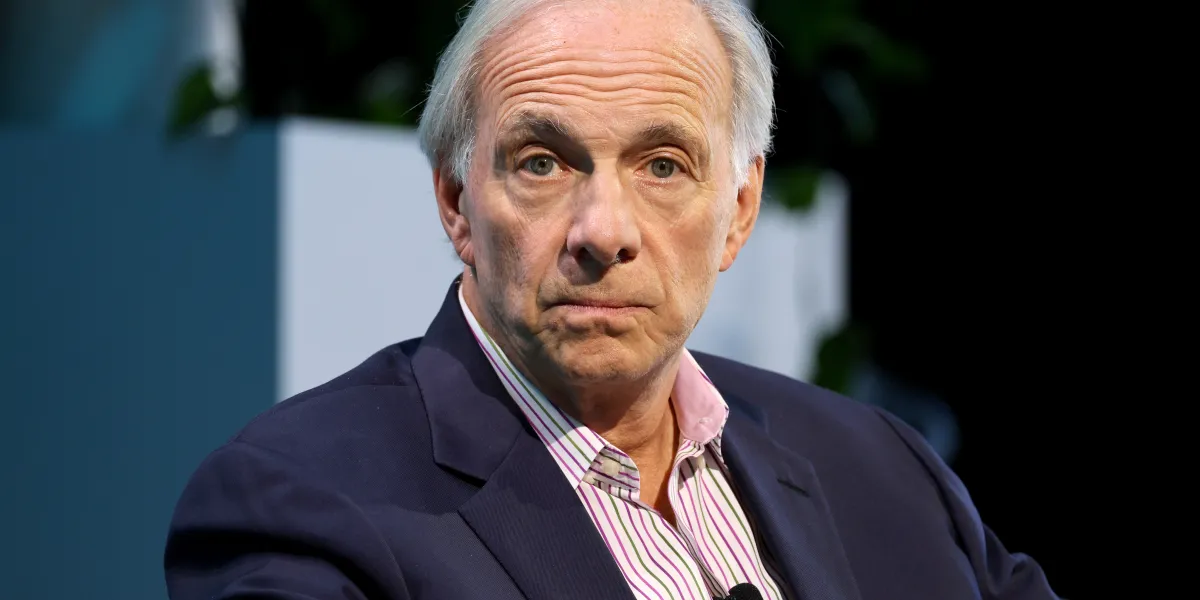

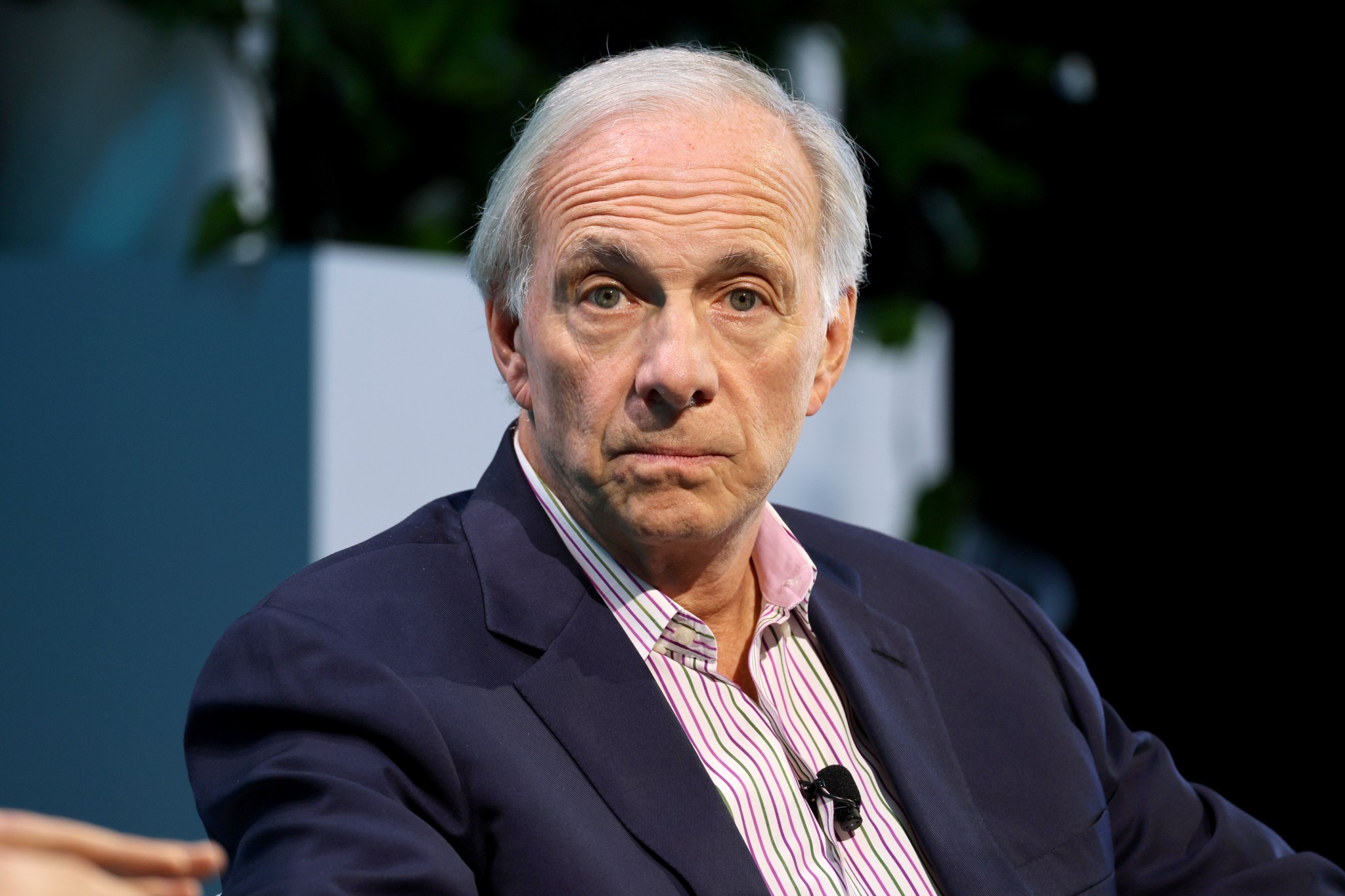

Bridgewater Associates founder Ray Dalio is always on the lookout for the next issue which could derail the economy. He, like many others, is extremely concerned about national debt. He’s also mindful of geopolitical conflict, restructuring of the monetary world order, and also the rising tensions within America itself.

Should friction in the U.S. continue, the hedge fund founder warned individuals’ ability to “hurt each other” has never been higher.

He explained: “We’re in wars. There is a financial, money war. There’s a technology war, there’s geopolitical wars, and there are more military wars. And so we have a civil war of some sort which is developing in the U.S. and elsewhere, where there are irreconcilable differences.”

Speaking to Bloomberg, Dalio said there are two outcomes for America: Either the nation pulls together and rises above, or conflicting sides exert as much pain on the other as they can.

Society may “rise above it and realize that our common good is going to necessitate us dealing with it so that what works for most people is going to work.” Unfortunately, this belief may prove “a little bit idealistic.”

“I have to be a practical person,” he continued. “I think that these conflicts will become tests of power by each side.”

America is more divided than in the past. Last year, a Gallup survey found 80% of Americans believed their country was “greatly divided” on key issues, with Republicans slightly more inclined than Democrats to say the country was united.

Indeed, many investors will be familiar with Dalio’s warnings—the billionaire has long said that geopolitical tensions could spill into another global conflict. Back in 2023, Dalio warned the likelihood of a third world war had increased to 50% following Russia’s invasion of Ukraine, and the Israel-Hamas conflict.

While naysayers may argue Dalio is the boy who cried wolf, his caution has paid off in the past. In 2007, Bridgewater began to warn of large risks embedded “in the system”—by 2008, a financial crisis had hit.

Moreover, while Dalio’s warning sounds alarming, it is also somewhat inevitable: “In history we have to recognize that all orders have come to an end, and then there’s a new order, and there’s a challenge. I have a principle, if you worry, you don’t have to worry. And if you don’t worry, you need to worry—if you worry then you will take care of what you’re worrying about and [prevent it] from happening.”

National debt fears

One of Dalio’s top fears—and indeed one of the factors he cites for a potential global war—is national debt. Like many of his peers (Jamie Dimon and Jerome Powell to name a few) Dalio is worried that one day America’s need to sell debt will outweigh the market’s appetite to buy it.

This will likely be prompted by America’s debt-to-GDP ratio becoming even more imbalanced—currently it stands at around 125%—at which point debt buyers will demand higher premiums to ensure returns, or will exit the market entirely. Either option leaves the U.S. in a tough spot, with higher interest to pay out or significant cutbacks to be made.

This imbalance, what Dalio calls the “debt bomb”, is an economic heart attack waiting to happen he argues: “When debt and debt service rise relative to your income it’s like plaque in the arteries that then begins to squeeze out the spending.”

The Bridgewater founder added this tension isn’t anything new, saying these issues cycle repeatedly through time—what’s needed to mitigate its impact is understanding the “cause and effect” dynamic.

“Whenever things are coming along that I had not seen before, I really needed to understand if they happened in history so I can understand the mechanics, which is why study history,” he added.