Spot Bitcoin ETFs have lastly been authorised by the US Securities and Trade Fee, and as anticipated, their approval led to a diverse market movement. The primary day of buying and selling for the 11 spot ETFs authorised turned out to be a memorable one, with nearly $4.6 billion value of ETF shares traded. ETF volumes have been additionally vital through the second day of buying and selling, with regular exercise pushing the cumulative quantity to over $7.6 billion {dollars}.

Based on BitMEX Analysis, the web influx reported throughout the 11 spot Bitcoin ETFs was $532 million throughout the first two days, with Blackrock popping out on high with $497.7 million value of BTC.

BlackRock’s Spot ETF Holdings

After two days of ETF buying and selling, statistics have revealed the standings of the 11 ETFs, these main the pack, and people falling behind. As anticipated, present knowledge places Blackrock’s whole Bitcoin asset in its ETF forward of the pack. The primary day of buying and selling noticed Blackrock’s internet influx totaling $111.7 million, falling behind Bitwise and Constancy with $237.9 million and $227 million respectively.

Bitcoin Spot ETF Circulate – Day 2 UPDATE

Circulate quantity for Blackrock now in. Blackrock had $386m of influx. This provides Blackrock nearly $500m of influx within the first 2 days, possible placing it within the lead https://t.co/N0jYEQpgdg pic.twitter.com/xGzY8jvblO

— BitMEX Analysis (@BitMEXResearch) January 13, 2024

Notably, issues took a activate the second day of buying and selling. Blackrock had the best internet influx of $386 million on day 2 to push its whole influx to $497.99 million within the first two days. Based on the website for Blackrock’s spot bitcoin exchange-traded fund (ETF), the Ishares Bitcoin Belief (IBIT), the fund now holds 11,439.2 BTC.

Though the ETF launch has finished nicely beneath regular circumstances, it appears to have fallen short of the massive numbers projected by many market analysts. Based on Blackrock CEO Larry Fink, the brand new ETFs are simply step one towards a brand new monetary world.

“ETFs are step one in the technological revolution in the financial markets. Step two is going to be the tokenization of every financial asset,” he mentioned in an interview with CNBC.

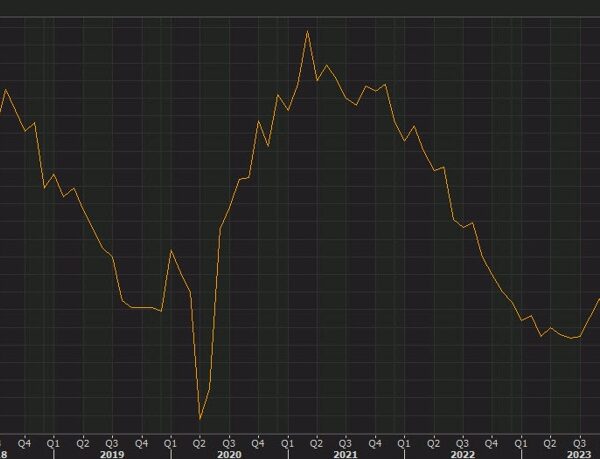

BTC market cap at present at $840.141 billion. Chart: TradingView.com

Present State Of Bitcoin ETFs

The report from BitMEX Analysis additionally revealed the dynamics between the primary and second days of buying and selling. As said earlier, the primary day of buying and selling ended with nearly $4.6 billion in buying and selling quantity and a $625.8 internet influx. Nevertheless, buying and selling quantity fell to simply over $3.1 billion on the second day, with BitMEX knowledge revealing a decrease internet influx of $205 million.

The vast majority of the second-day outflow could be attributed to the Grayscale Bitcoin Belief. Regardless of leading the market with about $1.9 billion in buying and selling quantity on the primary day, the fund did not register a internet influx, ending the day with $95.1 million in internet outflow. This outflow continued into day two, with the Grayscale Bitcoin Belief registering over $484 million internet outflow.

Featured picture from Shutterstock