Rumors recommend that BlackRock plans to provide itself a head begin by transferring funds from its personal Bitcoin belief to its ETF.

Large asset supervisor BlackRock Inc (NYSE: BLK) might have set plans in movement that can put the corporate effectively forward of its competitors if the US Securities and Alternate Fee (SEC) approves a spot Bitcoin ETF. BlackRock, more likely to obtain approval based on market observers, might have began the ETF race effectively upfront.

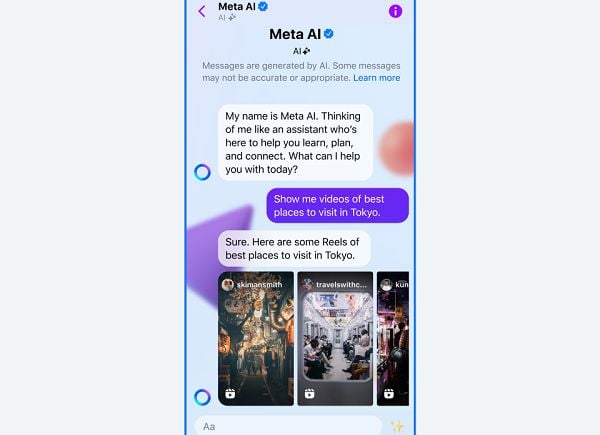

In keeping with Bloomberg ETF analyst Eric Balchunas, there are rumors that BlackRock may transfer the property in its spot Bitcoin personal belief into its ETF if it receives approval. In an X post on Tuesday, Balchunas says that though the roughly $200 million moved to the iShares Bitcoin Belief “wouldn’t be new demand per se,” it could positively “help them in early days of race”.

Balchunas was responding to fellow Bloomberg analyst James Seyffart, who identified that BlackRock’s personal belief just isn’t new. Final August, BlackRock launched a spot Bitcoin personal belief for its institutional shoppers in response to their curiosity in crypto. The belief, which is BlackRock’s first try to supply direct Bitcoin publicity, tracks the asset’s efficiency. The practically $200 million within the belief would considerably assist BlackRock’s iShares ETF upon approval, even when the SEC concurrently greenlights a number of ETFs from different candidates.

BlackRock ETF Updates

BlackRock just lately filed amendments to its utility for an ETF. The revisions recommend that the corporate made the updates following conversations with the Fee. The up to date submitting consists of plans to implement monitoring measures to rapidly detect suspicious or irregular market actions. The replace additionally consists of plans to reply to these irregularities when detected.

Moreover, BlackRock’s replace pledges to adjust to Anti-Cash Laundering (AML) necessities, and in addition comprises an audited assertion from monetary providers big PricewaterhouseCoopers (PwC). This pronounces BlackRock’s dedication to observe guidelines and keep away from any manipulation or fraud. The submitting additionally signifies the corporate’s readiness to contain third-party platforms for strong know-your-customer (KYC) compliance.

BlackRock is confident that the SEC will approve its ETF utility by January.

The asset supervisor’s plans for an ETF are progressing fairly quickly as BlackRock introduced it has received seed funding. In keeping with the agency, an unnamed investor agreed to purchase $100,000 price of iShares Bitcoin Belief shares at $25 per unit. The investor already obtained 4,000 shares on October 27, 2023.

Final month, BlackRock submitted an utility for a spot Ethereum ETF to the SEC. The corporate appointed main crypto trade Coinbase International Inc (NASDAQ: COIN) because the asset custodian.

Bitcoin So Far

Bitcoin is having fun with elevated motion from all of the exercise surrounding spot ETFs. The world’s largest asset by market cap hit a new 2023 all-time high on Monday at $42,100 and has constantly risen since then. As of this writing, CoinMarketCap exhibits that Bitcoin is at $44,000 after climbing practically 16% within the final 7 days and over 5.6% in 24 hours. Present Marketwatch information exhibits that Bitcoin’s year-to-date achieve is at 165.49%, with over 71% within the final 3 months and practically 24% within the final month.