Housing math wasn’t mathing for a lot of in 2023. Mortgage charges, residence costs, and low stock ranges made it each unattractive and more and more troublesome to purchase a house within the U.S. It was a far cry from the Pandemic Housing Increase and an institutional homebuying frenzy simply three years earlier than. The period of traditionally low rates of interest, quick access to capital—in addition to rising rents and residential prices, all led to a frozen housing marketplace for each customers and institutional buyers. However a serious multibillion-dollar acquisition introduced Friday could possibly be a sign that the institutional homebuying market is awakening from its slumber.

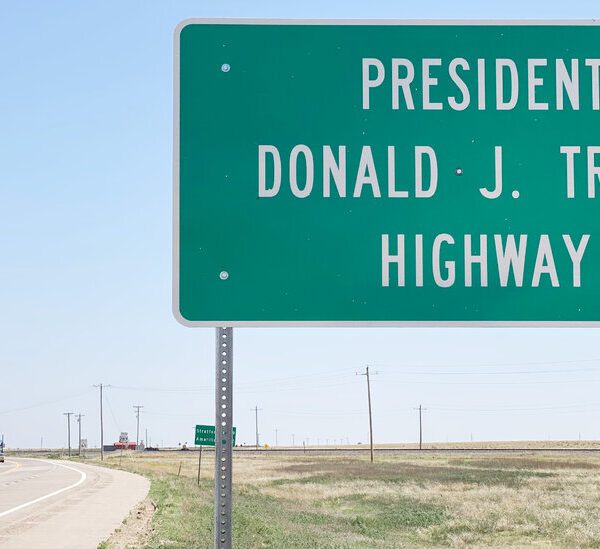

Personal fairness big Blackstone introduced Friday it was shopping for Tricon Residential, a Toronto-based landlord that owns 38,000 properties throughout the U.S. for $3.5 billion. It’s similar to Blackstone’s prior deal from 2021 for Home Partners of America, which owned greater than 26,000 properties, for $6 billion. The deal introduced Friday launches Blackstone into one of many high institutional homebuyer spots within the nation, simply behind Progress Residential and Invitation Homes, in keeping with knowledge from Parcl Labs, an actual property knowledge and analytics firm.

The overwhelming majority of Tricon’s rental properties are in Atlanta, Jason Lewis, co-founder of Parcl Labs advised ResiClub co-founder and former Fortune actual property editor Lance Lambert in a podcast on X (previously referred to as Twitter) on Friday. Tricon owns 7 million items in Atlanta and different main markets embrace Charlotte, North Carolina; Tampa, Florida; Dallas, Phoenix, and Houston.

Historical past can be considerably repeating itself with the Blackstone deal. The agency led a cost throughout Wall Road in shopping for properties after the U.S. foreclosures disaster in 2008. It was one of many first massive funding corporations to purchase properties in bulk within the aftermath of the subprime mortgage disaster. After Blackstone agreed to pay $11.25 a share in money for Tricon, Tricon shares jumped greater than 28% to $11.07 on the shut of Friday buying and selling.

A current historical past of institutional homebuying

The institutional homebuying market was cooking earlier than 2023. When mortgage charges and residential costs had been low, buyers scooped up rental properties with a decrease buy-in.

“The institutional side of the market saw a huge boom during the pandemic,” Lambert stated within the podcast. “There was a frenzy—low interest rates, home prices were ripping, rents were ripping, [there was] easy access to capital. It was really a perfect storm for capital flowing into the single family housing market.”

That led to extra institutional homebuyers like Tricon shopping for in main markets together with Charlotte, Tampa, Dallas, Phoenix, and Houston, he defined. However when mortgage charges hit 8% in October 2023, investments weren’t as profitable.

“Once rates spiked the math was less enticing for the institutional players,” Lambert stated. “We’ve seen a big pullback in institutional buying and there are a good number that have more dispositions than acquisitions.”

Lewis predicts that we’ll see extra institutional homebuying consolidations in 2024.

“There is enormous variation in how these portfolios are run, and that deals with the level of sophistication with using data and analytics,” Lewis advised Lambert. “That was fine when the housing market was a raging bull. And that’s becoming more of an acute pressure on portfolios that do not really have sophisticated or mature operational efficiencies. So I would imagine there will be other forms of consolidation throughout 2024 in deals like this.”