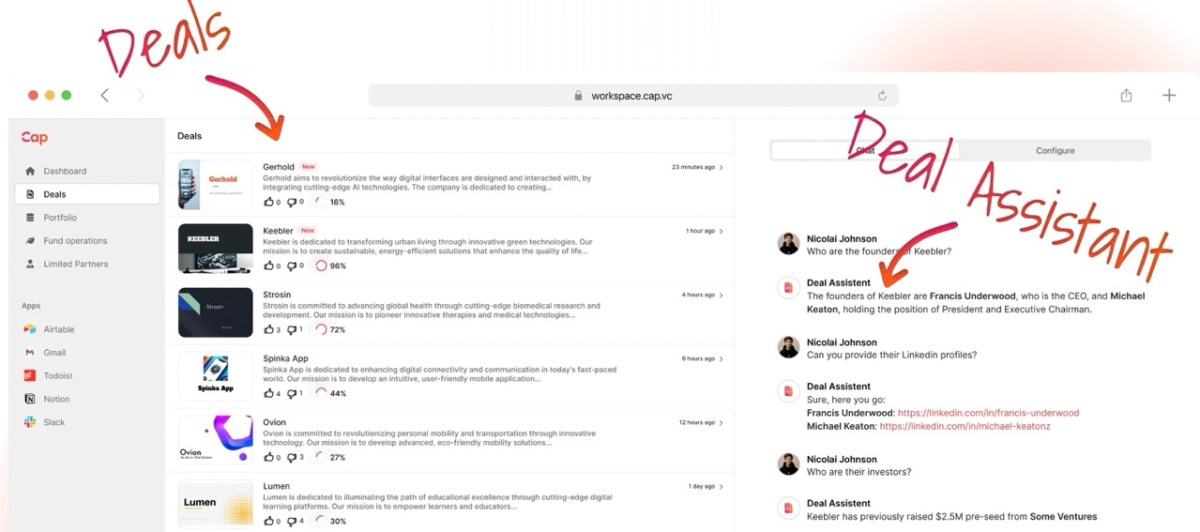

Cap VC is launching a software for VC companies, and is planning to increase its providing to startups elevating cash. The thought is to make higher funding choices, sooner, utilizing the ability of AI.

VC is a people-business above all, however as AIs are getting nearer and nearer to being individuals, too, there’s a slew of recent instruments making their technique to the market. A few of them (similar to Connetic Ventures’ tools) are developed in-house and saved as proprietary instruments giving VCs an edge, whereas others (DeckMatch and Headline) are spun out of VC companies in an try and carve up the startup funding area.

As a startup spun out of a VC fund that prides itself on leveraging AI-powered instruments to streamline VC operations, Cap VC is taking a stab at disrupting the individuals funding the disruptors.

The freshly minted startup says it noticed alternatives inside the enterprise capital business’s inefficiency, recognizing a largely unmet want. Particularly, it recognized that VCs are inundated with sophisticated PDF recordsdata, which is the place Cap VC is available in.

“We turn unstructured data from PDF files, balance sheets, income statements and P&L accounts into structured data,” explains Patrick Theander, CEO of Cap VC, in an interview with TechCrunch. “An ‘operating system for VCs’ was really the only description that seemed fitting for what we’re building. We are building native apps on Mac and Windows, and are launching an API so developers will be able to build on top of our platform. We are building a set of robust ecosystem tools for the VC industry.”

The method doesn’t finish there, Cap VC goals to go a notch increased and supply context to the portfolio corporations. This permits a strong platform for probably the complete historical past look-up of a startup the VC is desirous about. “We want to provide VCs with a full context of their portfolio, and of the companies they might invest in: The context of that company, the different funding rounds, the historical data and everything else,” Theander added.

Except for growing a platform, Cap VC can be making a extra accessible area for LPs and auditors. They’re tapping into collaborations, leveraging insights from auditing companies like Deloitte to construct a fund administration software that totally different stakeholders, even the regulatory our bodies, can make the most of.

Regardless of being uncertain concerning the specifics of the staff dimension, Theander is obvious about maintaining the staff small, with out compromising on effectivity. In his phrases: “It’s not my intention that we are going to be a huge team, I want to make a small, fairly compact team… if you have the right set of people, you’re able to build much faster and much better.”

An enormous query is turning into increasingly obvious: Why haven’t VCs constructed one thing related themselves? Theander’s idea is that the VCs don’t know how one can construct, saying that constructing a platform just like the one Cap VC is launching requires a nuanced understanding of the tech startup ecosystem.

Figuring out what I find out about VCs and the sum of money they spend on getting an edge over the competitors — NfX’s suite of instruments together with Signal, which helps founders discover the suitable traders for his or her funding spherical, is one instance — makes me surprise if Theander’s take is a bit of on the naive facet. However, software program improvement is a specialised talent, and he says Cap VC has a waitlist of keen traders standing by to take the corporate’s instruments for a spin.

On the identical time, Theander recognized that maybe there’s one other dynamic at play, too.

“I’ve also realized that most VCs are just lazy. If it works, it’s fine, and they don’t care. But I think that’s really good for us to be honest. We are building a super simple platform that is easy to get started with,” Theander says. If there’s fact to that, the lackadaisical angle on the a part of VCs could inadvertently have given Cap VC a possibility.

The platform is hoping to launch to the general public in February.