Adam Gault/OJO Pictures through Getty Pictures

Introduction

British American Tobacco (NYSE:BTI) caught my consideration as a result of its particularly excessive dividend yield, so I wished to check out the corporate’s financials and provides some opinion on why the shares may be buying and selling at such depressed ranges, and why it could proceed for some time longer. The excessive debt ranges could deter many buyers, however a double-digit yield appears to be moderately secure and can appeal to many buyers who’re in search of juicy yields. Even with what I contemplate conservative estimates, the corporate appears to be buying and selling at an honest worth, so folks can lock on this dividend yield, be affected person, and hope for operational restoration whereas the corporate continues its transition.

Financials

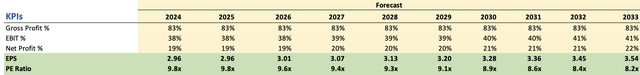

As of FY23, which ended 31st Dec ’23, and was printed on Feb 9th ’24, the corporate had round $6.7B in money and equivalents, in opposition to a whopping $44B in long-term debt. This quantity will delay many buyers who are usually extra debt-averse. This is also one of many causes that the corporate’s share worth is underperforming. It’s not the primary cause however a sound cause, nonetheless. There are a couple of metrics I like to have a look at, to see if the debt excellent is an issue. Firstly, the debt-to-assets ratio has been hovering at round 0.3 for the final 5 years, which is effectively under what I contemplate to be overleveraged. Secondly, the corporate’s debt-to-equity can be effectively under my restrict of 1.5, hovering at round .60 on common and 0.74 as of FY23. Lastly, to ensure the corporate is ready to pay down its excellent debt obligations, I like to have a look at the curiosity protection ratio. Right here, analysts contemplate a 2x ratio to be wholesome, so the corporate’s common ratio of round 7x is greater than adequate. The corporate passes all three metrics with flying colours, so it’s secure to say BTI is at no threat of insolvency. Do word that the goodwill impairment fees, had been non-cash gadgets, so FY23’s ratio shouldn’t be correct.

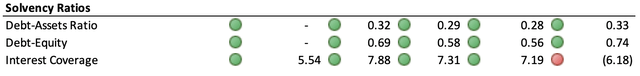

By way of income, the corporate has been stagnating for fairly some time, which isn’t a shock, given the shifts in shopper conduct. I truthfully would have anticipated steeper declines since persons are smoking much less, however the firm entering into the smokeless alternate options stored its prime line fairly sturdy.

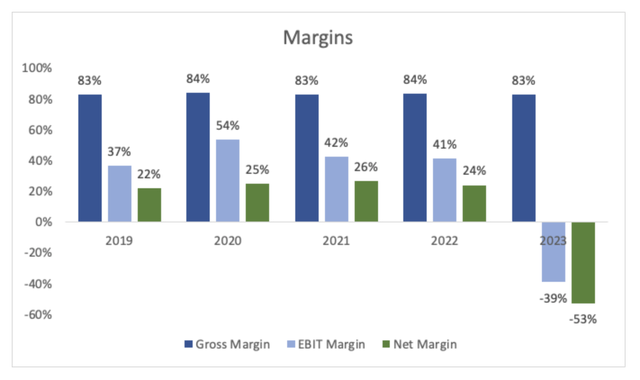

The corporate’s margins have been very constant through the years, and if we take out the non-cash cost within the newest yr, there is no such thing as a influence on the corporate’s profitability and effectivity.

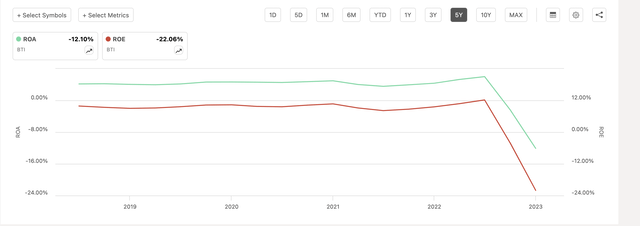

The identical story unfolds with the corporate’s ROA and ROE, if we take out the non-cash cost, these have been comparatively steady, and I don’t suppose are going to get any worse. All in all, the corporate appears to be working fairly effectively.

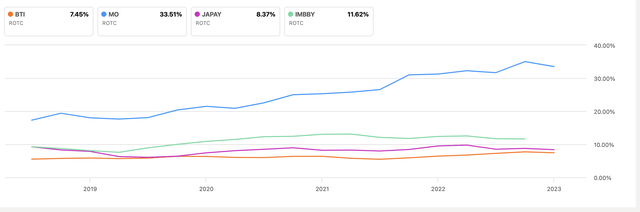

By way of aggressive benefit in opposition to its friends, BTI’s return on whole capital or ROTC has been on the decrease finish, and far decrease than its closest competitor Altria (MO). Plainly Altria could have the higher hand right here.

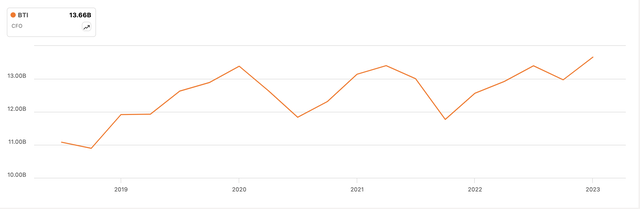

The corporate’s money circulate is at all-time highs, so the corporate is a money cow, it simply must put that money to good use, to entice buyers in beginning a place.

General, it seems to be like the corporate is simply cruising alongside very constantly, which is healthier than seeing a damaging development in the entire metrics above (if we ignore the non-cash cost). Little to no progress shouldn’t be dangerous, however it’s also not very thrilling for individuals who need to develop their capital. The sort of efficiency total can justify the corporate buying and selling at such a low P/E ratio. If there isn’t a lot progress left within the firm, I want to see profitability and effectivity bettering, nevertheless, margins are fairly respectable already, so I’m not certain how the corporate might enhance there. So long as the corporate can preserve such excessive money flows, it might probably repay its excellent debt, proceed paying that juicy dividend, and search for methods of rising the corporate and rejuvenating top-line progress, or a minimum of not let it begin declining. All methods ought to appeal to shareholders.

Feedback on the Outlook

The overall consensus amongst tobacco corporations is that the declining cigarette use will erode their prime line, therefore most are buying and selling beneath a P/E ratio of 10. Using tobacco has been on a decline for some time now, particularly in developed markets, coupled with anti-smoking advertising driving uncertainty that BTI will transition to a smokeless different product producer and preserve its revenues. The so-called “sin stocks” have grow to be a lot much less in style among the many youthful generations, who could also be extra ESG-oriented and have a tendency to keep away from playing or tobacco corporations.

Talking of transition, some classes are rising significantly better than others, with Vapor being the excellent one. The brand new classes of alternate options to cigarettes are nonetheless fairly small (round 12% of whole revenues), so the transition will take an extended whereas, and we received’t know the way profitable this transition might be. Nonetheless, I commend these corporations for making an attempt to remain within the enterprise and never extinguish with the final cigarette. This is likely one of the causes the corporate is buying and selling at such multiples. The uncertainty of the transition. Altria is a powerful competitor that has been specializing in alternate options for some time now, and its merchandise are highly regarded. I’m nervous that BTI received’t be capable to seize an honest market share in the event that they fall behind the formidable competitors.

Talking of alternate options, the long-term well being results should not but identified, since there isn’t a variety of information gathered thus far. Now we have all the information we might need on cigarettes and the way dangerous they’re for an individual’s well being. Can not say the identical about these alternate options. They might be higher than smoking cigarettes, however there may be nonetheless a variety of uncertainty on the long-term results they could have. At first look, it seems to be like they’re much more healthy than smoking, however with the analysis finished by the cigarette corporations themselves, I are usually a bit extra skeptical.

With time, the extra folks transition to smokeless alternate options, the extra we’re going to see some type of well being issues pop up from the utilization of stated alternate options, which leads me to a different essential issue which may be weighing on the corporate’s share worth, lawsuits.

Many buyers are likely to keep away from these corporations since they’re all the time concerned in class-action lawsuits, blaming second-hand smoke for affecting their well being, and getting lung cancers, coronary heart illness, and different respiratory diseases. To settle these lawsuits, corporations like BTI should cough up mountains of money to cowl all of the authorized charges and damages. Buyers don’t prefer to get entangled with such corporations, for ethical causes or in any other case. I wouldn’t be stunned to see some lawsuits popping up relating to the smokeless alternate options, as soon as the consequences set in after extended use.

So, briefly, declining cigarette income will proceed to weigh on the corporate’s efficiency, particularly if it can’t substitute it with the alternate options quick sufficient. Destructive well being results will definitely usher in lawsuits, and the corporate must have sufficient assets to cowl all of the charges and settlements. Laws might also put a damper on a few of these new alternate options after we all know much more about them, and that uncertainty is almost definitely to maintain the corporate’s multiples depressed, so is the corporate truly low cost?

Dividend

As I discussed earlier, the corporate’s double-digit dividend is what prompted me to look just a little deeper into the corporate. I’d enterprise a guess, that a variety of BTI buyers are right here solely for the juicy yield and don’t actually care concerning the firm’s merchandise and whether or not they’re dangerous or not. More often than not, folks make investments to maximise returns and are unwilling to forego a few proportion factors if meaning they’re investing responsibly, as this paper suggests. Possibly with the following generations getting older and getting into the funding house, it will change, however we’ll should see these research and the way it will prove with time.

To be sincere, I don’t blame them, as I’d fall into the maximizing returns class. So, a ten% yield does appear just a little unsustainable, however is it? Briefly, I’d say sure. Simply final month, the corporate raised its dividend by 6.1%. This is likely one of the comforting indicators that the corporate feels financially robust and supplies us with confidence that it received’t be lower any time quickly. Nevertheless, issues can change, and it’s not unprecedented for corporations to lift dividends after which the identical yr lower it in half or extra. Pfizer (PFE) did that way back, whereas Kinder Morgan (KMI) did that in 2015, proper after it elevated its dividends.

With such a excessive dividend yield, I don’t suppose there may be a variety of room for progress going ahead, so it’s dangerous in that sense. The corporate’s dividend per share is $2.92 at the moment and in FY23 the corporate’s free money circulate per share was principally double that, at $5.80 a share. This implies {that a} payout ratio of round 50% is greater than sustainable for my part, so I don’t suppose the corporate goes to chop the dividend in half, which might nonetheless be an honest dividend, nevertheless, that may certainly convey its share worth down even additional.

Valuation

Let’s have a look at some eventualities to see what a good worth could be to purchase the corporate at.

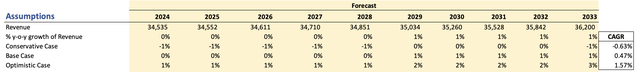

For revenues, I went with principally no progress. The reason being that the declining cigarette income will almost definitely be offset by alternate options in the long term, however I don’t suppose these alternate options will present any significant progress going ahead. Analysts are in the identical boat however a bit extra optimistic. To account for a greater end result and even a worse end result the place the corporate sees declines to outpace different beneficial properties, I additionally modeled two further eventualities. Under are these eventualities, and their respective CAGRs.

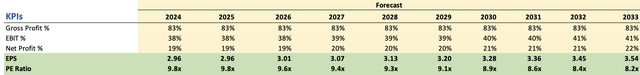

By way of margins, as I discussed earlier, these are already fairly spectacular, so to be on the safer aspect, I made a decision to maintain these about the identical, aside from bettering EBIT by round 300bps, which led to the identical enchancment within the backside line too. You’ll word that my EPS remains to be a lot decrease than what the analysts are estimating.

Margins and EPS assumptions (Creator)

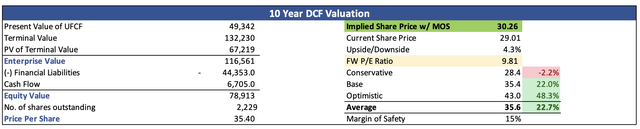

For the DCF evaluation, I made a decision to go together with a reduction fee of seven% for the bottom case, as an alternative of the corporate’s WACC of 4.7% as a result of I want to have a bit extra margin of security. 4.7% appears awfully low. Moreover, I went with a 1% terminal progress fee as an alternative of two.5% as I often like to make use of as a result of I don’t suppose the corporate might develop at these numbers. This fashion, I get much more room for error in my estimates. To prime all of it off, I’m going so as to add one other 15% low cost to the ultimate calculation, simply to maintain it further secure. With that stated, BTI’s intrinsic worth is round $30 a share, which means it’s buying and selling near its conservative honest worth.

Dangers

The primary dangers will contain the corporate’s transition away from the dangerous habits of smoking to the much less dangerous perceived alternate options and whether or not persons are prepared to spend money on “sin stocks”. As I discussed, a variety of them don’t thoughts so long as they’re getting good returns.

The alternate options section could not carry out effectively and will not efficiently substitute the misplaced revenues of cigarettes, bringing the share worth additional down.

Money circulate in flip worsens, and the corporate is compelled to chop the dividend, or fully axe it. Many buyers will flee if that occurs, and the share worth will proceed its tumble.

The debt turns into tougher to pay down if money circulate comes considerably down, which can additional detract buyers from holding the corporate of their portfolio.

Future laws that aren’t in impact but because of the comparatively small information on alternate options to folks’s well being could ban sure merchandise, simply as we’re seeing with menthol cigarettes and flavored vapes.

Closing Feedback

So, on paper, it does appear to be the corporate is buying and selling at its honest worth, however my assumptions had been fairly conservative. I’m assuming a Ahead PE ratio of 10, whereas many analysts are placing a Ahead PE ratio of round 6 as a result of increased earnings numbers in comparison with my assumptions.

For an organization like BTI, the primary attractor is its dividend yield for certain, and a double-digit yield shouldn’t be straightforward to come back by, particularly the one which appears to be fairly secure for my part. So, I’d say it’s not a foul time to begin a place right here, lock in that yield, reinvest the proceeds into extra shares in BTI or some place else, and hope that the administration doesn’t resolve to chop it. Alternatively, is the yield sufficient when the corporate’s share worth continues to slip? That’s as much as the person investor and whether or not they consider the corporate’s share worth will get well in the long term, and whereas they look forward to that to occur, they’re getting paid effectively for his or her persistence.

Given the conservative estimates above, I contemplating beginning a place at these worth ranges, and will construct it out over the following yr or two, particularly if the share worth stagnates or drops additional.

![Which Countries are utilizing ChatGPT the Most? [Infographic]](https://whizbuddy.com/wp-content/uploads/2024/08/bG9jYWw6Ly8vZGl2ZWltYWdlL3doYXRfY291bnRyaWVzX3VzZV9jaGF0Mi5wbmc.webp.webp)