Eoneren

Introduction

I like utilities and have written a number of bullish articles on some of them this year. In general, utilities have two major benefits.

- Stock dividends from utility companies often prove to outyield other fixed-income investments and have less volatility than other equities.

- Utilities tend to be very resistant to economic cycles because demand for utilities does not change much compared with most other industries, even in the deepest recessions. – Investopedia (emphasis added)

In other words, the benefits are income and safety, two of the most desired characteristics of a dividend stock.

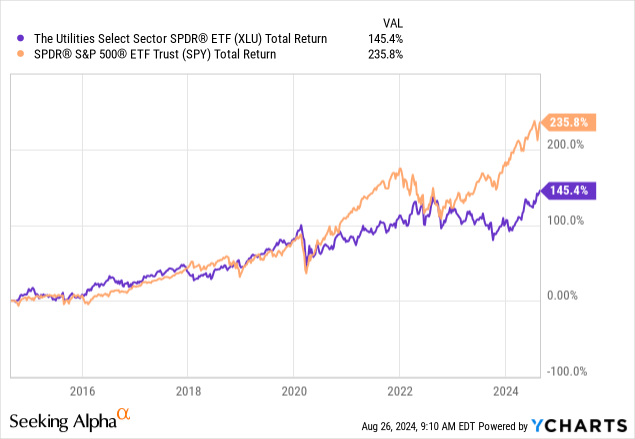

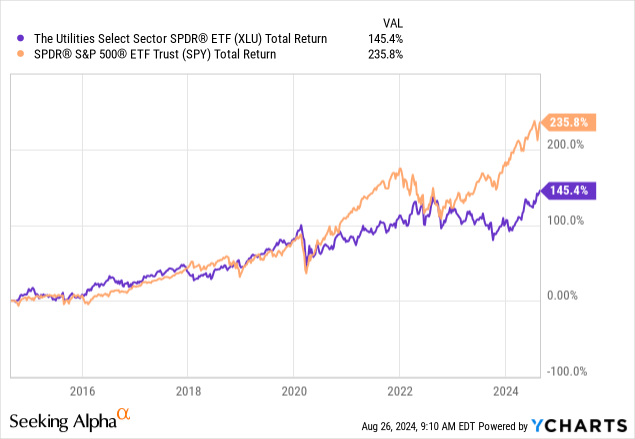

Despite these characteristics, utilities have not been a great place to be. At least not if we use The Utilities Select Sector ETF (XLU) as a proxy. This ETF has returned just 145% over the past ten years, including dividends.

Unfortunately, on top of having demand and income tailwinds, utilities have a number of headwinds:

- Utilities have limited pricing power. Especially in light of sticky inflation, this has become an issue.

- Utilities are aggressively investing in renewable energy and infrastructure upgrades. Most of these investments are financed by debt, which has gotten more expensive since 2021.

- Because of higher rates, investors were able to buy risk-free government bonds with decent returns.

Although utilities are also benefitting from strong secular growth from data center-related power demand, I believe there’s a better way to buy utilities. One that involves buying more than just power infrastructure!

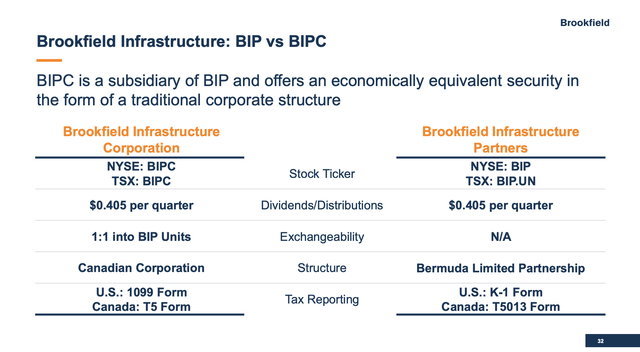

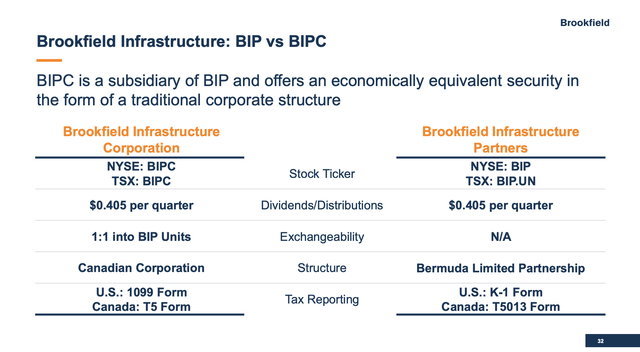

That’s where Brookfield Infrastructure Partners (NYSE:BIP) comes in, a company that is also traded as the Brookfield Infrastructure Corporation (NYSE:BIPC).

The only difference between the two is tax treatment. Brookfield launched BIPC to allow a wide range of investors to buy its Infrastructure business, as Limited Partnerships can be a real headache for foreign investors. Also, many ETFs and fund managers are not allowed to buy these “complex” businesses.

Brookfield Infrastructure Corporation/Partners

My most recent article on this company was written on June 11, when I called the company “A Billionaire-Style Income And Growth Play.” Since then, BIP has returned 18%, beating the 5% return of the S&P 500 by a wide margin.

In this article, I’ll update my thesis, using its latest earnings and new developments to explain why Brookfield Infrastructure remains a great long-term pick for a wide range of investors.

So, let’s get to it!

Everything A Utility Has – And More

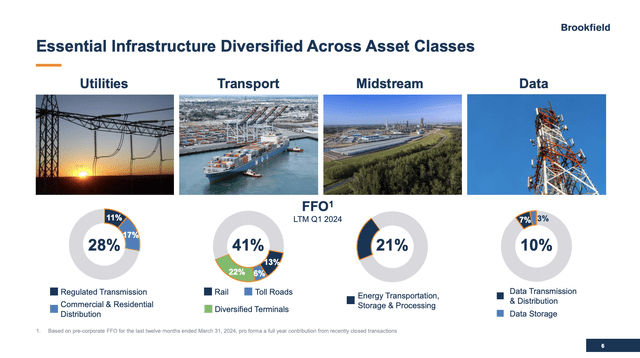

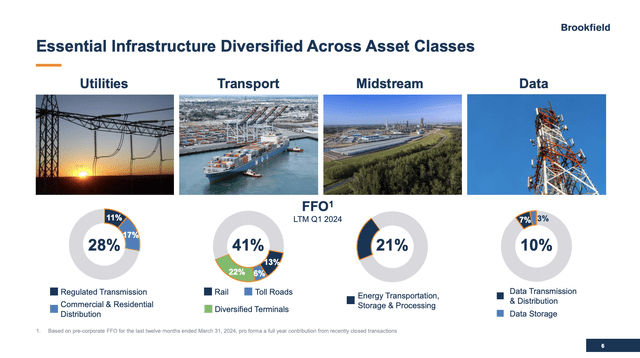

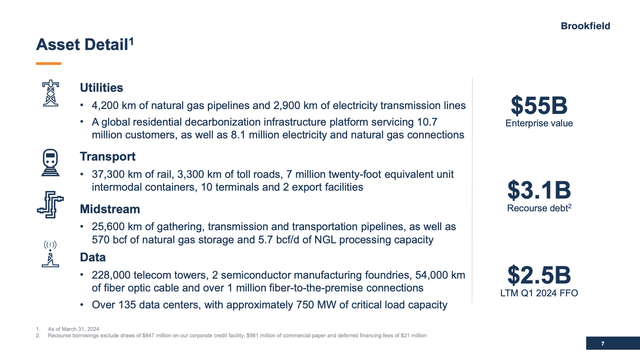

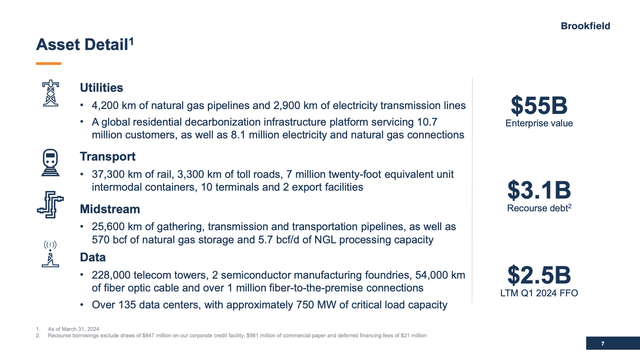

Brookfield Infrastructure has a lot of utility exposure. Close to 30% of its funds from operations (“FFO”) comes from the utility sector.

In this area, it owns 4,200 kilometers (1 kilometer is 0.62 miles) of natural gas pipelines and 2,900 kilometers of electricity transmission lines. It also owns a global residential decarbonization infrastructure platform and 8.1 million electricity and natural gas connections.

Brookfield Infrastructure Corporation/Partners

On top of that, it owns a wide range of other critical assets, including 37.3 thousand kilometers of rail, 3.3 thousand kilometers of toll roads, 7 million intermodal containers, ten terminals, and two export facilities.

Even better, it owns close to 26 thousand kilometers of gathering, transmission, and transportation pipelines in its midstream segment. This segment also comes with 5.7 billion cubic feet per day of natural gas liquids storage. As I have written in other articles, natural gas demand is in a huge bull market, requiring a lot of infrastructure.

Meanwhile, 10% of its FFO comes from telecom towers, fiber optic cables, and more than 135 data centers.

Brookfield Infrastructure Corporation/Partners

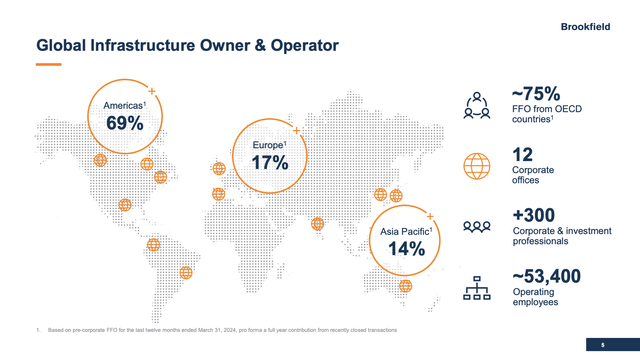

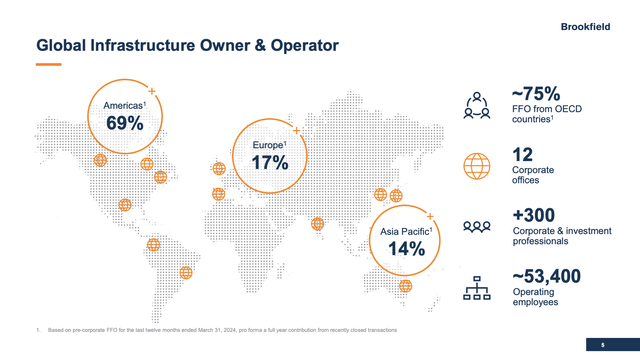

In other words, investors get more than just utilities. They get a portfolio of mission-critical assets in a wide range of industries managed by 12 corporate offices, including more than 300 corporate and investment professionals and roughly 53,400 operating employees.

Brookfield Infrastructure Corporation/Partners

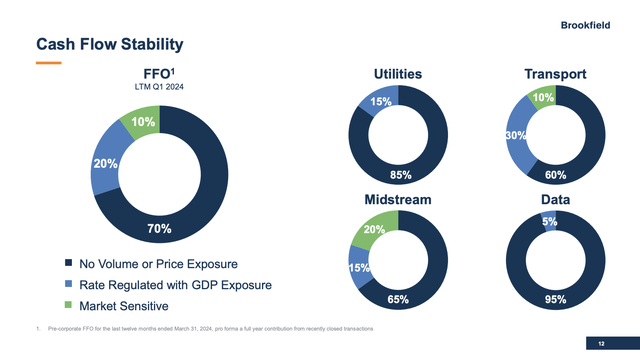

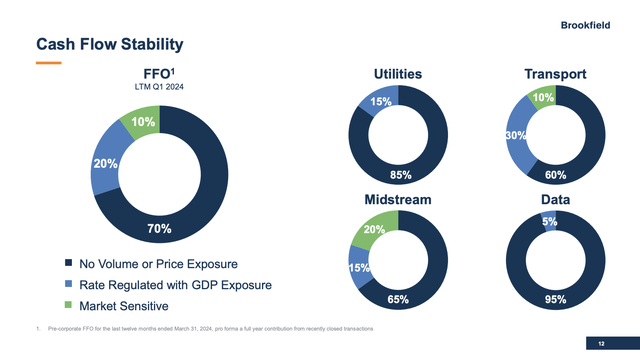

Moreover, as one can imagine, these infrastructure assets come with stability, as 70% of total FFO has no volume and price exposure. Just $0.10 of every revenue dollar is cyclical. That’s truly impressive.

Brookfield Infrastructure Corporation/Partners

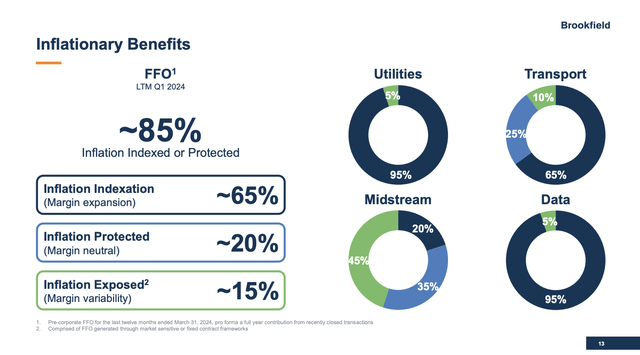

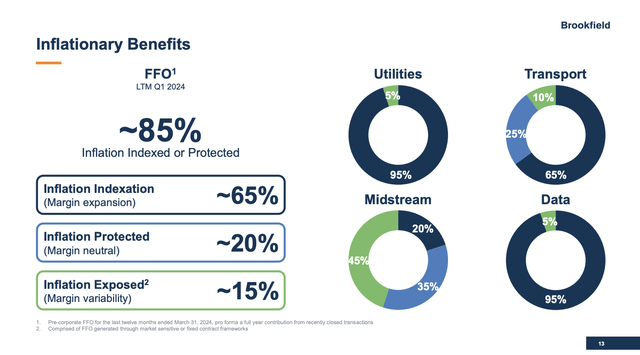

Furthermore, roughly 85% of total FFO is protected against inflation, with 65% of total FFO coming from operations that can benefit from inflation (instead of just being protected). This more than offsets the 15% of its FFO exposed to inflation.

Brookfield Infrastructure Corporation/Partners

So, how’s the company doing in this environment?

A Path To Higher (Dividend) Growth

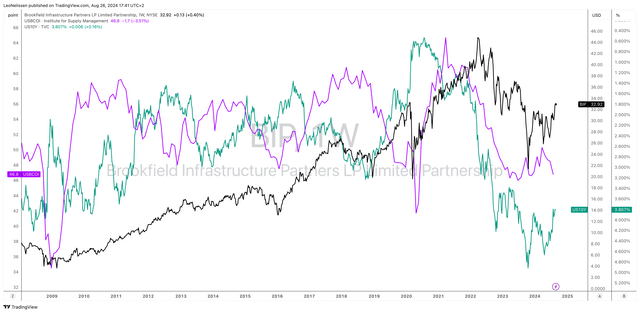

The chart below shows that the BIP stock has been a disappointment since the first half of 2022. This has two reasons:

- Economic growth has peaked at the end of 2021. Although Brookfield is mainly anti-cyclical, it still caused investors to drop stocks with exposure to cyclical industries. This is displayed by the ISM Manufacturing Index (pink line) in the chart below.

- Interest rates started to accelerate going into 2022. This is displayed by the (inverted) green line below. Like utilities, this also pressured Brookfield, as investors found lower-risk income in other places (including government bonds).

TradingView (BIP, ISM Manufacturing Index, U.S. 10Y Yield)

The good news is that the Brookfield business continues to perform well.

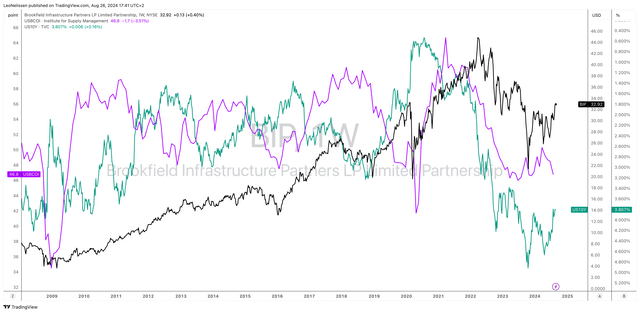

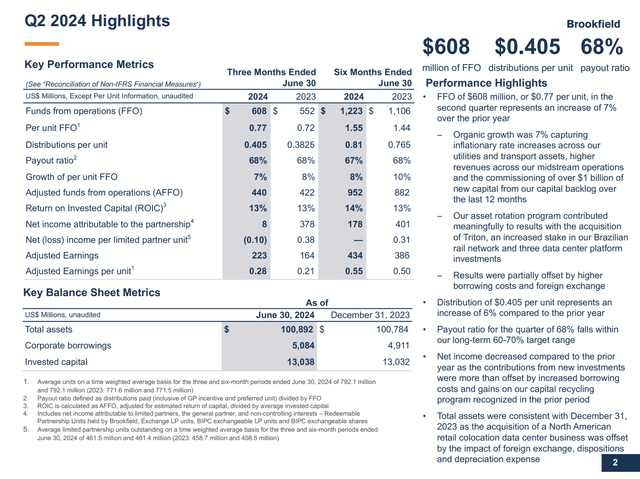

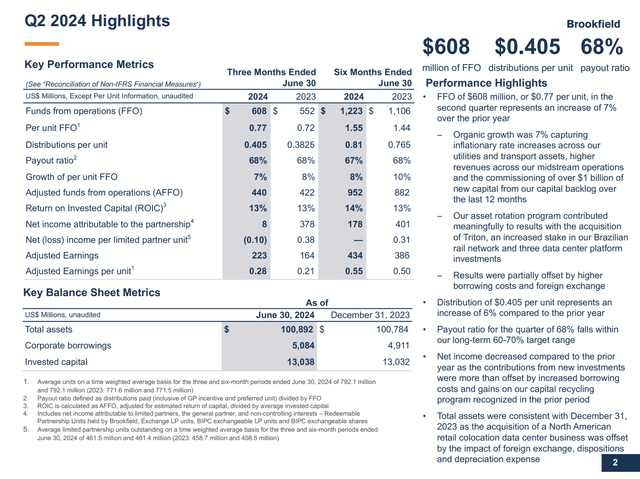

In the second quarter, the company reported $608 million in FFO. That’s a 10% increase, driven by organic growth and strategic M&A like a bigger stake in a Brazilian integrated rail and logistics provider. I believe this company could be VIL, a major transporter of agriculture and steel products. Brookfield has been invested since 2014.

Brookfield Infrastructure Corporation/Partners

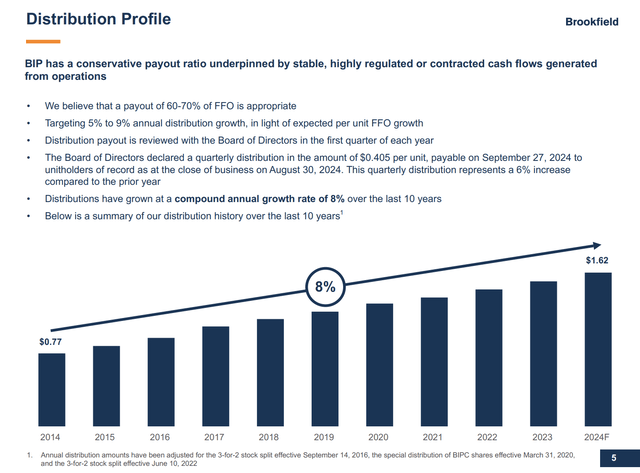

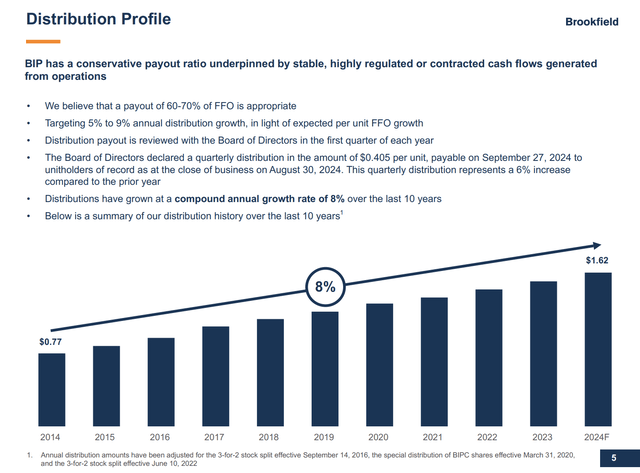

As we can see in the overview above, the company distributed $0.405 per unit. This translates to a yield of 4.9%. This distribution is covered by a 68% payout ratio, unchanged compared to the prior-year payout ratio.

Since 2014, the distribution has been hiked by 8% per year. The company has maintained a 60-70% payout ratio, targeting 5-9% annual distribution growth. This is highly attractive, as the company combines income with consistently elevated growth.

Brookfield Infrastructure Corporation/Partners

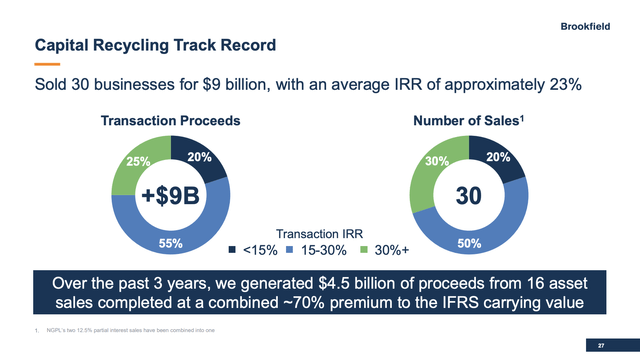

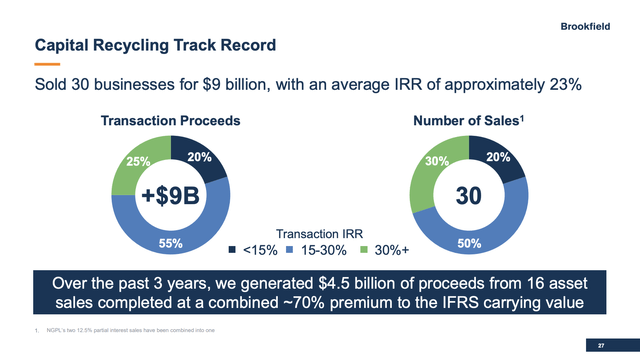

The dividend is also protected by a balance sheet with an investment-grade rating of BBB+. In 2Q24, the company had $1.9 billion in liquidity and generated $210 million from capital recycling, which is the process of selling previously bought assets.

For example, as of the first quarter, the company has sold 30 businesses for $9 billion, with an average internal rate of return of roughly 23%.

Brookfield Infrastructure Corporation/Partners

Moreover, going back to the second quarter, the company had a well-structured debt maturity profile, with only 1% of asset-level debt maturing in the next 12 months and no corporate maturities until 2027.

A healthy portfolio like this allows the company to engage in M&A. In addition to increasing its Brazilian transportation investment by 10% for $365 million, it also bought 40 data centers out of bankruptcy from Cyxtera in the first quarter of this year. It also bought cell tower assets in India, which is a deal expected to close in the second half of this year.

On top of that, the company has a project backlog of $7.7 billion, 15% higher compared to the prior-year quarter.

With all of this in mind, Brookfield Infrastructure is bullish going forward, as it expects the second half of 2024 to be very active for M&A, supported by easing monetary policies of central banks like the ECB and Bank of Canada. We can also add the Fed to that list, as Powell more or less promised a rate cut in September.

In general, the company believes it is in a great spot to benefit from major global trends like AI adoption, digitalization, and decarbonization, which are driving demand in the sectors we discussed in the first part of this article.

Not only does BIP/C own the power lines and pipelines fueling these data centers, but it also owns data centers and a wide range of assets that allow it to benefit from secular growth without taking elevated financial risks. This includes its balance sheet and the fact that most of its income is non-cyclical and inflation-protected.

Valuation

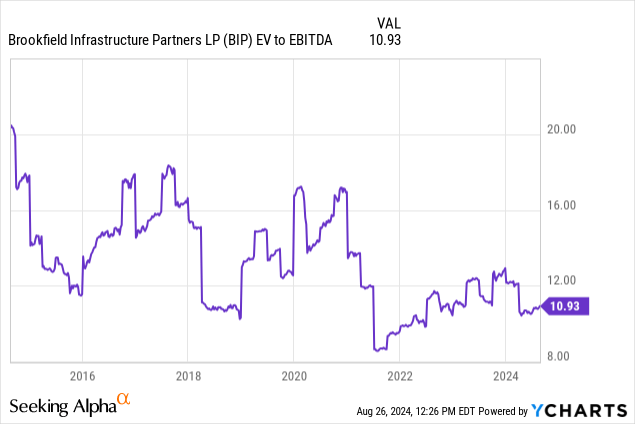

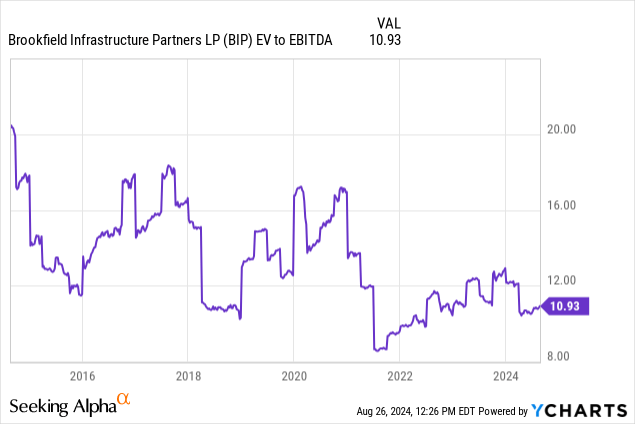

Valuation-wise, BIP trades at a blended EV/EBITDA ratio of 10.9x, which is below its 10-year average.

Moreover, 2025 is expected to see $4.5 billion in EBITDA, potentially 10% more than this year’s EBITDA forecast of $4.1 billion. In 2026, analysts expect $4.9 billion in EBITDA.

These growth rates are highly favorable. Once interest rates come down and economic growth bottoms, I expect these tailwinds to result in a higher valuation multiple.

The current consensus price target for BIP is $38.30, 16% above the current price. As I wrote in my prior article, I agree with this target and believe we could see a return to $45 in the years ahead if interest rates and economic growth provide tailwinds.

Takeaway

Brookfield Infrastructure offers more than just the stability of utilities, as it provides exposure to a diverse portfolio of mission-critical assets across multiple industries.

While traditional utilities face challenges like limited pricing power and rising debt costs, Brookfield’s strategic investments in renewable energy, data centers, and telecom infrastructure position it for long-term growth.

Moreover, with a strong balance sheet, inflation-protected income, and consistent dividend/distribution growth, Brookfield is in a fantastic spot to benefit from major global trends like AI adoption and decarbonization.

As interest rates stabilize, the company’s valuation has significant upside potential, making it an attractive investment for investors seeking income and growth.

That’s why I call it a one-stop shop for conservative investors.

Pros & Cons

Pros:

- Diverse Asset Portfolio: Brookfield Infrastructure owns a wide range of mission-critical assets, which offer stability and growth potential.

- Inflation Protection: With 85% of its funds from operations protected from inflation, Brookfield provides income security even in a challenging economic environment.

- Consistent Dividend Growth: The company has a strong track record of 8% annual dividend increases, backed by a sustainable payout ratio and a BBB+-rated balance sheet.

- Strategic M&A: Brookfield’s ability to engage in high-quality acquisitions, like its recent investments in Brazilian logistics and global data centers, drives long-term growth.

Cons:

- Interest Rate Sensitivity: Higher interest rates can impact funding costs and investor sentiment.

- Geopolitical Risks: As a global operator, BIP is exposed to geopolitical uncertainties that can affect its operations.

- Economic Growth: Although the company’s business model is mainly anti-cyclical, economic downturns can negatively impact its growth opportunities and re-sell the value of its capital recycling program.