“When an investor passes on you, they will not tell you the real reason,” mentioned Tom Blomfield, group accomplice at Y Combinator. “At seed stage, frankly, no one knows what’s going to fucking happen. The future is so uncertain. All they’re judging is the perceived quality of the founder. When they pass, what they’re thinking in their head is that this person is not impressive enough. Not formidable. Not smart enough. Not hardworking enough. Whatever it is, ‘I am not convinced this person is a winner.’ And they will never say that to you, because you would get upset. And then you would never want to pitch them again.”

Blomfield ought to know – he was the founding father of Monzo Financial institution, one of many brightest-shining stars within the UK startup sky. For the previous three years or so, he’s been a accomplice at Y Combinator. He joined me on stage at TechCrunch Early Stage in Boston on Thursday, in a session titled “How to Raise Money and Come Out Alive.” There have been no minced phrases or pulled punches: solely actual speak and the occasional F-bomb flowed.

Perceive the Energy Legislation of Investor Returns

On the coronary heart of the enterprise capital mannequin lies the Power Law of Returns, an idea that each founder should grasp to navigate the fundraising panorama successfully. In abstract: a small variety of extremely profitable investments will generate nearly all of a VC agency’s returns, offsetting the losses from the various investments that fail to take off.

For VCs, this implies a relentless concentrate on figuring out and backing these uncommon startups with the potential for 100x to 1000x returns. As a founder, your problem is to persuade buyers that your startup has the potential to be a type of outliers, even when the likelihood of attaining such large success appears as little as 1%.

Demonstrating this outsized potential requires a compelling imaginative and prescient, a deep understanding of your market, and a transparent path to fast progress. Founders should paint an image of a future the place their startup has captured a good portion of a giant and rising market, with a enterprise mannequin that may scale effectively and profitably.

“Every VC, when they’re looking at your company, is not asking, ‘oh, this founder’s asked me to invest at $5 million. Will it get to $10 million or $20 million?’ For a VC, that’s as good as failure,” mentioned Blomfield. “Batting singles is literally identical to zeros for them. It does not move the needle in any way. The only thing that moves the needle for VC returns is home runs, is the 100x return, the 1,000x return.”

VCs are on the lookout for founders who can again up their claims with knowledge, traction, and a deep understanding of their trade. This implies clearly greedy your key metrics, resembling buyer acquisition prices, lifetime worth, and progress charges, and articulating how these metrics will evolve as you scale.

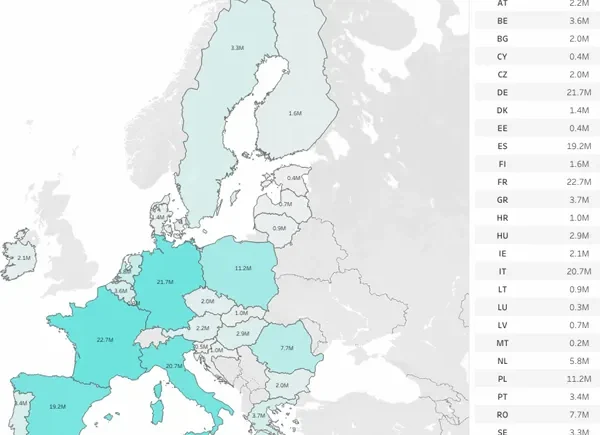

The significance of addressable market

One proxy for energy legislation, is the dimensions of your addressable market: It’s essential to have a transparent understanding of your Complete Addressable Market (TAM) and to have the ability to articulate this to buyers in a compelling manner. Your TAM represents the whole income alternative obtainable to your startup if you happen to have been to seize 100% of your goal market. It’s a theoretical ceiling in your potential progress, and it’s a key metric that VCs use to guage the potential scale of your online business.

When presenting your TAM to buyers, be lifelike and to again up your estimates with knowledge and analysis. VCs are extremely expert at evaluating market potential, they usually’ll shortly see by means of any makes an attempt to inflate or exaggerate your market dimension. As an alternative, concentrate on presenting a transparent and compelling case for why your market is enticing, how you intend to seize a big share of it, and what distinctive benefits your startup brings to the desk.

Leverage is the secret

Elevating enterprise capital is not only about pitching your startup to buyers and hoping for one of the best. It’s a strategic course of that entails creating leverage and competitors amongst buyers to safe the very best phrases to your firm.

“YC is very, very good at [generating leverage. We basically collect a bunch of the best companies in the world, we put them through a program, and at the end, we have a demo day where the world’s best investors basically run an auction process to try and invest in the companies,” Blomfield summarized. “And whether or not you’re doing an accelerator, trying to create that kind of pressured situation, that kind of high leverage situation where you have multiple investors bidding for your company. It’s really the only way you get great investment outcomes. YC just manufactures that for you. It’s very, very useful.”

Even if you happen to’re not a part of an accelerator program, there are nonetheless methods to create competitors and leverage amongst buyers. One technique is to run a decent fundraising course of, setting a transparent timeline for if you’ll be making a call and speaking this to buyers upfront. This creates a way of urgency and shortage, as buyers know they’ve a restricted supply window.

One other tactic is to be strategic in regards to the order during which you meet with buyers. Begin with buyers who’re prone to be extra skeptical or have an extended decision-making course of, after which transfer on to those that usually tend to transfer shortly. This lets you construct momentum and create a way of inevitability round your fundraise.

Angels make investments with their coronary heart

Blomfield additionally mentioned how angel buyers usually have completely different motivations and rubrics for investing than skilled buyers: they often make investments at a better charge than VCs, significantly for early-stage offers. It’s because angels usually make investments their very own cash and usually tend to be swayed by a compelling founder or imaginative and prescient, even when the enterprise continues to be in its early phases.

One other key benefit of working with angel buyers is that they will usually present introductions to different buyers and assist you to construct momentum in your fundraising efforts. Many profitable fundraising rounds begin with a couple of key angel buyers approaching board, which then helps entice the curiosity of bigger VCs.

Blomfield shared the instance of a spherical that got here collectively slowly; over 180 conferences and 4.5 months price of exhausting slog.

“This is actually the reality of most rounds that are done today: You read about the blockbuster round in TechCrunch. You know, ‘I raised $100 million from Sequoia kind of rounds’. But honestly, TechCrunch doesn’t write so much about the ‘I ground it out for 4 and 1/2 months and finally closed my round after meeting 190 investors,’” Blomfield mentioned. “Actually, this is how most rounds get done. And a lot of it depends on angel investors.”

Investor suggestions may be deceptive

One of the difficult elements of the fundraising course of for founders is navigating the suggestions they obtain from buyers. Whereas it’s pure to hunt out and thoroughly take into account any recommendation or criticism from potential backers, it’s essential to acknowledge that investor suggestions can usually be deceptive or counterproductive.

Blomfield explains that buyers will usually go on a deal for causes they don’t absolutely open up to the founder. They might cite issues in regards to the market, the product, or the workforce, however these are sometimes simply superficial justifications for a extra basic lack of conviction or match with their funding thesis.

“The takeaway from this is when an investor gives you a bunch of feedback on your seed stage pitch, some founders are like, ‘oh my god, they said my go-to-market isn’t developed enough. Better go and do that.’ But it leads people astray, because the reasons are mostly bullshit,” says Blomfield. “You might end up pivoting your whole company strategy based on some random feedback that an investor gave you, when actually they’re thinking, ‘I don’t think the founders are good enough,’ which is a tough truth they’ll never tell you.”

Buyers are usually not all the time proper. Simply because an investor has handed in your deal doesn’t essentially imply that your startup is flawed or missing in potential. Lots of the most profitable firms in historical past have been handed over by numerous buyers earlier than discovering the fitting match.

Do diligence in your buyers

The buyers you carry on board won’t solely present the capital you could develop however may even function key companions and advisors as you navigate the challenges of scaling your online business. Selecting the incorrect buyers can result in misaligned incentives, conflicts, and even the failure of your organization. A number of that’s avoidable by doing thorough due diligence on potential buyers earlier than signing any offers. This implies wanting past simply the dimensions of their fund or the names of their portfolio and actually digging into their repute, monitor report, and strategy to working with founders.

“80-odd percent of investors give you money. The money is the same. And you get back to running your business. And you have to figure it out. I think, unfortunately, there are about 15 percent to 20 percent of investors who are actively destructive,” Blomfield mentioned. “They give you money, and then they try to help out, and they fuck shit up. They are super demanding, or push you to pivot the business in a crazy direction, or push you to spend the money they’ve just given you to hire faster.”

One key piece recommendation from Blomfield is to talk with founders of firms that haven’t carried out effectively inside an investor’s portfolio. Whereas it’s pure for buyers to tout their profitable investments, you’ll be able to usually be taught extra by inspecting how they behave when issues aren’t going based on plan.

“The successful founders are going to say nice things. But the middling, the singles, and the strikeouts, the failures, go and talk to those people. And don’t get an introduction from the investor. Go and do your own research. Find those founders and ask, how did these investors act when times got tough,” Blomfield suggested.