Byju’s says its recently launched $200 million rights issue has been fully-subscribed, however the startup’s founder urged a few of its main buyers to take part amid a rift between the edtech group and a few of its largest shareholders.

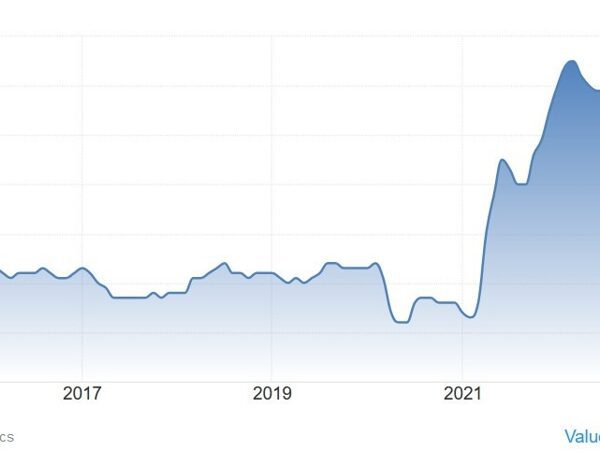

The Bengaluru-headquartered startup, valued at $22 billion in its final financing spherical in early 2022, introduced final month that it could try to boost about $200 million by way of a rights concern. Byju’s minimize the pre-money valuation ask within the rights concern to about $20 million to $25 million, TechCrunch earlier reported.

A bunch of buyers, together with Prosus and Peak XV, have but to point out any curiosity in collaborating within the rights concern, in response to an individual aware of the matter. In the event that they don’t take part within the rights concern, they danger dropping practically all their stake in Byju’s.

“Our rights issue is fully subscribed and my gratitude to my shareholders remains strong,” founder and chief government Byju Raveendran wrote in a letter to shareholders Tuesday. “But my benchmark of success is the participation of all shareholders in the rights issue. We have built this Company together and I want us all to participate in this renewed mission. Your initial investment laid the foundation for our journey and this rights issue will help preserve and build greater value for all shareholders.”

The Prosus-led group has referred to as for a rare common assembly in latest weeks to remove Raveendran and his family members from the edtech group. Byju’s later responded that the buyers didn’t have the voting rights to enact any such change.

However within the new letter to shareholders, Raveendran has sought to calm the scenario with the investor group. He mentioned the startup will appoint a third-party company to observe the fundraising within the rights concern, and is dedicated to restructuring the board and appointing two non-executive administrators.

“I understand that participating in this rights issue may seem like a Hobson’s choice. However, this is the only viable option in front of us today to prevent permanent value erosion,” he wrote.

Byju’s has been chasing new funding for practically a yr. The startup was within the ultimate levels to raise about $1 billion last year, however the talks derailed after the auditor Deloitte and three key board members give up the startup. As an alternative, Byju’s ended up elevating lower than $150 million in that spherical from Davidson Kempner and needed to repay the investor the total dedicated quantity after making a technical default in a separate $1.2 billion term loan B.

The startup was making ready to go public in early 2022 by way of a SPAC deal that might have valued the corporate at as much as $40 billion. Nonetheless, Russia’s invasion of Ukraine in February despatched markets downward, forcing Byju’s to place its IPO plans on maintain, in response to a supply aware of the matter. As market circumstances worsened, so too did the enterprise outlook for Byju’s.

A few of Byju’s buyers have publicly aired their considerations concerning the startup in latest quarters, questioning a few of its enterprise choices and demanding higher governance.

“Despite these headwinds we face as a company, there are tangible indicators of our enduring brand strength and future potential,” Raveendran wrote to the shareholders. “The traffic on our website and apps has shown remarkable growth in spite of reduced marketing spends in the recent past. This is a clear testament to the value our users find in our services and the faith they put in our content. The negativity has affected perception of the brand, but consumer belief continues to grow.”

It is a creating story. Extra to comply with.