Andy Roberts

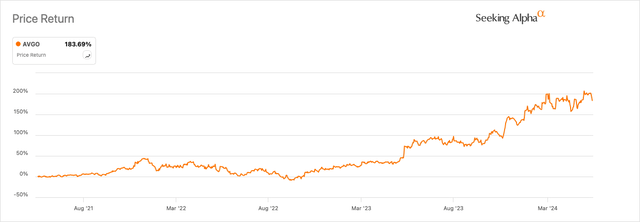

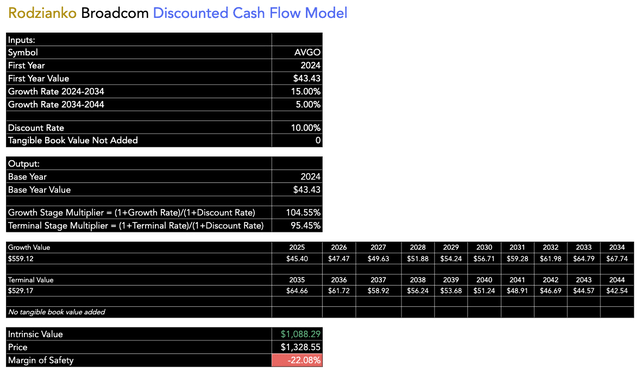

I last covered Broadcom (NASDAQ:AVGO) in February, and since my Hold rating at the time, the stock has gained 9% in price. However, on reanalysis, I believe the stock could be significantly overvalued at this time, a sentiment driven by the result of my 20-year discounted cash flow model and also because of its high P/E GAAP ratio and P/S ratio at this time compared to its major competitors. In addition, there is some concern at the moment that there is a moderate correction underway in stocks that have benefited from high investor exuberance from the advent of mainstream AI. For these reasons, I am maintaining my Hold rating for Broadcom right now.

Operations Analysis

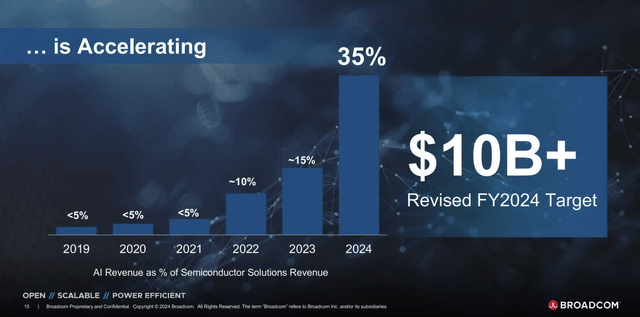

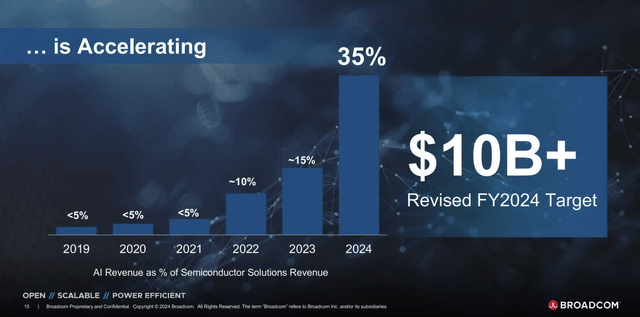

Broadcom has been experiencing significant growth, which has been primarily influenced by the increasing adoption of AI technologies. For fiscal 2024, Broadcom has projected $10 billion in revenue, specifically from AI-related chips:

Broadcom Enabling AI Infrastructure Presentation

This explains a lot of the heightened investor sentiment surrounding Broadcom stock at the moment, contributing to a gain of 212% since October 14, 2022:

The surge in sales is primarily a result of Broadcom’s advancements in AI networking and accelerators; this includes high-speed optical interconnect solutions tailored for AI and machine learning applications, which are designed to handle the massive data transfer requirements of AI systems. Examples of these solutions include the 200-Gbps per lane electro-absorption modulated laser (‘EML’) and the vertical-cavity surface-emitting laser (‘VCSEL’). Companies like Google (GOOGL) (GOOG) and Nvidia (NVDA) use these technologies to interconnect their GPUs and TPUs, which significantly improves the processing speed and capability of their AI models.

Despite these positive developments, shares dipped slightly after they were announced in the company’s most recent Q1 Earnings Report. I believe this may indicate investors’ growing concerns surrounding the valuation of stocks exposed to AI operations. While the demand for AI technologies remains strong, there might be a recalibration of expectations and valuations following the recent period of heightened exuberance.

However, Broadcom is strategically diversified, which could protect it from some of the reduced sentiment that may have begun related to AI at the moment. Its portfolio includes:

| Cloud and Data Center | Broadcom provides networking and storage solutions essential for data centers, including Ethernet switches, fiber optics, and RAID controllers. |

| Networking | Broadcom offers enterprise and service provider networking equipment such as switches, routers, and network interface cards. |

| Broadband | Broadcom supplies chips for broadband communications. These technologies include modems, set-top boxes, and home networking devices. |

| Wireless | Broadcom provides radio frequency (‘RF’) solutions and Wi-Fi connectivity products used in smartphones, tablets, and other wireless devices. Its wireless portfolio includes Bluetooth and GPS chips. |

| Storage | Broadcom’s storage solutions, including HDD and SSD controllers, enable efficient data storage and retrieval in various applications, from personal computing to enterprise storage. |

| Industrial | Broadcom’s semiconductor solutions support a range of industrial applications, including automation, energy management, and automotive systems. |

| Enterprise Software | Broadcom offers software solutions for cybersecurity, mainframe, and cloud infrastructure management. This includes tools for threat detection, data protection, and IT infrastructure management. |

Its actual revenue percentage breakdown per segment is as follows, as per the full-year fiscal 2023:

| Semiconductor Solutions | $28.18 billion, 78.7% |

| Infrastructure Software | $7.6 billion, 21.3% |

The company’s AI-related sales predominantly fit into the Semiconductor Solutions segment. However, as I mentioned, management has estimated that 35% of Semiconductor Solutions revenue will be related to AI for the full-year fiscal 2024. Fortunately for the company, that leaves 65% of its largest operating segment open to a more diversified set of offerings. In my opinion, this is good for the company because it reduces some of the risks of volatility in its price, as most investors will not be investing in Broadcom as a ‘pure AI firm’. That being said, the likelihood of Broadcom scaling its AI offerings over the next decade is high, in my opinion, and we could see a new Broadcom where 50%+ of total revenue is AI-related, although this may be further diversified by significant iterations into robotics semiconductor solutions as demand for automated technological labor scales.

In this operations analysis, I am introducing the major competitors to Broadcom, which I will use in my financial and valuation peer analysis to come:

| Intel (INTC) | Intel is one of the dominant players in semiconductors, providing a diverse portfolio including processors, chipsets, and networking components. |

| Nvidia (NVDA) | Nvidia has leading GPUs and AI processors, positioning itself as one of the leaders in data centers and AI markets. |

| Cisco (CSCO) | Cisco is a major player in networking hardware and telecommunications equipment; it primarily competes with Cisco in networking products. |

| Qualcomm (QCOM) | Qualcomm specializes in wireless technology and mobile chipsets, directly competing with Broadcom in the wireless segment. Qualcomm’s advancements in 5G technology and mobile processors are particularly noteworthy. |

Financial Analysis

For my financial analysis, please consider the peers I have chosen above compared on various fundamental financial measures that I have compiled:

| AVGO | INTC | NVDA | CSCO | QCOM | |

| FWD Revenue Growth Rate 5Y Avg | 10.79% | -1.16% | 28.13% | 2.62% | 12.33% |

| FWD EPS Diluted Growth 5Y Avg | 13.84% | -8.57% | 33.96% | 5.98% | 20.60% |

| FWD Free Cash Flow Per Share Growth 5Y Avg | 15.37% | -8.35% | 40.13% | 4.79% | 24.98% |

| TTM Net Income Margin 5Y Avg | 23.92% | 20.04% | 29.13% | 22.16% | 22.93% |

| Equity-to-Asset Ratio | 0.4 | 0.55 | 0.64 | 0.37 | 0.46 |

As semiconductor companies are usually prone to high capital intensity, affecting free cash flow, Broadcom has had strong free cash flow growth rates over the past 5 years, primarily a result of its fabless model. However, even stronger is Qualcomm, which was founded only five years earlier than Broadcom, so I believe its strength is largely a result of organizational and capital efficiency rather than a significant lead in infrastructure build-out. Nvidia obviously has extremely high growth at the moment because it is newer to the market in many respects, and it has notably strong free cash flow generation. The fact that Nvidia is not involved directly in manufacturing is crucial to why it is so strong in free cash flow at a time of heightened interest for its products and services, as it outsources most of its manufacturing to TSMC (TSM). Nvidia must be recognized for its strength; founded in 1993, the company has proven itself as arguably the most agile and operationally prudent of the 5 peers I have compared. In addition to the highest growth, it has managed to maintain the strongest balance sheet.

From my assessment, Broadcom is doing very well financially, and it has proven itself as highly profitable over the long term historically. Yet, it carries $73,429 million in long-term debt and $2,374 million in current debt, contributing $75,803 million to $107,586 million in total liabilities. It has total cash and ST investments of just $11,864 million, making its cash-to-debt ratio 0.16. That’s not terrible because of how profitable the company is and its strong history of free cash flow generation, but it still strains its ability to grow and expand because it will find itself obligated to pay back its liabilities in instances where, instead, it could be investing in new vital acquisitions to stay competitive.

However, the primary issue here with Broadcom and other semiconductor companies involved in AI at the moment isn’t the performance in fundamental financials. Instead, it is the way the market has been reacting to these recently, which I believe has caused a significant overvaluation of many semiconductor stocks.

Value Analysis

At the moment, Broadcom looks overvalued even if it manages to sustain its 5-year average FWD free cash flow growth rate over the next 10 years, which might be unattainable due to how mature the business is now. That being said, higher adoption of AI and robotics semiconductor solutions could sustain this; therefore, I think it is reasonable as an input for the first 10 years of my discounted cash flow model of the company. For the following 10 years, I have opted for a more conservative 5% growth rate in free cash flow. I have used my standard 10% discount rate, which I consider a good benchmark for the typical average annual return of the S&P 500 (SP500).

This realistic model shows that Broadcom could be 22% overvalued at the moment. While typically, semiconductor companies perform poorly in a DCF model because of high capital intensity issues, this is not the case with Broadcom as it is largely fabless, and as such, it has generated stable free cash flow growth over its history. This means that the company could benefit from higher growth in the future if it innovates and invests its resources correctly, pulling greater competitive advantage. However, as I mentioned earlier, its balance sheet prohibits this considerably, and I believe incorporating all of these elements in the analysis of my DCF model proves that Broadcom is indeed roughly 20% overvalued at the time of this writing.

To further demonstrate the issue I have with the valuation, we can compare Broadcom to the major peers I used in my peer analysis above on forward P/E GAAP ratio and forward P/S ratio:

| FWD P/E GAAP Ratio | FWD P/S Ratio | |

| AVGO | 69.5 | 12.5 |

| INTC | 32 (TTM ratio used, as the FWD ratio is not meaningful due to high earnings contraction estimated) | 2.5 |

| NVDA | 43 | 22.5 |

| CSCO | 18.5 | 3.5 |

| QCOM | 24.5 | 6 |

From the above table, it is clear that Broadcom is richly valued, particularly based on its forward earnings, where it is expecting a contraction; its TTM ratio is 50. Broadcom’s valuation based on multiples is not as high as Nvidia’s, all things considered, when we also include the price-to-sales ratio, but other than Nvidia (which is arguably the most highly valued semiconductor stock on the planet right now), Broadcom is next compared to these 5 peers. Therefore, I think investors should be skeptical of investing in Broadcom at these levels. I believe the present price has become speculative, and investors in the AI markets at this time should be more cautious about which companies in the field they invest in, carefully considering the valuation at a time when multiples are expanding arguably irrationally based on mass-market exuberance. There are much better-valued semiconductor companies, including Infineon (OTCQX:IFNNY) and ON (ON), which both supply AI operations.

Risk Analysis

The semiconductor industry is prone to fast innovations, which can make older companies redundant over time if they are not efficiently strategic in their iterations of offerings. With companies like Nvidia on the scene, who are taking a much more aggressive and modern approach to chip design, Broadcom might find that it cannot compete with such extensive ecosystems, especially as Nvidia builds out its moat more thoroughly and might gain competitive advantages in the price of products sold as a result of efficiencies of scale.

In addition, I would like to reiterate Broadcom’s significant levels of debt. If the company finds it needs to make significant investments to build out its portfolio of offerings, which might include capex for infrastructure to support its acquisition strategy, the debt could become a problem for management and shareholders. Over time, this could drag the company back into a position of weakness against the leaders in the industry, who are not as indebted and have kept developing infrastructures and portfolios. Broadcom is likely to have reduced operating cash flow in the future as a result of debt repayments, which is then going to affect free cash flow per share. Unless managed meticulously, this could lead the company into a situation for an extended period where its free cash flow growth is stagnant as its balance sheet improves.

Key Elements

Broadcom expects $10 billion or more in revenue from AI in fiscal 2024, which translates as roughly 35% of Semiconductor Solutions segment revenue for the period. Despite irrational exuberance around AI firms at the moment in the market, Broadcom is well diversified, meaning it could provide some buffer against too much speculation in its stock price over the long term.

Broadcom has very good growth and profitability, including strong free cash flow growth because it operates a fabless model, outsourcing production, which significantly reduces its capex. However, its balance sheet is weak compared to its major competitors, which could reduce its success in the industry over time.

Based on my 20-year DCF model, Broadcom stock is roughly 20% overvalued at the time of this writing. In addition, compared to its major competitors, the stock is richly valued based on P/E GAAP and P/S ratios. I believe it is wise for investors to refrain from investing in this particular semiconductor stock at this time.

Q2 Earnings Expectations

Broadcom will have its Q2 fiscal 2024 earnings on 6/12/2024 post-market. Key expectations include robust revenue growth driven by current high demand, with AI-related revenue continuing to be a major driver and EPS normalized of $10.84, following a strong performance in Q1 where the EPS estimate was exceeded by $0.57. However, investors would be wise to monitor how Broadcom frames its debt and whether it shows any signs of looking to ease this more proactively over the next year and beyond. Other than this, the earnings should deliver promise for investors outside of the trouble with the stock valuation, as the EPS consensus estimate is a 5% YoY growth.

Conclusion

Broadcom is clearly a great company, but many investors know this already, and I think the market at large has become too excited by the company’s growing exposure to AI in my opinion. For this reason, primarily, I think the stock valuation has become unreasonable at this time, and I believe investors can find much better semiconductor companies to buy a stake in right now, including the much better-valued Infineon and ON.