TrongNguyen/iStock through Getty Photographs

Funding motion

I really helpful a purchase ranking for Burlington Shops (NYSE:BURL) after I wrote about it the last time, as I used to be assured that BURL would have the ability to obtain its 5-year goal primarily based on how comparable retailer gross sales and web retailer development carried out. Based mostly on my present outlook and evaluation, I reiterate a purchase ranking. My confidence degree in BURL’s capability to fulfill its 5-year goal has gone up after wanting on the 4Q23 efficiency.

Within the close to time period, I imagine administration steerage is simply too conservative, and if I’m proper, it ought to have the ability to meet the excessive finish of its development steerage and beat its EBIT margin enlargement information, each of which ought to proceed to help the premium valuation that BURL is buying and selling within the close to time period. That mentioned, I have to observe that even at a premium a number of (26x ahead EBIT), the upside potential is enticing solely when traders have greater than 1 12 months of funding length (that’s to say, the share worth has already priced within the very near-term efficiency expectations).

Overview

FY23 carried out consistent with my expectations, as 4Q23 retail gross sales grew 13.9% Y/Y (beating consensus expectation of 12%), and comparable retailer gross sales grew 2%. Gross margin additionally improved (190bps enlargement pushed by merchandise margin and decrease freight price) higher than what the road was anticipating, coming in at 42.7% vs. 41.6%.

These drove the 4Q23 EBIT margin to 10.5%, which was additionally above consensus estimates of 9.9%, which additionally led the FY23 EBIT margin to six%, consistent with my mannequin. Administration additionally guided for FY24 EPS of $7 to $7.60 and pointed to comparable gross sales rising flat to 2% with an EBIT margin enlargement of 10 to 15bps. As for 1Q24, the EPS steerage was for $0.95 to $1.10 with comparable gross sales development of flat to 2%.

Based mostly on 4Q23 efficiency, my view is that administration steerage is simply too conservative and appears to be simply beatable. At a look, utilizing the midpoint of the information, it implies that FY24 will see a step down in comparable gross sales development vs. 4Q23, and this does not appear to gel nicely with the feedback supplied. Within the name, administration cited a few key factors that talk nicely of the underlying demand power. Firstly, they noticed continued sturdy gross sales at opening worth factors, with the low-income prospects responding nicely to worth.

Secondly, BURL continued to see constructive traction from their methods to focus on trade-down or barely higher-income consumers, particularly the recognizable manufacturers within the attire and equipment enterprise. Thirdly, BURL appears to have the ability to exert some type of pricing energy, as administration cited sturdy promoting on regular-priced merchandise as inventories turned sooner, and so they noticed lesser reliance on utilizing clearance gross sales methods (comparable gross sales development from clearance merchandise was down double-digits, for reference). My takeaway from these insights is that BURL is gaining visitors share because of its methods to focus on a wider vary of audiences (i.e., each decrease and better earnings teams) and is ready to take action with out sacrificing margins (i.e., with the ability to promote at full worth), and I see this as very sturdy proof of wholesome demand for BURL.

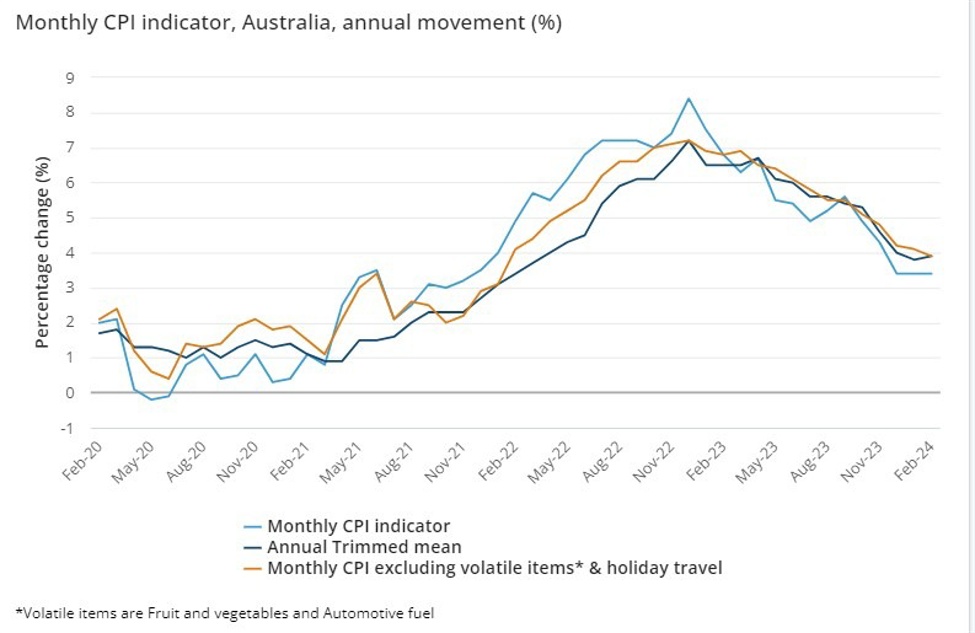

On condition that the macro situations haven’t dramatically modified since 4Q23 (inflation continues to be sticky, which suggests trade-down movement is more likely to maintain), I count on the momentum to proceed, and it’s unlikely that we’ll see a step down in comparable gross sales development (observe that pre-covid, common comparable gross sales development since 2014 was ~3.3%).

Whereas I do agree that there are some adverse impacts from the tax refund timing lap and climate challenges in 1Q24, I feel that the FY24 EBIT margin enlargement information is definitely beatable. Notice that the three primary margin enlargement drivers famous by administration usually are not depending on gross sales development and have “room to improve.”

The primary driver famous was merchandise margin enlargement. As we now have seen in 4Q23, merchandise margin has improved with decrease clearance gross sales. My view is that with client demand staying wholesome (for BURL to this point), they might presumably proceed this tempo of promoting at full worth and turning inventories sooner. On stock turnover, I feel the important thing driver can be the elevated vary of focused viewers (extra visitors = extra quantity = increased stock turnover), which BURL has seen constructive traction in attracting to this point.

This was pushed by a 140 foundation level enhance in merchandise margins, principally pushed by decrease markdowns in addition to a 50 foundation level lower in freight expense. 4Q23 call

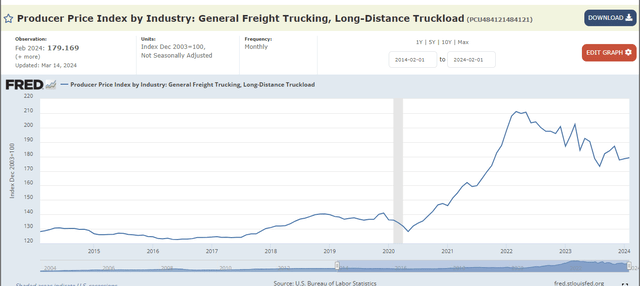

The second driver famous freight price financial savings. That is just about within the bag on condition that BURL has visibility contracts on ocean freight charges largely lined by 1H24. As for home freight prices, wanting on the present trendline, we might very nicely see prices persevering with to say no, which ought to function an upside to margin enlargement.

Secondly, on freight, freight continues to be a tailwind for us, significantly within the first half of 2024. We’re benefiting from decrease contracted home charges and stay largely lined with our contracts on ocean freight charges. 4Q23 name

The final driver is price financial savings from provide chain enchancment, which I’m additionally optimistic is achievable given administration is specializing in driving a extra cost-efficient off-price mannequin for receiving and delivering items. Considered collectively, for EBIT margin enlargement potential, I feel the baseline guided by administration is definitely achievable given all of the potential upside and, importantly, my expectation that comparable gross sales will are available in on the excessive finish of steerage (2%).

This 2% comparable gross sales development ought to present BURL with extra working leverage that offers an upside shock to EBIT margin enlargement (keep in mind that the three drivers supplied usually are not depending on development, so any comparable gross sales development upside will simply be “extra”).

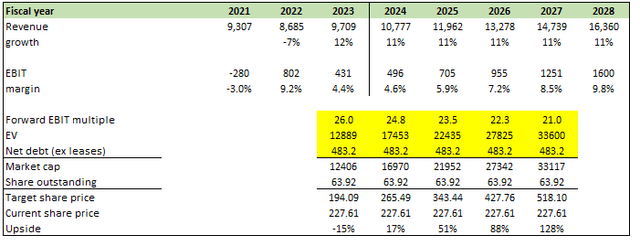

Valuation

My modeling method anchors on the identical long-term assumption that I’ve used beforehand: 11% development CAGR by FY28, however I’ve revised my EBIT assumption upwards to $1.6 billion (matching administration steerage). My underlying assumption is that BURL can obtain these targets, with my confidence degree bolstered primarily based on the 4Q23 efficiency.

In FY24, my view is that BURL can obtain the excessive finish of the expansion steerage: 11% development given the momentum seen in 4Q23, and an EBIT margin to beat steerage. My expectation is an enlargement of 20bps vs management-guided vary of 10 to fifteen bps, primarily based on how administration has traditionally crushed consensus EBIT estimates by ~20% (consensus estimates are inclined to comply with steerage).

Right here is the catch: my view on valuation is that it ought to see imply reversion ultimately as BURL continues to mature and this section of development and margin enlargement ends. In my mannequin, I count on linear imply reversion over 5 years; as such, whereas near-term returns usually are not enticing (e.g., 1 12 months), if an investor has longer-term holding energy, the upside potential is enticing.

Beneath is a quote from the earnings name that confirmed administration reiterating their 5-year goal with confidence.

the important thing a part of your query was about our longer-term outlook. So, let me try to reconcile our 2024 steerage to a longer-range goal of mid-single-digit comp development. Within the years main as much as the pandemic, though we’d have deliberate low-single-digit comp, the intent was at all times to chase above that. And measured over a number of years, our comp, certainly, averaged 3% to 4%.

However we predict that because the after-effects of the pandemic proceed to recede, that is the correct baseline for our longer-term mannequin. We imagine all of the underlying client, aggressive and structural elements that drove that development nonetheless exist. However as well as, we all know that we have taken important actions to enhance our personal execution of the off-price mannequin. And as these actions achieve traction, we count on to outperform that 3% to 4% baseline.

So, if I pull all this collectively, for the 12 months forward, for 2024, our plan is predicated on low-single-digit comp development with the potential to chase. For future years, I ought to add, we’ll probably take the same method, and I count on in some years, we’ll chase and beat that quantity. In different years, we cannot. However we imagine over an prolonged interval, a five-year interval, we can obtain common annual comp development within the mid-single digits. 4Q23 name

Threat

Gross sales traits might decelerate beneath my present expectations if family spending takes a steeper dive than predicted. Moreover, the potential for gaining market share could possibly be negatively affected by a shift within the aggressive panorama regarding promotional exercise, particularly within the division retailer channel.

Last ideas

My suggestion is a purchase ranking (long-term length). Essentially, the enterprise stays sturdy as 4Q23 efficiency with better-than-expected gross sales and margins signifies wholesome demand. Notably, BURL is efficiently attracting a wider buyer base and sustaining pricing energy. I stay assured that BURL’s long-term development targets stay achievable primarily based on present execution monitor document. Administration’s FY24 steerage additionally appears conservative, with potential for upside in comparable gross sales and EBIT margin, which might probably drive valuation additional upwards.