Figures reported by BlackRock for This autumn 2023 beat the expectations of analysts as the corporate additionally bought World Infrastructure Companions.

Big asset supervisor BlackRock Inc (NYSE: BLK) has introduced earnings for This autumn 2023, with figures beating Wall Road expectations. In response to reviews, BlackRock had revenue of $0.15, and $9.66 per share for earnings adjusted for restructuring and amortization prices. Additionally, the full income for BlackRock Inc’s This autumn 2023 was $4.63 billion, which met expectations on Wall Road. Along with BlackRock’s figures for This autumn 2023, the corporate additionally introduced the acquisition of personal fairness agency World Infrastructure Companions in a $12.5 billion deal.

BlackRock’s This autumn 2023 earnings beat expectations, as analysts polled by Zacks Funding Analysis estimated $8.84 for earnings per share. The corporate’s belongings underneath administration (AUM) crossed $10 trillion within the quarter, increased than the $9.8 trillion Wall Road estimated. As well as, inflows for This autumn 2023 alone hit $96 billion. For your complete 12 months, the corporate reported income of $17.86 billion, with revenue of $5.5 billion or $36.51 per share.

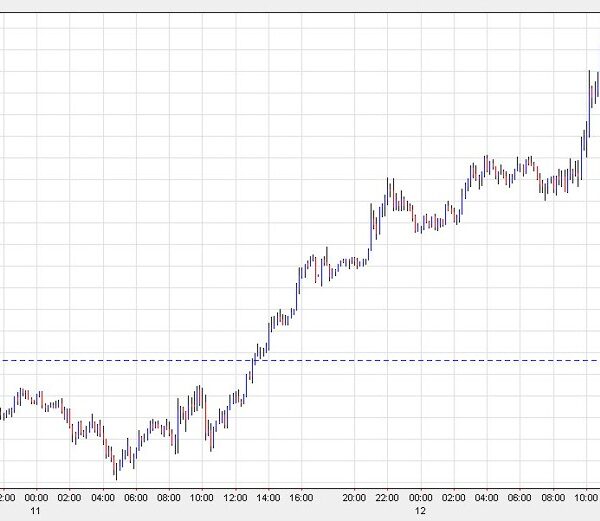

BlackRock shares rose barely yesterday to shut at $792.61. Nonetheless, it has fallen 0.9% in premarket buying and selling, to $785.5. Though BLK climbed almost 25% within the final three months, the inventory has fallen 2.36% this 12 months.

BlackRock within the Information for World Infrastructure Companions Acquisition Together with This autumn 2023 Earnings Announcement

BlackRock’s acquisition of World Infrastructure Companions is a part of the asset supervisor’s deal with infrastructure and penetration into non-public markets. The deal, anticipated to shut within the second quarter of the 12 months, is price $12 billion in shares of BlackRock’s widespread inventory, and $3 billion in money.

In an announcement, BlackRock Chairman and CEO Larry Fink said:

“The combination of BlackRock infrastructure with GIP will make us the second largest private market infrastructure manager with over $150 billion in total AUM, providing clients – especially those saving for retirement – with the high-coupon, inflation-protected, long-duration investments they need.”

BlackRock Inc is one in all 11 candidates that obtained approval for spot Bitcoin exchange-traded funds (ETFs) from the US Securities and Trade Fee (SEC). On the primary day of buying and selling, the full quantity of ETFs crossed $4 billion, with BlackRock accounting for $924 million, under Grayscale’s $1.9 billion.

Estimates for the buying and selling quantity of ETFs are significantly bullish. In response to Bernstein analysts, the full might cross $10 billion this 12 months. Apparently, Normal Chartered analysts are much more bullish. The analysts consider that the ETFs might entice as much as $100 billion earlier than the top of this 12 months. Additionally, the analysts consider that this might probably push Bitcoin’s value as much as $100,000.

Nonetheless, different analysts have sounded notes of warning. In response to them, the thrill surrounding Bitcoin ETFs could be prematurely grand, solely because of approval after a protracted interval of software. For others, there’s merely no actual want for a Bitcoin funding. In response to Robert Arnott, the chairman and founding father of consultancy and asset administration agency Analysis Associates, Bitcoin is solely a “speculative vehicle” and never an asset or a foreign money.” He added that so long as traders know what they’re doing, there’s nothing improper with speculative automobiles.