It’s a little bit of a gradual day for commodities, however I’m ready on a possible huge transfer brewing on the 4-hour chart of Brent crude oil.

Is the pattern nonetheless our pal or are we about to see the bend on the finish?

Take a look at these ranges!

Crude oil costs bought a lift earlier on, thanks to provide constraints coming from Crimson Sea tensions and Russia’s plans to extend its output cuts.

Do not forget that directional biases and volatility circumstances in market worth are usually pushed by fundamentals. In case you haven’t but accomplished your fundie homework on crude oil headlines, then it’s time to do some work by testing the financial calendar and keep up to date on every day basic information!

Experiences that Angola is exiting the OPEC may also contribute to draw back pressures on world oil provide ranges, because the African nation mentioned that the group was now not serving its pursuits.

Nevertheless, skinny liquidity and profit-taking in the direction of the tip of the 12 months would possibly spur a retreat from the most recent rally, particularly because the commodity worth is already hitting upside limitations.

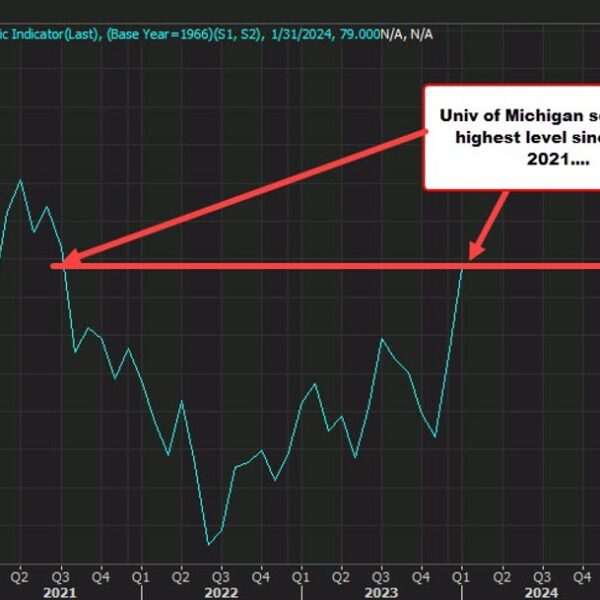

Specifically, Brent crude oil (UKOIL) is testing the highest of its descending channel seen on the 4-hour time-frame.

Value has additionally fashioned increased highs whereas Stochastic already made decrease highs, displaying a bearish divergence. To high it off, the 100 SMA is beneath the 200 SMA in spite of everything, confirming that bearish vibes are current.

Maintain a watch out for a transfer to the following draw back targets similar to S1 ($76.25) close to the mid-channel space of curiosity and S3 ($71.48) on the channel help in case worth falls by means of the Pivot Level degree ($78.40).

A continuation of the rally previous R1 ($81.02) may sign that crude oil bulls are refusing to again down, which could imply {that a} reversal from the downtrend may observe. In that case, UK oil may set its sights on the upside targets at R2 ($83.18) and even R3 ($85.79).

Higher be careful for these bullish strikes if a Santa Claus rally exhibits up!