JamesBrey

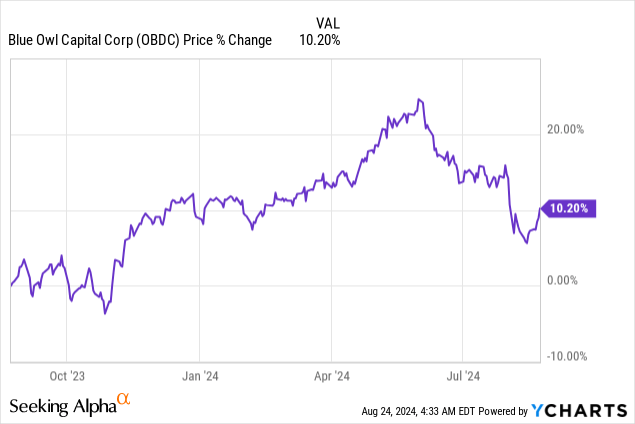

Shares of Blue Owl Capital (NYSE:OBDC) have steadily revalued lower since my work on the BDC was published in May, as the market feared an economic contraction and lower federal fund rates. However, Blue Owl Capital maintained good asset quality and a robust distribution coverage profile in the second quarter, which still work in favor of the BDC. Blue Owl Capital is also merging with another business development company which is set to provide benefits in terms of scale, diversification and cost structure. What makes shares especially attractive from a yield and risk profile perspective is that income investors can now buy Blue Owl Capital’s well-supported 12% yield below net asset value.

Previous rating

I rated shares of Blue Owl Capital a buy in May when they were trading at a 7% premium to net asset value, and I recommended Blue Owl Capital due to an improving non-accrual percentage: Why I Am Buying Blue Owl Capital At 1-Year Highs. Further, I considered the dividend to be reasonably safe even in case the Federal Reserve were to lower federal fund rates. Blue Owl Capital also announced a merger with Blue Owl Capital Corporation III (OBDE) which is set to benefit the BDC’s portfolio and diversification metrics.

First lien strategy, asset quality and merger deal

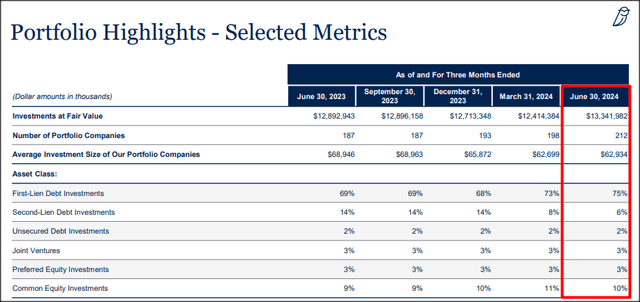

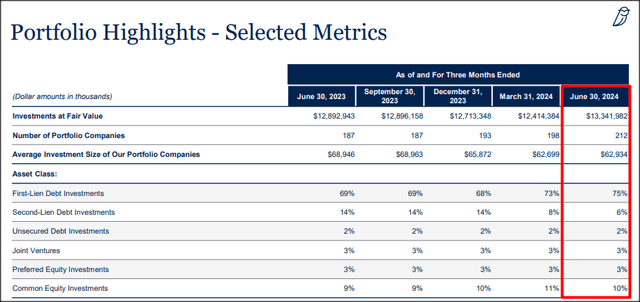

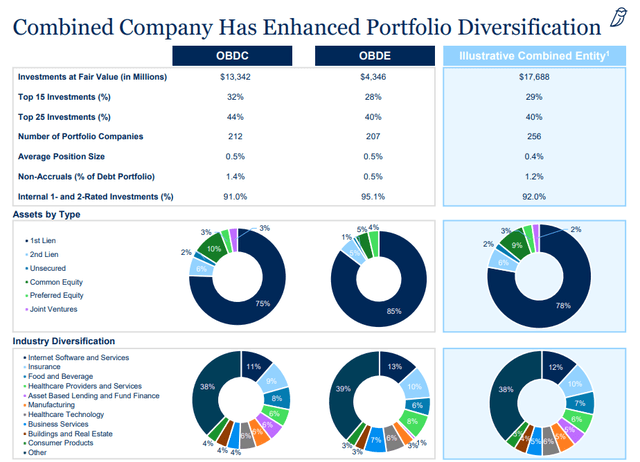

Blue Owl Capital runs a senior secured lending strategy that it built around the BDC’s first lien debt investments. The BDC chiefly invested in first lien debt in the second quarter, which represented 75% of all debt investments. An additional 6% of investments were second liens, resulting in a senior secured lending percentage of ~82%.

Blue Owl Capital

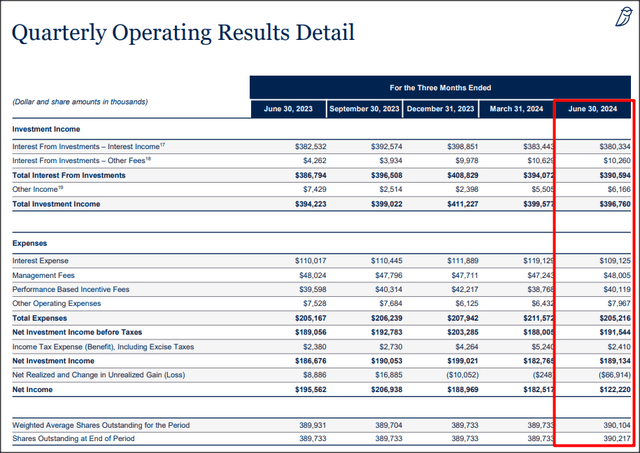

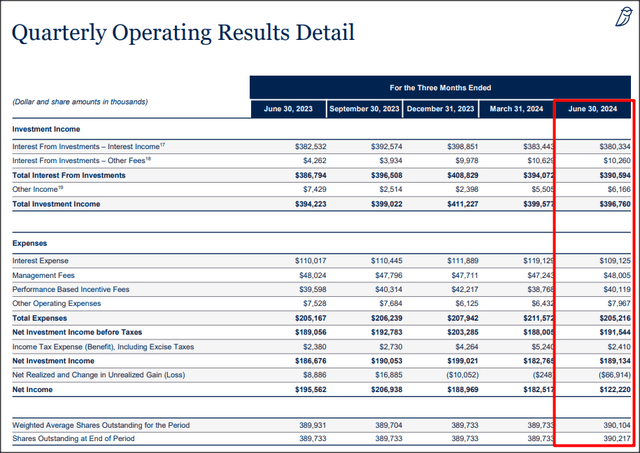

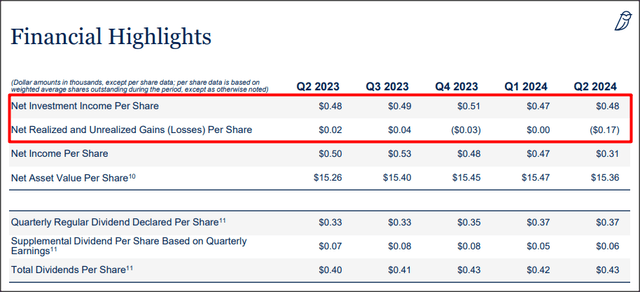

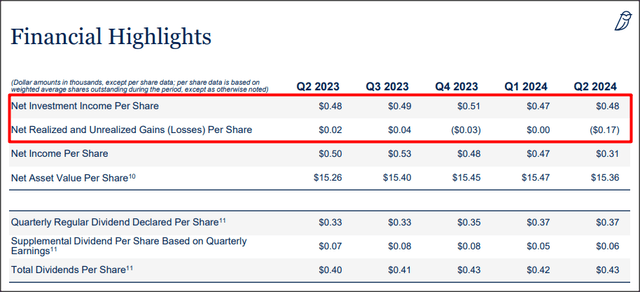

Blue Owl Capital generated $189.1M in net investment income in the second-quarter, showing a year-over-year increase of only about 1%. Going forward, I am not ruling out a decline in net investment income, especially considering current inflation developments: inflation was 2.9% in July, showing a fourth consecutive decline last month. This decline in the inflation rate prompted Jerome Powell last week to guide for the Federal Reserve’s first federal fund rate cuts next month. Since Blue Owl Capital is largely invested in variable rate debt (the variable rate loan percentage was 97% at the end of the June quarter), OBDC may see a dip in net investment income in the coming quarters.

Blue Owl Capital

Blue Owl Capital benefited from a sequential improvement in balance sheet quality as well as its non-accrual percentage declined 0.4 PP quarter-over-quarter in Q2’24. At the end of the June quarter, Blue Owl Capital’s non-accrual percentage totaled 1.4% and a total of six portfolio companies were marked as non-accrual compared to five in the March quarter.

Turning to Blue Owl Capital’s merger deal.

The BDC announced in August that it would merge its business with Blue Owl Capital Corporation III in a bid to capture synergy and diversification benefits. The transaction is expected to close in the first-quarter of FY 2025.

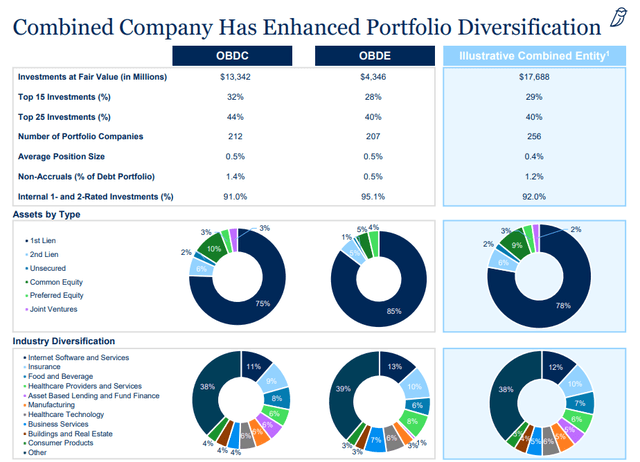

The merger between OBDC and OBDE is set to create the second-largest BDC in the U.S. after Ares Capital (ARCC) with an estimated portfolio value of $17.7B. Since the portfolio has considerable strategic overlap (including the same portfolio companies and debt instruments), Blue Owl Capital’s first lien percentage is set to rise to 78% while its non-accrual percentage is expected to decline to 1.2%.

Blue Owl Capital

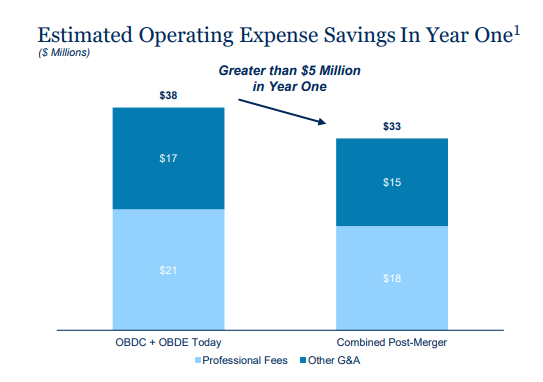

Further, Blue Owl Capital’s portfolio combination would allow the BDC to cut down its operating expenses, potentially creating positive tailwinds for the company’s net investment income. According to the company’s merger overview, Blue Owl Capital expects to lower its operating expenses by $5M annually, starting in the first year.

Blue Owl Capital

The result of this merger will be a larger BDC with a more diversified portfolio that will be tilted even further towards high-quality first liens. An added benefit is that OBDC will have better balance sheet quality (a non-accrual percentage of 1.2%) and the BDC’s shares may offer investors better liquidity as well.

Distribution coverage analysis

Blue Owl Capital’s Q1’24 net investment income was steady year-over-year: the BDC generated $0.48 per-share in net investment income, which calculated to a distribution coverage ratio was 1.12X… which was the same ratio as in the previous quarter. In the last four quarters, the BDC’s total distribution coverage ratio was 1.15 so the BDC’s dividend has a high sustainability factor, in my opinion.

Blue Owl Capital

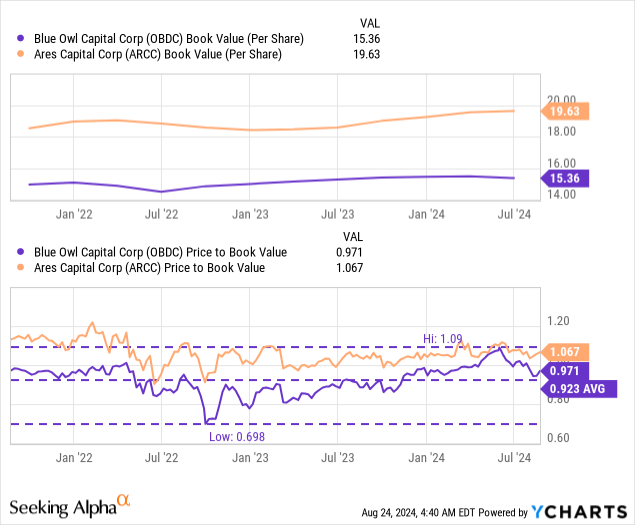

Blue Owl Capital’s valuation

The single biggest reason why I like Blue Owl Capital is that the BDC’s shares have started to trade at a (3%) discount to net asset value… which was the main reason why I doubled down on the BDC last week. Blue Owl Capital is valued at a price-to-NAV ratio of 0.97X which makes the BDC comparatively more competitive: Ares Capital, the only BDC larger than Blue Owl Capital after the merger, is trading at a 7% premium to net asset value and Blue Owl Capital has a merger catalyst that could drive a revaluation going forward.

Last time I worked on Blue Owl Capital, shares traded at a 1.07X P/NAV ratio, which is the same kind of ratio Ares Capital has now. If Blue Owl Capital returned to a 1.07X P/NAV ratio, shares could have a fair value of ~$16.44 per-share, representing approximately 10% upside potential.

Risks with Blue Owl Capital

Blue Owl Capital is going to see lower net investment income going forward if the Federal Reserve lowers its federal fund rate in September. The Chairman of the Federal Reserve, Jerome Powell, last week said that the time has come for rate cuts and investors should take this seriously. Given that Blue Owl Capital has very good dividend coverage, I am not worried about the 12% dividend yield.

Final thoughts

Blue Owl Capital’s merger with Blue Owl Capital Corporation III is likely going to be beneficial for shareholders. The new BDC is set to become the second-largest BDC in the market, after Ares Capital, and the portfolio will be bigger, more diversified and have a lower non-accrual percentage. Further, cost synergies are set to add to Blue Owl Capital’s net investment income, so even in case the Federal Reserve lowers the federal fund rate in September for the first time, the BDC should have no challenges to cover its solid dividend in the future. Lastly, I like the discount to net asset value, which makes shares especially attractive from a risk profile point of view.