Presently valued at $8.6 billion after its £590 million ($624 million) funding spherical final 12 months, SumUp stands sturdy in non-public markets with no quick plans for an preliminary public providing.

London-based monetary companies firm SumUp has secured £285 million value roughly $307 million in its newest funding spherical to broaden its enterprise choices to different elements of the world exterior the UK.

The corporate has already established its presence in different monetary markets exterior Europe, together with the US and Australia.

World Growth Plans

In accordance with an official announcement on December 11, the funding spherical was led by Sixth Road Development, a subsidiary of the famend world funding firm Sixth Road.

The funding noticed contributions from each new and current buyers, similar to Bain Capital Tech Alternatives Fin Capital and debt financing agency Liquidity Group. The spherical primarily consists of fairness, with a minor portion raised as debt.

The London-based fintech agency, serving roughly 4 million small companies throughout Europe, the Americas, and Australia, plans to make use of the recent capital to broaden its companies around the globe to assist strengthen its foothold within the trade.

SumUp’s natural progress technique entails launching extra monetary companies to higher serve its intensive small enterprise clientele.

Equally, the corporate goals to penetrate new geographies, extending its attain past its present strongholds. The fee firm additionally plans to discover mergers and acquisitions as a part of its purpose to remain aggressive within the dynamic fintech panorama.

Firepower to Act on Alternatives

Hermione McKee, SumUp’s chief monetary officer, described the brand new funding spherical as “more firepower to act on opportunities”. He additional famous that the monetary companies agency plans to make use of the recent capital for strategic initiatives over the following two years.

Earlier this month, McKee told CNBC that the agency is consistently accessing its purchase versus construct technique and scouting for extra areas to discover. The agency is eyeing each Africa and Asia for its subsequent growth plans.

“We have this foothold in Latin America, and there’s more expansion that can be done there. Then we look at Asia, how we think about that region, and then obviously opportunities across Africa. There are so many opportunities globally. We’re constantly assessing this ‘buy versus build’ strategy.”

SumUp Lunches Upgraded Level of Sale

Presently valued at $8.6 billion after its £590 million ($624 million) investment round final 12 months, SumUp stands sturdy in non-public markets with no quick plans for an preliminary public providing. The corporate’s entry to personal capital solidifies its monetary stability, permitting it to concentrate on strategic growth.

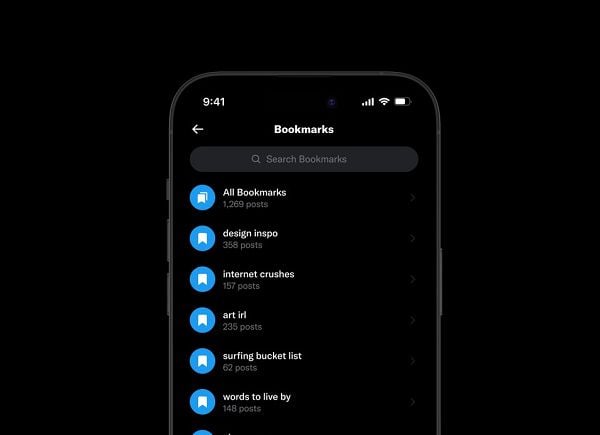

The fintech agency, identified for its compact card readers, has been actively diverting its companies exterior of conventional funds.

Along with funds, SumUp has launched different revolutionary options, together with self-service kiosks and the mixing of Apple’s Faucet to Pay function. Earlier this August, the agency rolled out an upgraded Level of Sale (PoS) model to assist small companies flip clients into followers.

In accordance with the announcement, the improved PoS can create automated advertising and marketing campaigns with rewards to lure clients again.

SumUp additionally strengthened its money advance companies, securing a $100 million credit score facility from Victory Park Capital this previous summer time. The transfer allowed retailers to entry money advances or enterprise loans based mostly on card gross sales – an motion met with constructive service provider response.

McKee stated the lending product thrives, with most retailers promptly repaying.