USD/JPY ANALYSIS & TALKING POINTS

- Japanese inflation retains strain on BoJ to shift coverage.

- Robust emphasis on US financial knowledge that features core PCE.

- Upside dangers stay regardless of strong begin to the week for the yen.

Supercharge your buying and selling prowess with an in-depth evaluation of the Japanese Yen outlook, providing insights from each elementary and technical viewpoints. Declare your free This fall buying and selling information now!

Advisable by Warren Venketas

Get Your Free JPY Forecast

JAPANESE YEN FUNDAMENTAL BACKDROP

The Japanese Yen ended the buying and selling week on a muted tone as a result of US Thanksgiving Day hangover however Friday held some key data to issue into the Financial institution of Japan’s (BOJ) evaluation. As soon as once more, headline inflation held above the 2% while beating estimates and remaining above 3%. Keep in mind the BoJ persistently reinforces the truth that they wish to see sustained +2% inflation thus rising the probability of a coverage shift. A hawkish transfer will assist the yen and conclude unfavorable rates of interest coverage.

The Israel-Hamas conflict must be intently monitored because the JPY may discover further assist ought to the state of affairs escalate – secure haven demand. The week forward (see financial calendar under) will likely be extra centered on US financial knowledge with the core PCE deflator the dominating report as it’s the Fed’s most well-liked measure of inflation. From a Japanese perspective, BoJ officers are scattered all through alongside retail gross sales and unemployment knowledge.

USD/JPY ECONOMIC CALENDAR (GMT +02:00)

Supply: DailyFX financial calendar

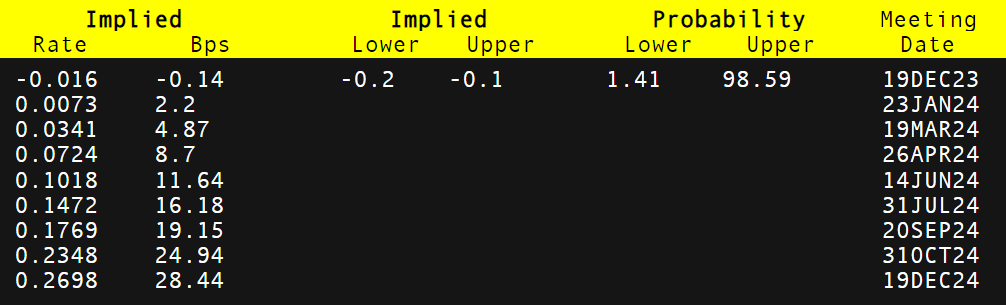

Cash market pricing (see desk under) forecasts a price hike in direction of the latter a part of 2024 as however incoming knowledge will stay extremely influential and will drastically change expectations as we’ve seen with many central banks this 12 months.

BANK OF JAPAN INTEREST RATE PROBABILITIES

Supply: Refinitiv

Wish to keep up to date with essentially the most related buying and selling data? Join our bi-weekly publication and preserve abreast of the most recent market shifting occasions!

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to Publication

USD/JPY TECHNICAL ANALYSIS

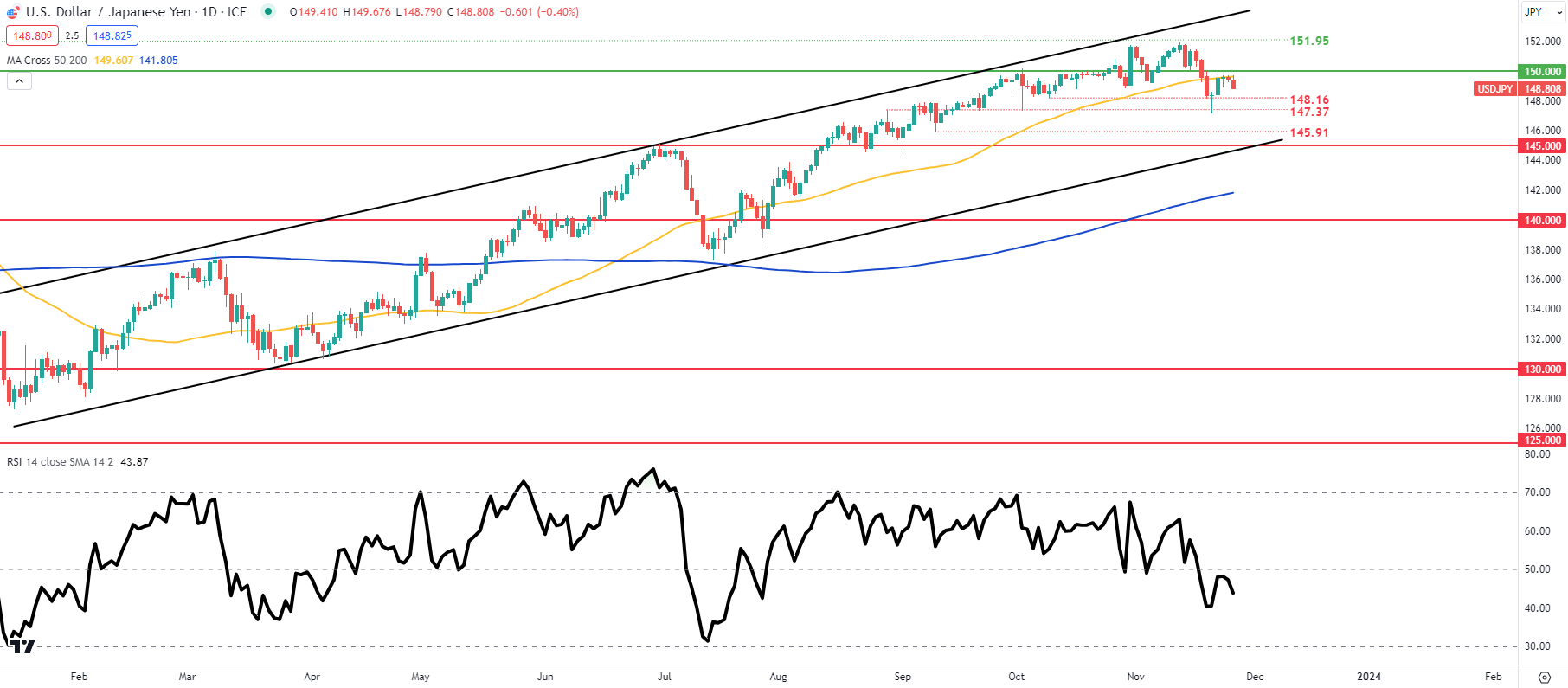

USD/JPY DAILY CHART

Chart ready by Warren Venketas, IG

Each day USD/JPY value motion has been respectful of the 50-day shifting common (yellow) of latest with the Relative Power Index (RSI) now favoring bearish momentum short-term. That being stated, final week’s weekly candle shut fashioned a hammer-like candlestick that might recommend a longer-term bullish desire. The previous couple of each day candles now resemble an ascending triangle kind sample – one other bullish advocate.

Key resistance ranges:

Key assist ranges:

- 148.16

- 50-day shifting common (yellow)

- 147.37

- 145.91

- 145.00

IG CLIENT SENTIMENT: MIXED

IGCS reveals retail merchants are presently internet SHORT on USD/JPY, with 81% of merchants presently holding brief positions (as of this writing).

Curious to find out how market positioning can have an effect on asset costs? Our sentiment information holds the insights—obtain it now!

Introduction to Technical Evaluation

Market Sentiment

Advisable by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas