Byju’s, as soon as valued at $22 billion, is prepared to chop its valuation to beneath $2 billion because it hunts for brand spanking new funding, an individual accustomed to the matter instructed TechCrunch.

The Bengaluru-headquartered startup, as soon as India’s most beneficial, is trying to increase $100 million to $300 million in new funding by way of a rights challenge and the edtech group’s chief government and co-founder Byju Raveendran has agreed to step down from the highest position within the curiosity of improved governance after the brand new funding, in accordance with two individuals accustomed to the matter.

Byju’s willingness to chop the valuation is a shocking reversal of fortune for the startup, as soon as the poster little one of the Indian startup ecosystem. The startup, which spent greater than $2.5 billion in 2021 and 2022 buying over half a dozen companies globally, was as soon as showered a valuation as high as $50 billion by marquee funding bankers, TechCrunch earlier reported.

A Byju’s spokesperson declined to remark.

Byju’s has been chasing for brand spanking new funding for almost a 12 months. The startup was in remaining levels to raise about $1 billion last year, however the talks derailed after the auditor Deloitte and three key board members stop the startup. As a substitute, Byju’s ended up elevating lower than $150 million in that spherical from Davidson Kempner and needed to repay the investor the complete dedicated quantity after making a technical default in a separate $1.2 billion term loan B.

The brand new funding deliberation follows BlackRock chopping the worth of its holding in Byju’s, slashing the implied valuation of the Indian startup to about $1 billion, in accordance with disclosures made by the asset supervisor.

Byju’s was making ready to go public in early 2022 via a SPAC deal that might have valued the corporate at as much as $40 billion. Nonetheless, Russia’s invasion of Ukraine in February despatched markets downward, forcing Byju’s to place its IPO plans on maintain, in accordance with a supply accustomed to the matter. As market circumstances worsened, so too did the enterprise outlook for Byju’s. The corporate started going through mounting stress from traders to deal with points that it had beforehand left unresolved.

The startup has been backed by over a dozen movers and shakers within the business, from Peak XV Companions to Lightspeed, UBS and Chan Zuckerberg Initiative. Byju’s, which gained preliminary recognition in India as a result of its tutors used intuitive methods — tackling complicated ideas utilizing real-life objects reminiscent of pizza and cake — has raised over $5 billion in fairness and debt prior to now decade.

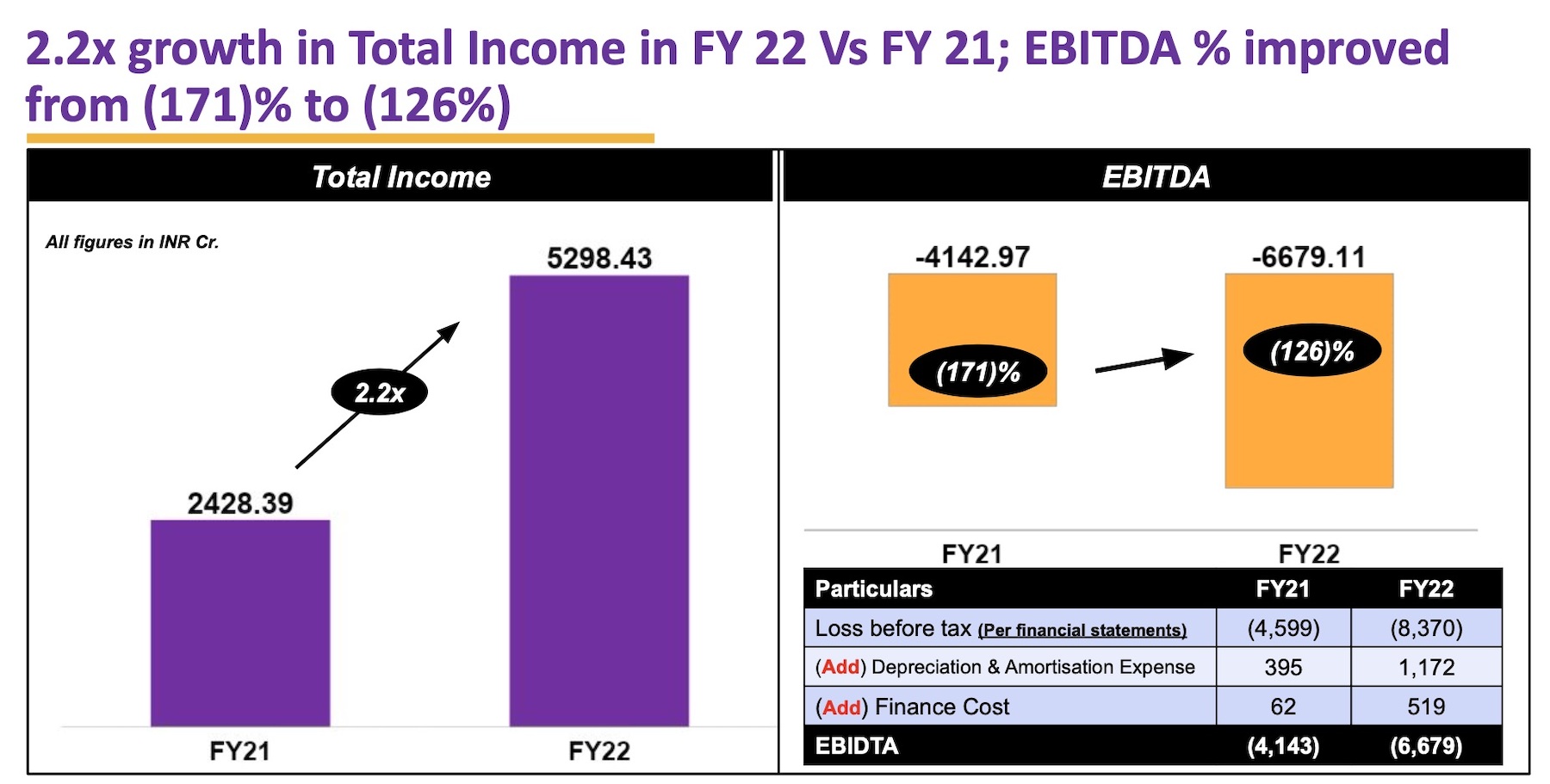

Byju’s financials for the 12 months ending March 2022. The startup has but to file the financials for the 12 months ending in March 2023.

Byju’s in the present day is reeling from a collection of challenges: It’s struggling to boost capital, make payroll and repay its billion-plus debt. It missed its revenue target for the monetary 12 months ending in March 2022, the startup disclosed in a much-delayed account final month. Prosus publicly slammed the Bengaluru-headquartered startup in July for not evolving sufficiently and disregarding the investor’s recommendation and suggestions regardless of repeated makes an attempt.