The demolition part is coming.

As distant work retains staff out of the workplace and vacancy rates sit at all-time highs, industrial property homeowners are desperately making an attempt to keep away from default: by upgrading their areas to draw new tenants, changing their area into residences or just offloading their property. One longtime business skilled doesn’t suppose that might be sufficient.

Because the market evolves, says Fred Cordova, of Santa Monica-based Corion Enterprises, there received’t be room for everybody—and a couple of third of workplace buildings are endangered species.

“There will be a bifurcation…The product in a good location with a good, safe environment will recover. And then you’ve got another group that will somehow hang in there and get reset in pricing,” stated Cordova, who’s CEO of the true property consultancy. “And then you have the others that are basically worth nothing—the D class. Those just have to be torn down. That’s probably at least 30% of all offices in the country.”

Residential conversion is the a lot touted resolution. And optimists have prompt that federal assist within the type of subsidies to help with changing places of work to residences might supply some assist to builders affected by the precipitous drop in demand for workplace area—however it possible received’t be sufficient to cease a major chunk of the industrial market from collapsing, each figuratively and actually.

Document-high workplace emptiness charges are threatening to ship main cities into an “urban doom loop,” the place falling property values shrink a metropolis’s tax base, slicing off funding for important public companies that solely drag property valued down additional. Columbia Enterprise Faculty professor Stijn Van Nieuwerburgh, who’s been dubbed the “prophet of urban doom” for his analysis on the subject, advised Fortune that we’re near the “event horizon” of that vicious public-finance circle.

There could possibly be a partial escape route, although. Specialists say that intelligent public coverage might assist lay the trail for a method out that doesn’t contain a doom loop. In New York Metropolis and elsewhere, residents are going through a surplus of office space alongside a severe shortage of housing. Merely changing sq. footage from industrial to residential appears like a easy repair—however the authorities would want to play a component for it to take off.

“At the end of the day, I think the problem is that we have too much office relative to our future needs, and a lot of places have too little housing. So I think one way or another, we’re going to have to turn some of that office space into apartments,” stated Van Nieuwerburgh. “That might have to partially happen through demolition. But it would be nice if we could have at least some of it through conversion. It’s sort of the environmentally friendly way to go.”

Changing places of work into residences will be prohibitively expensive. Zoning codes mandating pure mild and recent air make it difficult to adapt giant, open-concept workplace flooring plans into residences which might be as much as code. Many buildings put up during the construction boom of the 1950s and 60s simply aren’t capable of being converted into housing. And skyrocketing building prices are squeezing margins for would-be builders, that means that merely tearing an workplace constructing down and changing it with brand-new residences is definitely typically the cheaper possibility, stated Cordova.

“[We used to be involved with] conversions that cost $75 to $150 a foot. Now, the market rate is $350. For high-end luxury, it’s $450. The economic model is very challenging for conversion,” stated Cordova. “The way to do it is for governments to provide subsidies for conversion…the government needs to provide about a 20% cost subsidy.”

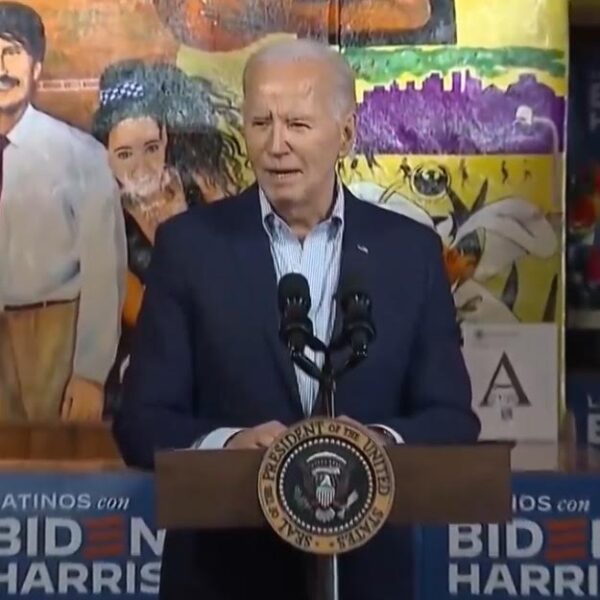

These efforts are already underway: the Biden administration earmarked $35 billion in below-market-rate loans to assist builders with all these conversions final fall, and NYC Mayor Eric Adams greenlit a policy to relax conversion eligibility rules last fall. If states and municipalities begin pushing their very own applications, it might make the underside line value it for builders. However even with juicy incentives, Cordova predicts that nearly ⅓ of all industrial buildings merely received’t make it by means of a downturn in workplace demand, a development he calls “the great reset.”

“Evolutionary change doesn’t happen slowly—it happens when it happens. It’s not the strongest that survives, it’s the most adaptable that survives,” stated Cordova.