Marcus Lindstrom/iStock Unreleased by way of Getty Photographs

Elevator Pitch

I price CapitaLand Built-in Industrial Belief (OTCPK:CPAMF) [C38U:SP] as a Purchase. I beforehand wrote about CPAMF’s worth creation levers in my July 9, 2021 update for this business REIT.

With this newest write-up, I consider CapitaLand Built-in Industrial Belief’s not too long ago disclosed monetary efficiency for the second half of the prior 12 months, and the REIT’s outlook for the intermediate time period.

CPAMF’s 2H 2023 gross income and DPU (Distribution Per Unit) development had been moderately good, and it has a good FY 2024-2026 outlook. There may be justification for CapitaLand Built-in Industrial Belief buying and selling at a decrease yield (greater valuation) contemplating its DPU development prospects, which explains why I’ve determined to stay with a Purchase score for the REIT.

Readers can commerce in CapitaLand Built-in Industrial Belief shares on the Over-The-Counter market and the Singapore market. The buying and selling liquidity of the REIT’s OTC shares with the CPAMF ticker image is low, contemplating its imply each day buying and selling worth of roughly $10,000 (supply: S&P Capital IQ) for the previous three months. Traders can contemplate dealing in CapitaLand Built-in Industrial Belief’s shares traded on the Singapore Inventory Trade, which boast a a lot greater three-month common each day buying and selling worth of $30 million as per S&P Capital IQ information. The REIT’s Singapore-listed shares with the C38U:SP ticker image could be purchased or offered with US brokerages similar to Interactive Brokers.

Current 2H 2023 Outcomes Have been Respectable

Final week, CapitaLand Built-in Industrial Belief revealed its 2H 2023 monetary efficiency with an announcement issued on February 6. Observe that the Singapore-listed REIT solely studies its full monetary outcomes on a semi-annual foundation.

CPAMF’s distribution per unit rose by +2.8% HoH (Half-on-Half) and +1.7% YoY to S$0.0545 within the second half of the earlier 12 months, because the REIT’s belongings throughout completely different property segments carried out properly. Gross income for CapitaLand Built-in Industrial Belief’s workplace belongings, built-in developments (belongings with a mixture of property varieties), and retail belongings expanded by +6.5%, +4.3%, and +1.9%, respectively on a YoY foundation for 2H 2023.

The REIT’s workplace properties witnessed a sturdy +9.0% lease reversion final 12 months. CapitaLand Built-in Industrial Belief additionally disclosed in its 2H 2023 results presentation slides that the imply month-to-month lease per sq. foot for its Singapore workplace belongings elevated from S$10.41 as of June 30, 2023, to S$10.49 on the finish of final 12 months. These numbers indicate that new leases with greater rental charges for its workplace properties have pushed a +6.5% enhance within the REIT’s 2H 2023 gross income for its workplace belongings.

With respect to built-in developments, CapitaLand’s Raffles Metropolis Singapore asset was the star, as its general (workplace and retail) occupancy price elevated from 95.3% on the finish of 2022 to 98.7% as of December 31, 2023. Throughout the identical time interval, the occupancy price of Raffles Metropolis Singapore property’s retail element rose from 91.0% to 97.4%. The completion of the Asset Enhancement Initiatives or AEIs at Raffles Metropolis Singapore, as indicated within the chart offered beneath, was the main contributor to +4.3% YoY gross income development for the REIT’s built-in developments in 2H 2023.

An Overview Of Asset Enhancement Initiatives At Raffles Metropolis Singapore Which Have been Accomplished In 2022

CPAMF’s FY 2022 Outcomes Presentation Slides

CapitaLand’s retail belongings delivered a formidable lease reversion of +8.5% for 2023. Specifically, it’s price taking note of the relative outperformance of downtown retail properties over suburban retail properties. Within the earlier 12 months, tenant gross sales and shopper site visitors for CPAMF’s downtown retail belongings grew by +2.5% YoY and +9.5% YoY, respectively. As a comparability, tenant gross sales and shopper site visitors for the REIT’s suburban retail belongings elevated by +1.9% and +7.8%, respectively in YoY phrases for 2023. At its FY 2023 results briefing, CPAMF highlighted on its newest earnings name that its downtown retail properties are benefiting from Singapore’s “push to increase the commercial activity outside of the core CBD (Central Business District).”

My view is that the REIT’s robust efficiency is sustainable. Within the subsequent part, I element the intermediate time period prospects for CPAMF.

Mid-Time period Outlook For CPAMF Is Optimistic

The promote facet expects CapitaLand Built-in Industrial Belief’s distribution per unit or DPU in Singapore greenback phrases to increase by +1.5% in FY 2024, earlier than accelerating to +2.6% and +7.2% for FY 2025 and FY 2026, respectively as per S&P Capital IQ information. This interprets into a fairly wholesome DPU CAGR of +3.8% for CPAMF within the subsequent three years. In distinction, the REIT’s FY 2017-2019 DPU CAGR previous to the COVID-19 outbreak was decrease at +2.5%.

In my view, the market’s expectations of a quicker price of DPU development for CapitaLand within the FY 2024-2026 timeframe are cheap.

Firstly, the REIT is anticipating a “mid-single” digit proportion lease reversion for its workplace belongings and a lease reversion that’s “not too far” from its +8.5% reversion final 12 months for its retail properties this 12 months, as per its feedback on the current FY 2023 outcomes name.

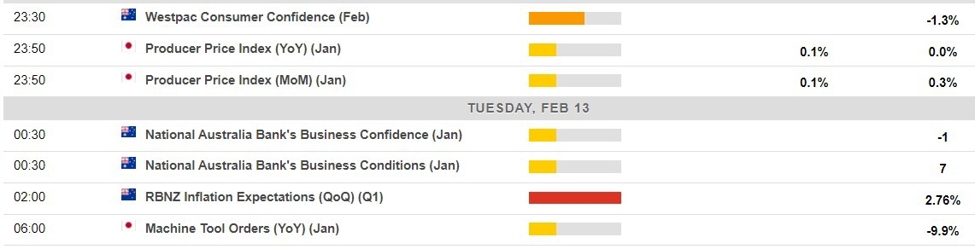

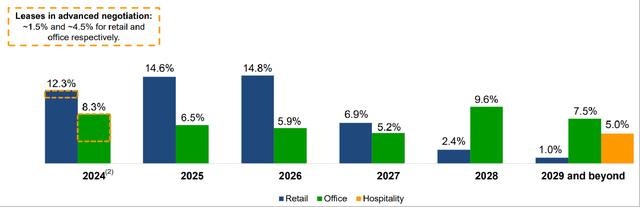

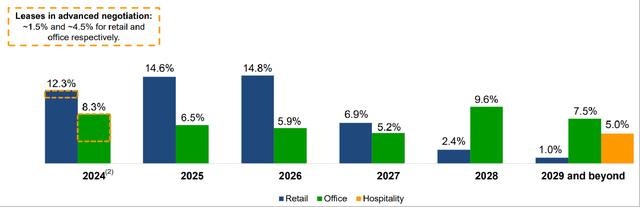

The Proportion Of CPAMF’s Leases That Expire Every Yr By Property Sort

CPAMF’s FY 2023 Outcomes Presentation Slides

CapitaLand Built-in Industrial Belief famous at its FY 2023 analyst name that the outlook for its retail belongings is favorable resulting from “limited availability of prime spaces in Singapore” and “very good demand from retailers.” At its most up-to-date analyst briefing, CPAMF additionally talked about that its workplace properties are more likely to profit from particular industries’ robust demand similar to “the wealth and asset management, financial services, legal”, and “the flight to quality.” On the purpose about “quality”, it’s price noting that the rental charges for a number of the REIT’s key grade A workplace asset leases due for expiry are decrease than market charges as outlined within the chart offered beneath.

A Comparability Of The Expiring Rents And Market Rents For Sure Of CPAMF’s Workplace Belongings

CPAMF’s FY 2023 Outcomes Presentation Slides

In a nutshell, it’s extremely possible that CapitaLand Built-in Industrial Belief’s asset portfolio will proceed to witness optimistic lease reversions for the foreseeable future.

Secondly, CPAMF’s future DPU development is predicted to be supported by new AEIs or Asset Enhancement Initiatives.

Within the previous part, I’ve already indicated how the AEI on the Raffles Metropolis Singapore property drove 2H 2023 gross income development of +4.3% YoY for the REIT. CPAMF described AEIs as “planting the flag along the runway to allow a more sustainable kind of income growth” at its newest analyst name. Wanting forward, CapitaLand Built-in Industrial Belief revealed in its FY 2023 outcomes presentation that it has plans to execute AEIs at three belongings, particularly “IMM Building, Gallileo and 101 Miller Street.”

Thirdly, there are alternatives for CapitaLand to promote sure belongings and subsequently re-allocate the asset gross sales proceeds to new higher-returning properties.

The deal-making setting appears to have gotten higher judging by CPAMF’s current feedback, which will increase the chance of property divestitures materializing within the close to time period. On the REIT’s FY 2023 outcomes name, CapitaLand emphasised that “there has been interest (in the acquisition of office and retail assets) returning”, which is a “reflection of better risk appetite.” In line with a February 8, 2024 news article printed in Singapore media The Enterprise Instances, the REIT’s “Bukit Panjang Plaza and 21 Collyer Quay” properties are imagined to be the belongings that CPAMF may probably be contemplating for disposal.

Lastly, the REIT would possibly see its finance prices lower going ahead, assuming that it’s profitable with its deleveraging efforts.

CapitaLand Built-in Industrial Belief’s curiosity expense rose by +21.8% YoY to S$168 million within the second half of 2023. In different phrases, the REIT would have recorded a lot stronger DPU development for 2H 2023, if it had decrease monetary leverage. CPAMF’s objective is to scale back its monetary leverage (debt-to-assets) metric from 39.9% as of end-2023 to between 37% and 38% (supply: FY 2023 analyst briefing commentary) in time to come back. As such, it will likely be cheap to count on a lower in finance prices to spice up the REIT’s DPU sooner or later.

Closing Ideas

I proceed to award a Purchase score to CapitaLand Built-in Industrial Belief. The market at present values the REIT at a consensus subsequent twelve months’ distribution or dividend yield of 5.51% (supply: S&P Capital IQ), which is above its historic 15-year common distribution yield of 5.36%. Prior to now 15 years, CPAMF has traded at a dividend yield of as little as 3.03%.

I’m of the view that the REIT can commerce at a extra demanding valuation or a decrease distribution yield within the 4.5%-5.0% vary. This takes under consideration my expectations that its DPU development will speed up from +2.5% for FY 2017-2019 (pre-pandemic years) to +3.8% within the FY 2024-2026 time interval.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please pay attention to the dangers related to these shares.