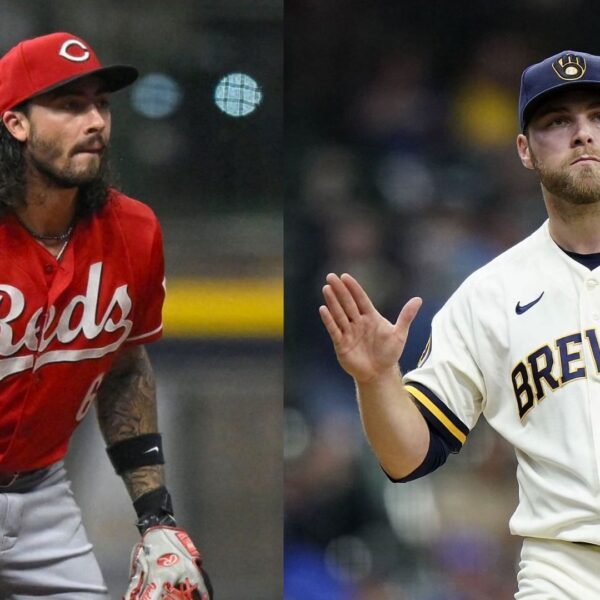

Bud Gentle, made by Anheuser-Busch.

Joe Raedle | Getty Photographs

Mountain climbing beer costs led Budweiser proprietor Anheuser-Busch InBev to revenue and income development final yr, even U.S. gross sales of staple model Bud Gentle have been curbed by boycott motion.

The world’s largest brewer on Thursday recorded annual income of $59.38 billion, up 7.8%, however shy of analyst expectations of $60.48 billion, in accordance with an LSEG-compiled consensus. Volumes bought fell by 1.7%, with beer manufacturers declining by 2.3%.

Core revenue (EBITDA) rose 7% yearly to almost $20 billion, additionally slightly below a forecast of $20.1 billion.

Belgium-listed shares dipped 0.2% in early Thursday commerce.

Fourth-quarter gross sales got here in barely forward of expectations at 6.2% development. However income within the U.S. fell 17.3% within the quarter, as sales-to-retailers dropped 12.1% — a drop that the corporate primarily attributed to declines in gross sales of Bud Gentle, which lost its spot because the best-selling U.S. beer.

The corporate grew to become embroiled in a social media-driven boycott of its core Bud Gentle model in the course of final yr. It additionally weathered wider beer business struggles from increased enter prices and a squeeze on shopper spending.

On Thursday, the agency introduced a full-year dividend of 0.82 euros ($0.89), up from 0.75 euros in 2022.

AB InBev CEO Michel Doukeris stated the outcomes have been a “testament to the strength of the beer category, resilience of our business and people, consistent execution of our replicable growth drivers and our unwavering commitment to invest for long-term growth and value creation.”

Analysts at Bernstein on Thursday stated the corporate noticed a “solid end” to 2023, as value rises offset declining gross sales.

Nevertheless, they flagged “cautious guidance and a tough pricing set-up in the USA,” and famous that gross sales traits within the remaining quarter have been weaker than anticipated, pushed by the continued hit to North America from Bud Gentle.

China was a brilliant spot, with earnings up 32% as a result of outperformance of premium merchandise, they added.