John M. Chase/iStock Unreleased via Getty ImagesUSA)” data-id=”1492777781″ data-type=”getty-image” width=”1536px” height=”1028px” srcset=”https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1492777781/image_1492777781.jpg?io=getty-c-w1536 1536w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1492777781/image_1492777781.jpg?io=getty-c-w1280 1280w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1492777781/image_1492777781.jpg?io=getty-c-w1080 1080w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1492777781/image_1492777781.jpg?io=getty-c-w750 750w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1492777781/image_1492777781.jpg?io=getty-c-w640 640w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1492777781/image_1492777781.jpg?io=getty-c-w480 480w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1492777781/image_1492777781.jpg?io=getty-c-w320 320w, https://static.seekingalpha.com/cdn/s3/uploads/getty_images/1492777781/image_1492777781.jpg?io=getty-c-w240 240w” sizes=”(max-width: 768px) calc(100vw – 36px), (max-width: 1024px) calc(100vw – 132px), (max-width: 1200px) calc(66.6vw – 72px), 600px” fetchpriority=”high”>

I last wrote about Boeing (NYSE:BA) back in March 2024. At that time, Boeing shares were trading at around $182, and the stock is trading at $185 now. My last article was bullish and I remain bullish. Even though the stock price is essentially right where it was in March, a lot has happened in the past few months and certain events have caused me to change my strategy with this stock. In this article, I want to cover some key developments and as a result, how my investment strategy is changing. The biggest new development is a potential deal for Boeing to buy Spirit AeroSystems (SPR), but there are also a lot of other new developments and updates to make since my last article, so let’s get into all of this now:

A Potential Buyout Of Spirit AeroSystems

Just days ago, news came out about a potential deal for Boeing to Acquire Spirit AeroSystems, which used to be owned by Boeing many years ago. This deal appears to have been in the works for a long time since Boeing sees it as a potential solution to having more oversight and increased safety measures in terms of the structural components like fuselages that Spirit AeroSystems supplies for Boeing and Airbus (OTCPK:EADSY). Spirit AeroSystems has been a major source of safety concerns for Boeing especially with the 737.

The exact terms of a potential deal have not been announced, but sources suggest that Boeing would be paying about $4.7 billion for Spirit AeroSystems that could value it for $37.25 per share, which is 10% above the current share price. Boeing’s potential offer is also said to be made as an all stock deal, so the amount paid could vary and be highly dependent on the final terms as well as the price of Boeing shares when and if any deal closes. With all things being equal, I believe buying shares in Spirit AeroSystems is currently more attractive from a risk/reward point of view than buying Boeing shares. I do think this potential deal has a strong chance of happening, and that it will also be approved by regulators (especially since Boeing owned this company before).

So, if I have to choose between buying Boeing shares now for about $185, or buying Spirit AeroSystems, I would take on the risk of a deal failure (which I think is small), and buy Spirit AeroSystems if it is trading for about a 10% discount (or more) to the proposed buyout deal of $37.25. I believe that a discount around that level could continue until the deal gets much closer to closing. In theory, if this deal works out at $37.25, this will in essence give me a chance to buy Boeing shares for a 10% discount to the current share price of $185.

A 10% discount in Boeing shares that appears to be potentially available by buying Spirit AeroSystems, is like buying Boeing for just around $166. For this reason, I am willing to accept some risk that comes with deal arbitrage, as it gives me a chance to buy Boeing for a solid discount to the current share price. At any rate, my main point is that there typically is some type of discount on the buyout price for any company until it is close to being finalized, and since I am confident this deal can go through, I think it makes more sense to add to my Boeing position by getting a potential discount on the shares by buying Spirit AeroSystems instead of Boeing directly.

Recent Issues At Airbus Show Industry-Wide Challenges

There has been some recent news from Airbus which I think is very noteworthy. Just days ago, Airbus announced that it was reducing production guidance for 2024. It now expects to deliver 770 planes instead of previous estimates of approximately 800. The reduced level of production is being caused by a number of factors, but mostly seems to be due to the inability to get supplies from outside sources for things like engines, cabin parts, and structural components. As a result, Airbus lowered its financial forecasts for 2024, and the stock plunged on this news by about 15%.

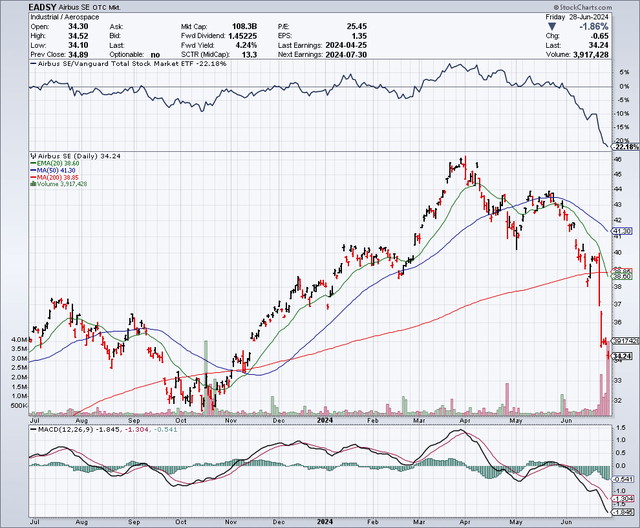

Airbus is based in Toulouse, France and trades on the French stock exchange. As such, some of the recent selloff could be partially due to a correction in the French stock market due to concerns over the snap elections that were recently ordered by President Macron. Just before the snap elections were announced in early June, Airbus was trading for about $42, and it looks like Airbus shares dropped by about 10% (like many French stocks) on this news as it traded down to about $38, and then it rebounded to around $40 per share on June 25th. After the Airbus news on reduced production came out, the stock has dropped further and now trades for about $34, which is well off the 2024 highs of about $46 per share. The chart below shows the story:

With the recent double-whammy of Airbus shares getting knocked down by French election concerns and then the hit from reduced production for 2024, this stock is back down to levels not seen since last year. This significant recent decline in Airbus shares has prompted me to start buying this stock. As I don’t want to be overly exposed to the aviation sector, and since this drop makes Airbus shares more compelling to me when compared to Boeing shares, this is changing my plans to keep buying Boeing shares at current levels. However, I do plan to buy Boeing shares if the stock falls from current levels, and I also plan to buy indirectly through the potential Spirit AeroSystems deal.

One final point on this Airbus news is that if Airbus is running into previously unexpected and/or larger supply chain issues, I have to think that Boeing could also potentially have underestimated supply chain issues as well. If that is the case, we could see Boeing follow suit with a similar announcement. But there is one thing that might save Boeing, and that is that their own production has been far more curtailed by safety issues already as well as ongoing investigations. So, in this case, Boeing’s much slower production might not be impacted in the same way as Airbus.

Bad News Continues As Does The Search For A New CEO

Another bit of major news has just come out on Boeing and that is a report stating that U.S. prosecutors plan to seek a guilty plea from Boeing over the 737 Max crashes. This could add to the volatility on Boeing shares in the coming days and weeks. A lot could depend on how Boeing plans to deal with this, but it is clear that this company is still not done putting all the bad news behind it.

A bit of good news could come from Boeing if it makes a great choice in picking a CEO, since the current CEO has stated he will leave the company at the end of this year. Unfortunately, it seems like very good candidates have not been easy to find. Larry Culp, the CEO of General Electric (GE) has reportedly declined to take the CEO role at Boeing. Mr. Culp is well-regarded for having managed some difficult challenges that GE was facing and he has restored confidence in that company for a lot of investors. I think it is unfortunate that he did not accept the position and that the search for a CEO continues. There is still time for Boeing to bring in a new CEO and if the right candidate is chosen, I believe this will be a potential upside catalyst for the stock.

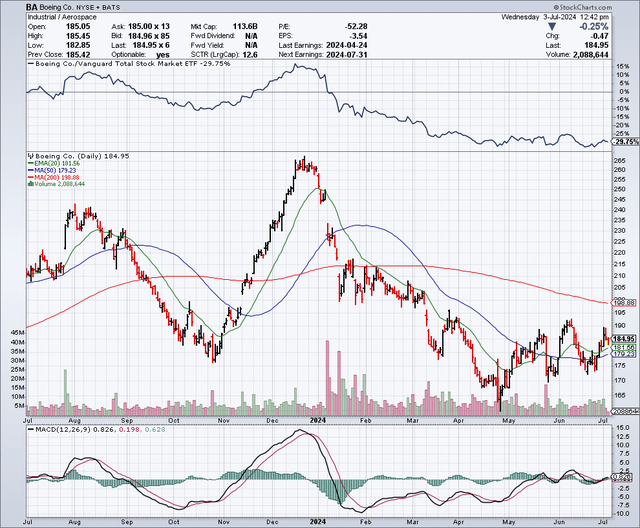

The Chart

As shown below, Boeing shares remain well below the highs of around $267 that it held last December. The 50-day moving average is $178.30 and the 200-day moving average is 199.23. This chart continues to show a bearish “Death Cross” formation, since the 50-day moving average is well below the 200-day moving average.

Potential Downside Risks

There are numerous potential downside risks when investing in this stock. Of course, there are macro risks for all stocks and that includes a potential recession, a stock market correction, geopolitical issues and more. Specifically to Boeing, I see the potential for new supply chain risks since Airbus seems to have just recently been caught off-guard by this and it could be an issue for Boeing as well. I also think Boeing could be impacted by trade tensions between China and the U.S.

Boeing’s credibility and continued production issues could be leading more airlines to buy planes from Airbus or seek other solutions. This could impact orders in the future and result in less of a backlog in the years ahead.

Another concern I have is that Boeing’s balance sheet has suffered in recent years and the company now has $47.94 billion in debt and only $7.53 billion in cash. This type of balance sheet can worry investors, especially if things don’t improve soon. One reason I am starting to put more of my money into Airbus now is because that company appears to have fewer issues, and the stock has recently plunged. But I also really like Airbus because of the balance sheet which is much stronger than Boeing’s. Airbus has around $14.76 billion in debt and about $17.58 billion in cash. A balance sheet with more cash than debt is the one I will always prefer.

I also want to add that buying shares of Spirit AeroSystems has just about all the risks that Boeing has above, plus it has the risk that for some reason, this deal falls through. If that is the case, this stock would likely plunge. For that reason, I would not take a big position in Spirit AeroSystems because deals can fall through for many seemingly small reasons, and the downside could be big.

In Summary

I still see Boeing as a strong buy, as I expect it to resolve the problems it has sooner or (probably) later. However, this deal for Spirit AeroSystems has created a potential opportunity to do some deal arbitrage whereby it makes more sense for me to buy Spirit AeroSystems due to the discount and arbitrage opportunity that comes with most buyout offers.

In addition, I have to say that Airbus shares are looking very attractive in terms of relative value thanks to a big recent drop in the share price. Also, the balance sheet at Airbus looks very attractive, so more of my investment dollars will be going into this company as well. The French elections could keep putting pressure on this stock so, again, I am going to buy in stages and keep my position at a conservative level.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.