JHVEPhoto

BMY: Outperformance Shouldn’t Have Surprised You

Bristol-Myers Squibb Company (NYSE:BMY) investors have had much to celebrate recently, as the stock went on a rampaging run to outperform the S&P 500 (SPX) (SPY). Notwithstanding the sharp pullback experienced by investors this week as the market sold off, BMY remains nearly 20% higher since my previous update in mid-July 2024.

In my bullish BMY article, I highlighted the company’s execution risks and tepid outlook as contributing to its pessimism. However, I also reminded investors that BMY’s valuation was highly attractive. In addition, it managed to consolidate constructively over a critical support level, improving my confidence that income and value investors could return more aggressively.

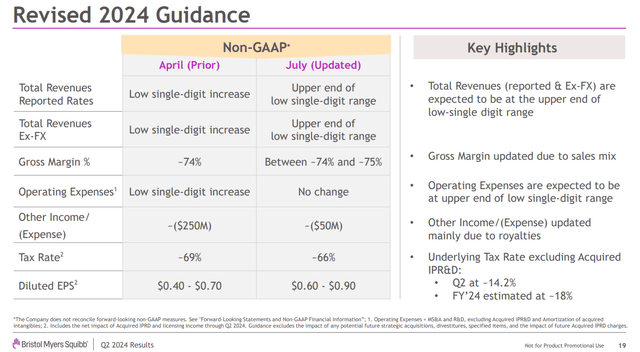

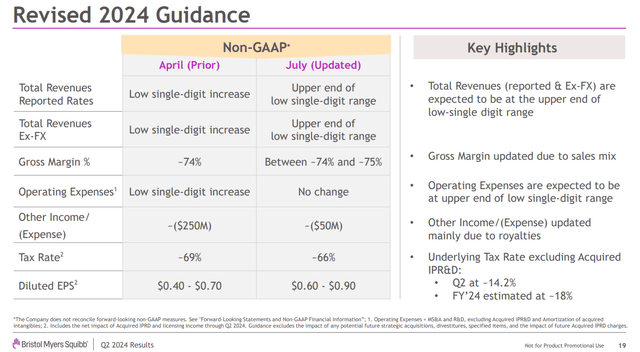

BMY: Upgraded 2024 Guidance Lifts Confidence

BMY revised 2024 guidance (BMY filings)

Bristol-Myers Squibb’s Q2 earnings release in late July 2024 demonstrated why investors were too pessimistic as the company unveiled its revised 2024 guidance. The company’s ability to telegraph a clearer near-term outlook underscores the increased visibility and lowered execution risks, even as BMY navigates its ability to overcome the patent cliff through 2030.

Furthermore, the leading biopharma company experienced robust metrics in its growth portfolio, suggesting all isn’t lost as it transitions from its legacy products. Accordingly, BMY recorded an 18% YoY increase in revenue in Q2. Notably, the growth products accounted for 46% of the company’s overall portfolio, underpinning its improved outlook. As a result, it should improve the market’s confidence in its execution over the next few years as the company works on “transformational medicines where [BMY has] a competitive advantage.”

Hence, we should expect the company to continue demonstrating solid progress in its pipeline as it potentially “discontinues programs” that fail to meet its ROI metrics. In a recent conference, Bristol-Myers Squibb is confident its growth portfolio could “exceed 50%” of its overall business next year. Hence, I believe it’s increasingly clear the market is correct in assessing lowered execution risks as BMY works out its long-term guidance.

There are valid concerns over Medicare’s revised drug prices for Eliquis. Based on the latest release, Wall Street doesn’t anticipate a significant impact on the company’s performance. BMY also assured investors that Eliquis is expected to remain a critical anchor for its business and anticipates “no material impact on EPS from that product” through its LOE in 2028. Several new launches, including (KarXT), are expected to bolster BMY’s growth portfolio, helping to mitigate the market’s concerns about its LOE challenges.

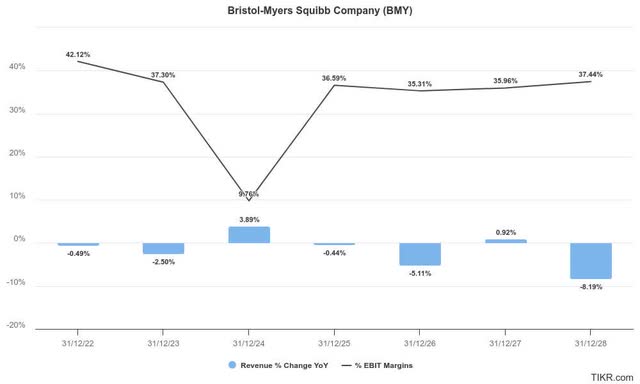

BMY’s Progress Expected To Remain Uneven

Wall Street has upgraded BMY’s estimates, supporting its recent surge as it outperformed the market. Despite that, revenue growth is expected to remain uncertain and uneven as it works through its portfolio transformation headwinds. Therefore, a further valuation re-rating could be challenging unless the company can telegraph much more robust guidance over the next few years.

Despite that, BMY’s focus on driving growth through more robust commercial execution is expected to keep its adjusted operating profitability at a high level. BMY’s best-in-class “A+” profitability grade should bolster investor confidence in its ability to make the necessary changes to improve its overall growth profile. As a result, unless the market anticipates a substantial impact on its underlying profitability (which isn’t the base case at the moment), a further valuation de-rating seems unlikely.

Is BMY Stock A Buy, Sell, Or Hold?

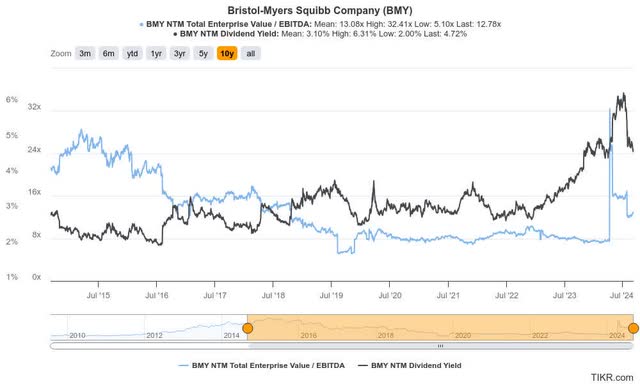

Accordingly, BMY’s forward adjusted EBITDA multiple of 12.8x is slightly below its 10-year average of 13.1x. Therefore, the stock doesn’t seem to be overvalued. In addition, the stock’s relatively high dividend yield of 4.7% should attract income investors keen on fundamentally strong biopharma plays as the Fed potentially lowers its interest rates. Hence, I’ve not assessed potentially significant valuation de-rating risks that could scupper its recent surge from its June 2024 lows.

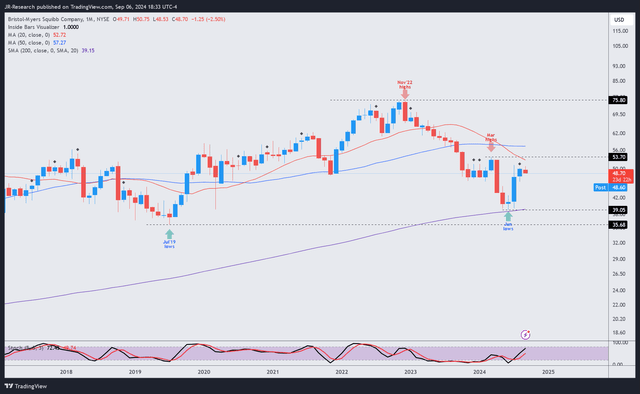

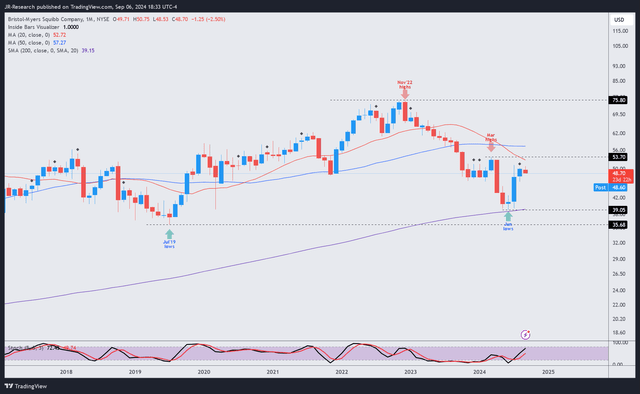

BMY price chart (weekly, medium-term, adjusted for dividends) (TradingView)

As seen above, BMY has emerged from its battering after forming a long-term bottom in June 2024 above the $40 level. However, it should also be noted that the stock seems to lack the decisive breakout momentum to surge above its $55 zone (March highs).

Therefore, I assess BMY will more likely consolidate over the next few quarters, as the market reassesses the developments from its commercial launches and pipeline developments. In addition, its long-term trend bias has weakened, suggesting investors must be cautious with their allocation in the stock.

Given a more balanced valuation and price action outlook over its catalysts and fundamental profile, I have determined that a Hold rating seems more appropriate for now.

Rating: Downgraded to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!