Robert Way

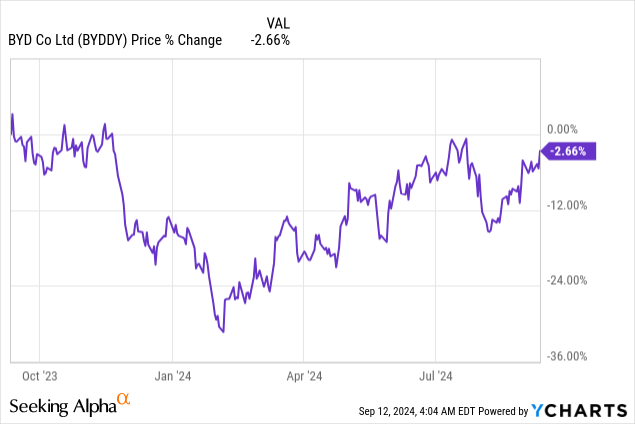

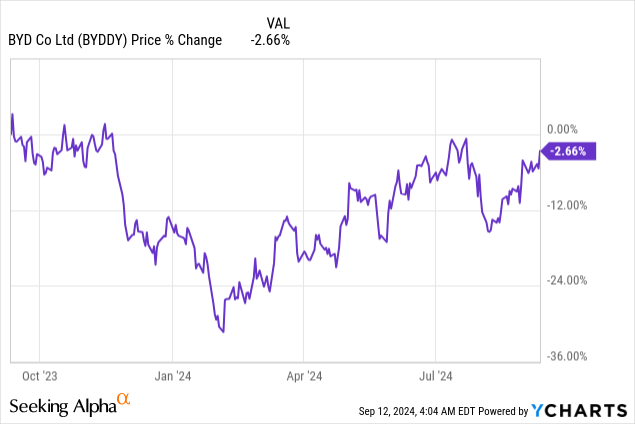

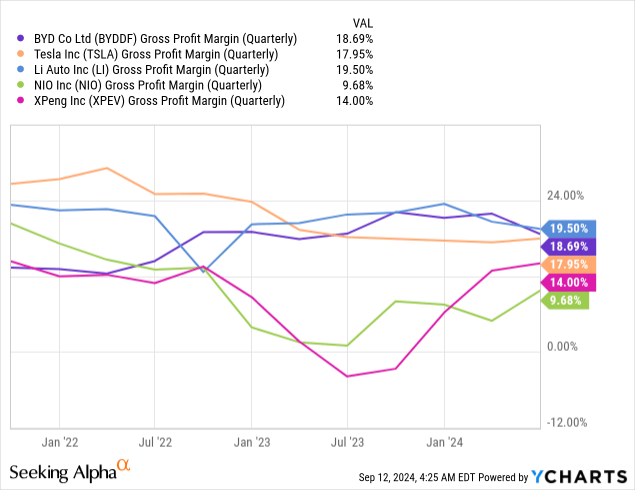

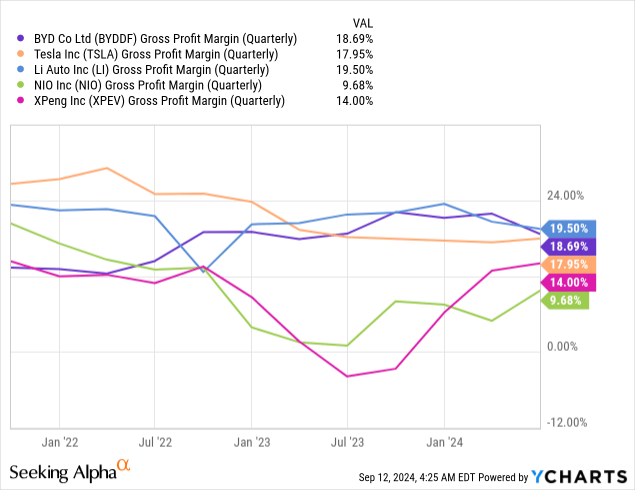

Chinese electric vehicle giant BYD (OTCPK:BYDDF) reported record monthly sales in its new electric vehicle division for the month of August a few days ago. BYD leads the Chinese market in terms of deliveries and has focused aggressively on exporting its EVs to other countries around the world, including the European Union. BYD generated impressive sales growth for a number of months now, which is impressive considering the increasing challenges in the market as far as demand and margins are concerned. BYD has the second-largest gross margins in its industry group, after Li Auto (LI), and I believe BYD continues to represent excellent value for growth investors in the Chinese EV industry.

Previous rating

I rated shares of BYD a strong buy in June — A Profitable EV Growth Play —because the electric vehicle company executed very well on its growth strategy. Further, BYD distinguished itself by being a solidly profitable EV company which in my opinion lowered investment risks for investors. BYD recently reported record sales, in an overall weak market environment, and I believe that BYD is undeservedly cheap, based off of earnings. I continue to see the EV giant as one of the best EV investment options in the market.

Record sales, export momentum impressive margins

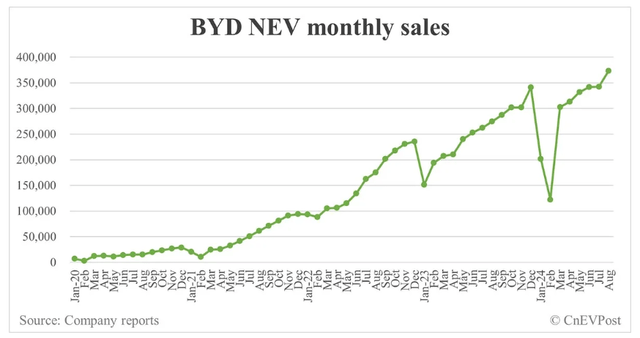

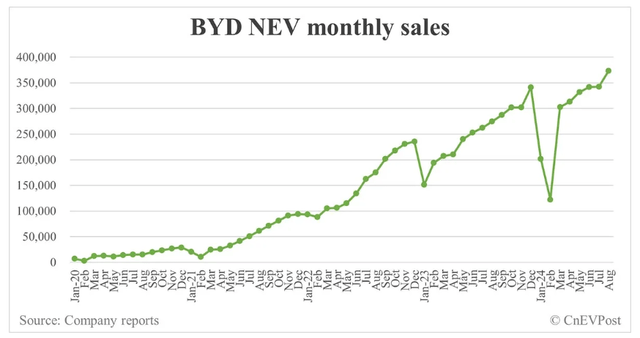

Despite its large size, BYD is still putting up some very impressive growth numbers. In the month of August, BYD sold 373,083 new electric vehicles, showing a year-over-year growth rate of 36%. The company also exceeded its previous sales record from July by more than 30k units.

BYD’s new energy vehicle sales have been in a consistent and healthy uptrend since March, which is when EV sales typically recover from a slump due to Chinese Lunar New Year. During this period, manufacturing plants typically close as workers head home for holidays, leading to a seasonal sales dip that affects all EV manufacturers equally. The rebound in new electric vehicle sales since March shows that the EV giant is still doing an excellent job in scaling its production, however, and new sales records going forward are likely.

BYD

NIO (NIO), did also reasonably well with its deliveries in August: NIO delivered 20,176 vehicles last month. It was the fourth month in which NIO delivered more than 20k EVs to its customers, but the Y/Y growth rate in August was a much more moderate 4%. XPeng (XPEV) delivered 14,036 Smart EVs in August, showing 3% year-over-year growth. Li Auto (LI), which is an EV start-up that offers by far the highest vehicle margins in excess of 18%, delivered 48,122 vehicles in August, showing 38% growth year-over-year.

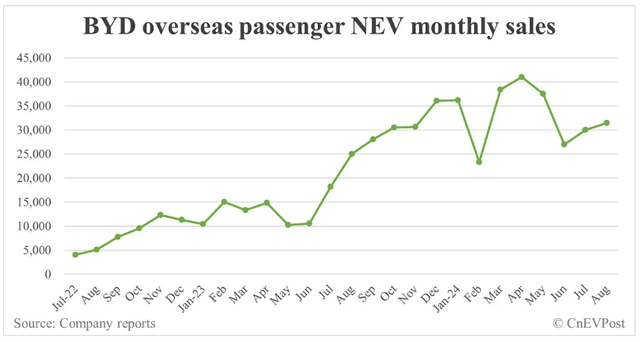

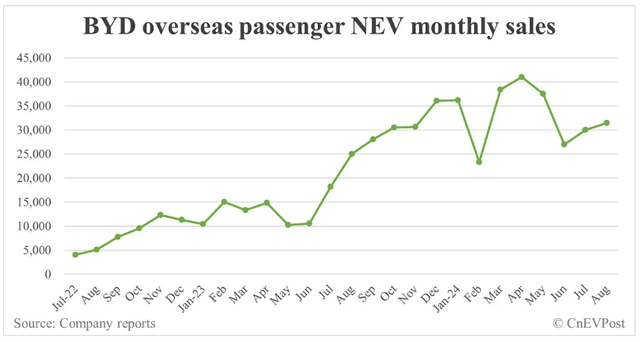

BYD is also quite successful in overseas markets, especially with models such as the BYD Atto 3 or the BYD Seagull. The Chinese EV firm sold 31,451 vehicles outside of China in August, showing a year-over-year growth rate of 26%.

BYD

The margin picture for BYD is also quite impressive: the EV maker had the second-highest gross margins in Q2’24 after Li Auto… which I have previously highlighted as a top margin play for EV investors. BYD achieved gross profit margins of 19% in the second-quarter, which is about 1 PP higher than what Tesla (TSLA) achieved.

BYD’s valuation

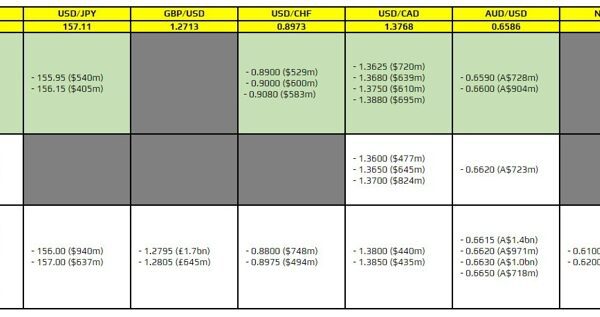

BYD is currently valued at a forward price-to-earnings ratio of 16.0X, but its rivals in the EV start-up industry are not yet profitable on a broad-scale basis (Li Auto is the exception). For this reason, I am comparing BYD to other Chinese EV manufacturers based off of a price-to-revenue ratio.

BYD is currently valued at a P/S ratio of 0.73X, which is way below the industry group average P/S ratio of 1.92X. Tesla is by far the most expensive EV company, largely because it is focused on the U.S. market, which offers investors higher levels of transparency. Without Tesla, the industry group average price-to-revenue ratio is 0.83X. Tesla is by far the most expensive company in the industry group with a P/S ratio of 6.3X, but the EV company has a ton of catalysts which would support, in my opinion, an even higher valuation multiplier.

In the longer term, I believe BYD could trade at a significantly higher P/S ratio as well, in large part because the company is seeing massive delivery momentum and is already profitable. The fact that BYD is already generating real profits is something that lowers risks for investors and makes shares especially attractive considering that most EV start-ups, both in China and the U.S., are losing money on their EV operations.

BYD is also expected to achieve a higher total revenue volume than Tesla next year, which would make the company the biggest EV company in the world. As I stated in my last work on BYD, I see a fair value P/S ratio of 2.0X for BYD, largely because the EV maker is already profitable and has the largest EV delivery volume. Based off of a FY 2025 revenue estimate of $123.4B (see table below), a 2.0X fair value P/S ratio translates into a fair value target of $85 per-share.

| Company | Revenue FY 2025 ($B) | Y/Y Growth | Forward P/S |

| BYD | $123.42 | 16% | 0.73X |

| Tesla | $116.32 | 17% | 6.27X |

| Li Auto | $27.56 | 35% | 0.75X |

| NIO | $13.47 | 37% | 0.86X |

| XPeng | $8.91 | 56% | 0.97X |

| Average: | 1.92X | ||

| Average ex-TSLA: | 0.83X |

(Source: Author)

Risks with BYD

One big risk that I see with BYD relates to tariffs that other countries impose in order to protect their domestic EV manufacturing industries. The European Union, as an example, recently added tariffs of up to 38% on Chinese EV imports in a bid to counter the dumping of low-cost electric vehicles. Higher prices obviously make BYD’s vehicles more expensive and less competitive, potentially affecting its export potential negatively. What would change my mind about BYD is if the company were to see lower margins in its EV business or slowing delivery growth in China, which is still BYD’s core market.

Final thoughts

BYD just reached a new sales record for its new electric vehicle sales in August, which is a respectable achievement in a market that is seeing slowing delivery growth overall and growing margin pressure due to increasing competition. BYD continued to grow at impressive rates in August and almost achieved the same growth as Li Auto, which is the fastest growing EV player in the start-up industry group. BYD’s exports are also looking robust, but EU tariffs represent a short-term risk. I continue to like BYD here as the company executes very well on its growth strategy, remains highly competitive in terms of margins and its shares are still massively undervalued.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.