case in August, the timeline was set in movement.

The previous few months have been full of hypothesis over when approval may come, in addition to how the mechanics round such novel merchandise would work. After a flurry of conferences between potential issuers and the SEC in December, the company pushed a cash model for creation and redemption of shares, which means the onus for getting and promoting Bitcoin could be on the issuers.

End line

Anticipating that the SEC would relent—even below the crypto-skeptical chair, Gary Gensler—the Bitcoin ETF race attracted main gamers from throughout the worlds of conventional finance and crypto. Whereas BlackRock stays the highest-profile issuer, because of its current fleet of ETF merchandise, different accepted companies embody Constancy, Franklin Templeton, and Cathie Wooden’s ARK.

Crypto-native companies, hoping to entice buyers by touting their expertise within the digital property house, embody Grayscale, Hashdex, and Valkyrie.

The frenzy additionally attracted different gamers that aren’t issuing Bitcoin ETFs however assuming associated roles. Coinbase is serving because the Bitcoin custodian for almost all of issuers, whereas companies equivalent to JPMorgan, Jane Avenue, and Virtu are set as authorized participants—companions who sit in between issuers and buyers to deal with the creation and redemption of ETF shares.

Given the crowded area of entrants, which incorporates 11 newly accepted issuers, companies have spent the previous few weeks undercutting each other by offering lowered charges and waivers. Others have relied on advertising campaigns with flashy tv advertisements and appeals to the crypto group. One issuer, the asset supervisor VanEck, pledged 5% of earnings to the builders who preserve Bitcoin’s blockchain.

The subsequent growth to observe shall be how a lot capital flows into the newly opened market, in addition to which issuers seize essentially the most market share. In a Twitter Areas final week, Matthew Sigel—VanEck’s head of digital asset analysis—claimed that BlackRock anticipated $2 billion of capital to move into ETFs from current Bitcoin holders alone.

“There’s lots of hype and fascination over the approval and launch and all that, but we really think of this over a much longer time horizon,” Mitchnick advised Fortune.

The decider

Onlookers had Wednesday circled on their calendar as a result of it was the deadline for the SEC to approve the primary issuer in line, ARK. Regardless of assurances of the date, shock waves rippled by means of the crypto world on Tuesday when a tweet from the SEC’s official account introduced the approval of each Bitcoin ETF software. The company shortly clarified that its account had been hacked, with the wrongdoer nonetheless unknown.

The SEC’s approval on Wednesday got here earlier than the official shut of market, prompting additional fears of a false begin—particularly after the preliminary submitting disappeared from its web site.

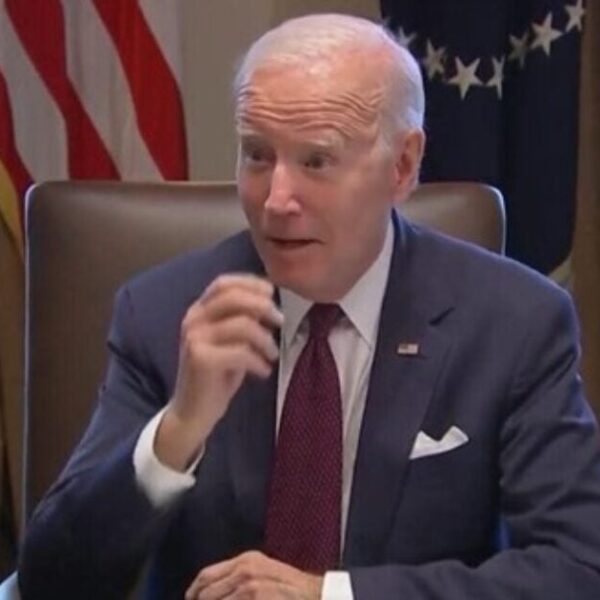

This time, the inexperienced gentle proved actual, with Gensler posting his own statement to the SEC’s web site warning that the company’s approval of the ETF is just not a sign that it’s going to approve the listings of different crypto asset securities.

Maybe most stunning, in a 3-to-2 vote, Gensler, a Democrat, sided with the fee’s two Republicans in voting to approve the ETFs, with the 2 different Democrats dissenting.

“As I’ve said in the past, and without prejudging any one crypto asset, the vast majority of crypto assets are investment contracts and thus subject to the federal securities laws,” Gensler wrote, including that the approval was not an endorsement of Bitcoin.

‘Historic milestone’

“I am happy to confirm that the Grayscale team has received necessary regulatory approvals to uplist GBTC to NYSE Arca,” Jenn Rosenthal, the agency’s VP of communications, wrote in a press release to Fortune shortly after the information broke.

“We are encouraged by the SEC’s decision and are excited to be at the forefront of providing U.S. investors a simpler means of allocating towards digital assets,” Roger Bayston, head of digital property at Franklin Templeton, stated in a press release shared with Fortune after the agency’s remaining prospectus had been accepted.

Crypto-friendly lawmakers additionally celebrated the choice, together with Home Monetary Providers Committee chair Patrick McHenry (R-N.C.) and the chair of the Digital Belongings Subcommittee, French Hill (R-Ark.)

“Today’s spot Bitcoin ETF approvals mark a historic milestone for the future of the digital asset ecosystem in the United States,” they wrote in a press release shared with Fortune.