It started with a gathering on a yacht off the coast of Cannes in the summertime of 2009. The newly-elected prime minister of Malaysia was aboard on the invitation of businessman Jho Low and Saudi-Swiss businessman Tarek Obaid. The boys had gathered to discover offers for Malaysia’s new financial growth fund, 1MDB.

Fifteen years later, the prime minister is in a Malaysian jail serving time for corruption. Low, the alleged mastermind behind the $4.5 billion defrauding of 1MDB, stays at massive. And Obaid and his enterprise companion Patrick Mahony will stand trial at Switzerland’s high legal courtroom on April 2, accused of making a sham oil exploration firm by way of which they stole greater than $1.8 billion in 1MDB funds.

Neither Mahony or Obaid have spoken in public about their offers with Jho Low, a round-faced businessman they nicknamed ‘Chunk.’ The month-long trial, set in Switzerland as a result of the 2 males primarily based their enterprise there, could reveal contemporary particulars in regards to the fugitive, who’s suspected of pulling off arguably the largest monetary heist of the twenty first century. Mahony has denied the costs and pleaded not responsible. A lawyer for Obaid didn’t return a number of messages in search of touch upon the costs.

It’s additionally an opportunity for Switzerland, seen as a tender contact on white-collar criminals, to show it may be powerful on monetary crime. A former Coutts & Co. banker discovered responsible in 2020 of failing to flag money-laundering issues associated to a $700 million switch made by Low was fined simply 50,000 Swiss francs ($55,700).

Prosecutors declare that the pair labored with Low on the scheme from as early as 2009, and the quantities at stake make it one of many largest frauds that Low allegedly helped orchestrate.

Mahony has been charged with legal mismanagement, fraud, bribery and aggravated money-laundering, in line with the 213-page indictment, with Obaid accused of all that and forgery. A conviction simply on fraud fees carries a jail sentence of as a lot as 10 years, although in lots of Swiss circumstances, the sentence is suspended.

Within the indictment, Swiss prosecutors lay out the pair’s alleged scheme — which, they are saying, included negotiating on behalf of a Saudi king that they had no mandate from, whereas claiming the rights to a Caspian Sea oilfield that they by no means managed — from that first Mediterranean assembly in 2009.

A lawyer for Obaid didn’t return emails in search of touch upon the costs towards her shopper. Laurent Baeriswyl, a lawyer for Mahony, mentioned by e mail that the indictment is the results of a “totally biased and incomplete investigation.”

The Swiss Legal professional Basic’s Workplace “ignored all the facts which did not correspond to its thesis, contrary to what the law requires” and so “our client therefore strongly contests the facts as they emerge from the indictment and he will defend his rights before the Federal Criminal Court.”

Saudi Connections?

Obaid based oil exploration firm Petrosaudi in 2005 together with his acquaintance Prince Turki Bin Abdullah al Saud, decided to capitalize on the connections that royal identify might allow.

However even with that woven into the corporate’s pitch, the bold 30-year-old nonetheless wanted money. He had secured a modest mortgage by way of Patrick Mahony, a former classmate from personal faculty in Geneva, who would turn into Petrosaudi’s unofficial chief funding officer in 2009, in line with the indictment. However he wanted extra, prosecutors say, and turned to Low.

Speaking solely by way of encrypted BlackBerry messages and personal e mail accounts, the three males set to work on the corporate. However in line with the indictment, their technique had little to do with oil exploration.

Prosecutors highlighted emails among the many three males to drive house their argument that Petrosaudi didn’t management the belongings it presupposed to have, nor did it have the Saudi monarch’s blessing. In accordance with one despatched in mid-September 2009 earlier than an introductory name with a 1MDB government, it was crucial to “hint that PSI is indirectly owned by King Abdullah.”

Turki, the seventh son of the late King Abdullah, isn’t accused of any wrongdoing in reference to Petrosaudi, and didn’t train any operational function inside the firm, in line with prosecutors. Turki was one in every of a number of princes detained in November 2017 by Saudi Arabia’s defacto ruler Mohammed bin Salman, and his present whereabouts are unclear.

Turkmeni Oil

Following the Cannes assembly, Obaid proposed that 1MDB and Petrosaudi create a three way partnership to use Petrosaudi’s stake in a Turkmeni oilfield. Obaid specified by writing, in line with prosecutors, that Petrosaudi would deliver “$2 billion worth of its assets in the energy sector into the joint-venture company.”

There was one downside: Petrosaudi didn’t personal the oilfield or the rights to it, however was slightly in stalled negotiations with a agency that had paid $10 million to purchase up the rights. However these paper rights had been primarily nugatory because the oilfield lay in waters whose possession was disputed by Turkmenistan and Azerbaijan.

So Obaid turned to an oil advisor and previous household pal to worth the oilfield. 9 days later, he produced a report that put the “fair net present value” of the belongings at between $2.98 billion and $4.06 billion.

With that hefty valuation in writing and the Saudi royal household’s backing established within the minds of 1MDB executives, the board of administrators signed off on Sept. 26, 2009, and two days later approved the switch of $1 billion to financial institution accounts held by the brand new three way partnership, 1MDB PetroSaudi.

300 million of that went to an account managed by Obaid, in line with prosecutors. The remaining $700 million went to GoodStar, which was falsely offered as a unit of PetroSaudi however was in reality a Seychelles-based entity managed by Low. On Oct. 5, the businessman wired $85 million of that to an account held in Obaid’s identify. Obaid, in flip, wired $33 million to Mahony on Oct. 21.

‘Our Way’

The next yr, prosecutors allege that the pair set about extracting extra cash from 1MDB. Obaid had persuaded the fund to show the three way partnership right into a mortgage facility and he drew down $500 million, ostensibly to spend money on French oil firm GDF Suez.

Newly flush, the pair appeared eager to distribute the funds rapidly, emails present.

“Right now we are in a good situation because we have this money in a clean and proper legal way so there is nothing anybody can do to us,” Mahony wrote to Obaid in September 2010.

The following day, he transferred $300 million into Obaid’s private account and the remaining $200 million to Petrosaudi accounts he managed, in line with prosecutors.

Then in 2011, Obaid drew down once more, this time for $330 million, prosecutors allege. To strain the Malaysians to just accept, he reminded them of how King Abdullah helped evacuate Malaysian Muslims throughout the Arab Spring protests, and the way he had elevated the quota of Malaysian Muslims capable of make the pilgrimage to Mecca.

Between 2009 and the tip of 2011, prosecutors say that the lads took a complete of $1.83 billion from 1MDB, with Obaid personally pocketing $580 million, and Mahony, $37 million.

Bangkok Jail

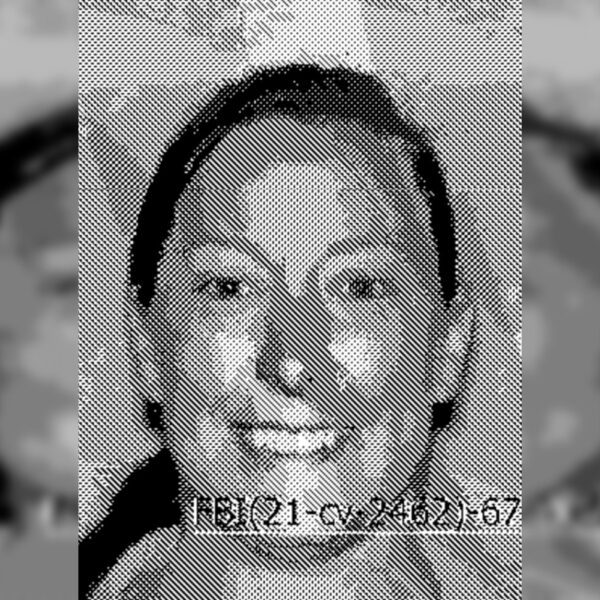

Obaid and Mahony’s 2023 indictment was primarily based partly on the testimony of Xavier Justo, the third worker at Petrosaudi. After only a yr on the firm, Justo left and was arrested in Thailand in June 2015. Convicted of tried blackmail in what he says was a conspiracy on the a part of Obaid, Mahony and the Malaysian authorities to silence him, the Swiss nationwide spent 18 months in jail earlier than his nation’s authorities intervened to assist get him launched.

Paperwork Justo shared with The Sarawak Report, a weblog targeted on corruption in Malaysia, led to the primary expose of the Petrosaudi pair in 2015. He printed a book final yr, co-written together with his spouse, chronicling his expertise with the 2 males.

The Malaysian Anti-Corruption Fee flagged its personal arrest warrants for Obaid and Mahony to Interpol in early 2020. It’s unclear in the event that they had been ever detained and Swiss prosecutors declined to say whether or not they ordered their arrest.

Years on, Justo says he hopes that his nation’s justice system will now do the suitable factor.

“This is the perfect opportunity for Switzerland to show the world that it is serious about fighting financial crime and that it is prepared to punish those who perpetrate it,” he mentioned.