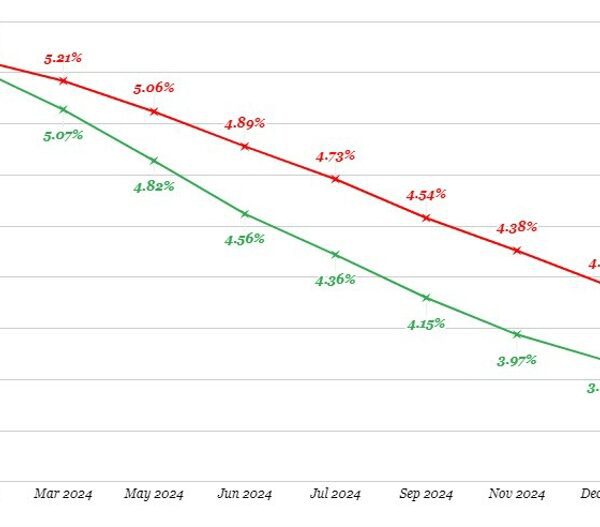

The US Treasury market has actually made issues attention-grabbing up to now in April.

On simply the second day of the month, the excessive yields in 10-years have damaged out, rising above the 4.35% double high to the best ranges since November.

If you wish to stretch for a motive for the 19 foundation level transfer this week, you possibly can level to Powell’s much less dovish feedback on Friday together with a greater ISM manufacturing report yesterday.

The fastened revenue group at BMO does not discover that to be a compelling motive and right now’s eurozone inflation information actually highlights how dangers are two sided. They level to approaching information this week as extra necessary than what we have heard already beginning with JOLTS right now however highlighted by ISM companies and non-farm payrolls later within the week.

It’s this backdrop that

makes the promoting strain at the moment evident within the Treasury market so

fascinating and certain extra concerning the calendar flip, positioning, and particular

flows than any true elementary shift. Certain, it’s typical for the beginning of a

new month, quarter, or 12 months to see an unwind (at the least partial) of any

constructive tone related to extension shopping for. What’s distinctive concerning the

present episode is just the magnitude of the backup in yields and the way rapidly

the transfer has occurred. The weak point seen through the in a single day session additionally

implies that the worth motion may not have fully run its course and

there may very well be follow-on promoting within the occasion technical help ranges of observe

are convincingly damaged

They observe that 4.50% is again on the desk and ‘actually achievable’. Yesterday, I highlighted a technical sample aiming for 4.65%.

What I discover compelling is that the FX market is not actually shopping for into this bond transfer, suggesting that BMO is not the one one skeptical that it is essentially pushed. Equities are smooth right now however do futures down 0.6% actually validate such a giant breakdown in bonds? Gold actually is not fretting because it hits new file highs.

Then again, perhaps this can be a sign that should not be ignored as bonds usually transfer first.

In any case, this actually raises the stakes for the remainder of the information this week, together with the heavy slate of Fed audio system.