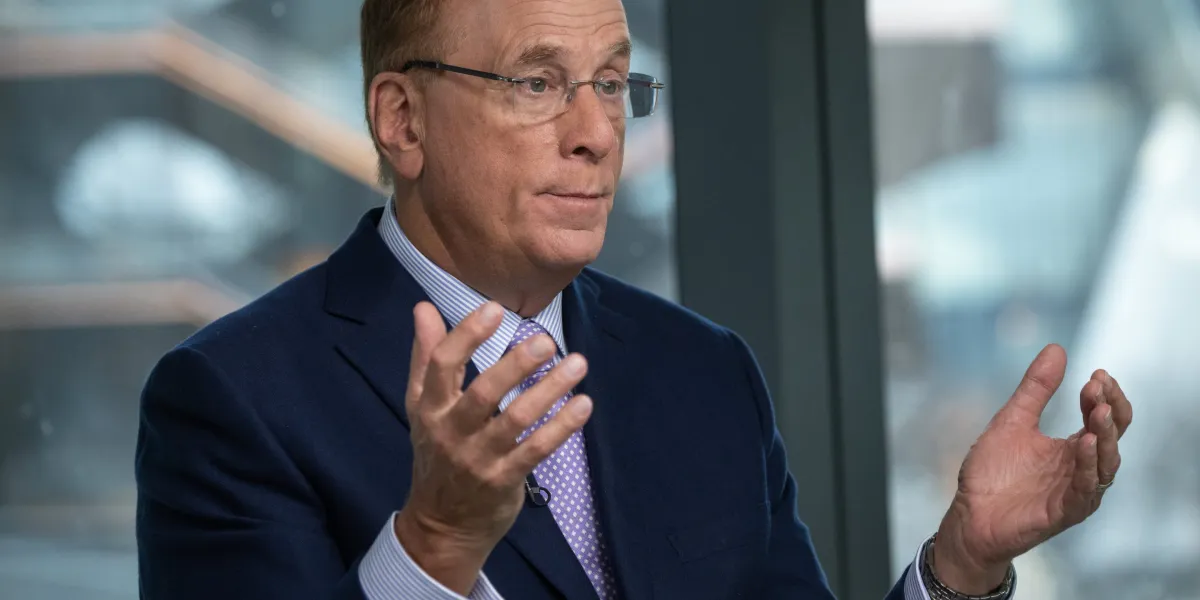

BlackRock Inc. Chief Govt Officer Larry Fink warned of a looming “retirement crisis” going through the US and known as on child boomers to assist youthful generations save sufficient for their very own futures.

That, he mentioned, will forestall them from changing into disillusioned with capitalism and politics in coming years.

With individuals residing longer lives however struggling to afford them and plan correctly, Fink used his annual letter as chairman of the world’s largest asset supervisor to induce company leaders and politicians to pursue “an organized, high-level effort” to rethink the retirement system. Greater than half of BlackRock’s $10 trillion of consumer belongings are managed for retirement.

“It’s no wonder younger generations, Millennials and Gen Z, are so economically anxious,” Fink wrote within the letter to BlackRock traders Tuesday. “They believe my generation – the baby boomers – have focused on their own financial well-being to the detriment of who comes next. And in the case of retirement, they’re right.”

Younger individuals “have lost trust in older generations,” Fink wrote. “The burden is on us to get it back. And maybe investing for their long-term goals, including retirement, isn’t such a bad place to begin.”

Fink mentioned members of the boomer era in positions of company management and politics have an obligation assist fix the system, and he questioned whether or not age 65 ought to nonetheless be the traditional notion of when individuals retire. People are eligible for Social Safety advantages as early as age 62, and people born after 1960 are thought of at full retirement age at 67. Medicare medical insurance protection begins at 65.

“No one should have to work longer than they want to,” Fink wrote. “But I do think it’s a bit crazy that our anchor idea for the right retirement age – 65 years old – originates from the time of the Ottoman Empire.”

By mid-century, a sixth of individuals globally will likely be over 65, up from 1-in-11 in 2019, Fink mentioned, citing information from the United Nations. Nearly half of Individuals age 55 to 65 didn’t have cash in private retirement accounts, he mentioned, referring to 2022 US Census information.

“The federal government has prioritized maintaining entitlement benefits for people my age (I’m 71) even though it might mean that Social Security will struggle to meet its full obligations when younger workers retire,” Fink wrote.

Fink mentioned BlackRock will announce a collection of partnerships and initiatives over the approaching months to weigh main questions, together with the common age of retirement and the way to encourage older Individuals to proceed working in the event that they need to accomplish that. The decline of outlined profit pensions has additionally made it tougher for individuals, together with those that have saved rigorously on their very own, to know how a lot they’ll spend in retirement, he added.

“The shift from defined benefit to defined contribution has been, for most people, a shift from financial certainty to financial uncertainty,” Fink mentioned.

Rising Criticism

Within the greater than a decade since Fink started writing high-profile annual letters to company executives and shareholders, BlackRock consumer belongings have surged to greater than $10 trillion, with vital stakes in firms, personal belongings and bond markets worldwide. The letters, usually revealed at the start of every yr, have given Fink and the corporate a robust say on social and political points — and have drawn growing criticism from all corners.

The give attention to retirement this yr emphasizes a core a part of BlackRock’s investing enterprise since its begin in 1988 and follows a number of years during which Fink used his letters to press for larger motion on world warming, solely to then discover himself — and the corporate — in a political maelstrom.

Local weather change advocates say the agency isn’t taking sturdy sufficient motion, whereas Republicans criticize Fink and BlackRock for allegedly hurting fossil-fuel producing states and selling “woke” capitalism. Earlier this month, Texas officers mentioned they might divest $8.5 billion in school-finance funds from BlackRock and criticized the agency for hurting vitality pursuits within the state.

Fink mentioned he has stopped utilizing the time period ESG and over the previous yr has emphasised the corporate’s work with vitality companies. BlackRock has scaled again its participation in worldwide local weather investing alliances, and it has given shoppers extra say over how their shares are voted at firm conferences as an alternative of counting on the cash supervisor to vote.

Within the letter, Fink mentioned he’s now targeted on “energy pragmatism.” Decarbonization and the transition to scrub applied sciences will take time, he mentioned, and nations more and more need to be certain they’ve dependable and protected entry to vitality sources, notably after Russia’s invasion of Ukraine.

BlackRock has greater than $300 billion invested in conventional vitality companies and $138 billion in vitality transition methods, he mentioned.

Extra feedback from Fink’s letter:

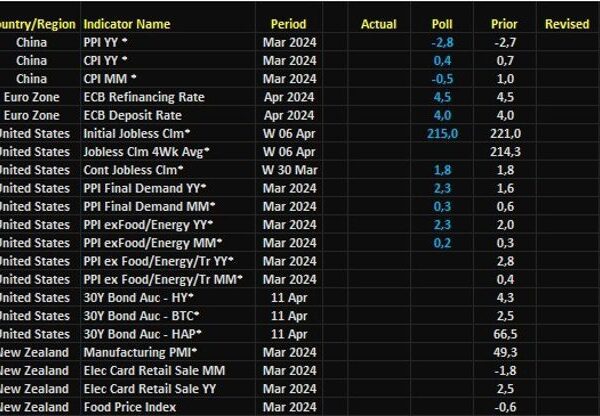

- The US public debt state of affairs “is more urgent than I can ever remember,” and the three share factors in additional curiosity funds the US authorities now should pay on 10-year Treasuries in contrast with three years in the past is “very dangerous”

- Personal partnerships with governments are how giant infrastructure tasks will likely be constructed sooner or later, and BlackRock’s $12.5 billion acquisition of World Infrastructure Companions positions the agency to develop within the trade

- BlackRock is “particularly excited” concerning the enterprise alternative for the agency’s bond managers given the surge in yields after 15 years of a low-rate surroundings and since shoppers are reconsidering their fixed-income allocations