PM Images/DigitalVision via Getty Images

There are multiple ways how investors approach the mechanics of their retirement portfolios. Types of asset classes, weights, geographies and so on are all dependent on how willing and able a particular retiree is to assume risk in order to enhance the return profile in his/her portfolio. For example, it might be so that an individual, who is already in the retirement or close to it has, say, paid down all debt, receives supplemental income streams from several real estate holdings and in the spare time finds a way on how to earn extra income. In such a case, provided that the lifestyle is not overly lavish and living expenses are modest, structuring a retirement portfolio that is based on high risk assets like bitcoin, small-cap equity, junk bonds etc. might turn out to be a somewhat justified approach (although there are still many “ifs” remaining).

However, in most cases, when we think about retirement portfolio strategies, the following criteria become relevant:

- Accessing yield that matches and preferably exceeds inflation.

- Making sure that these income streams will not be cut.

- Having a decent diversification in place to avoid single company risk (more from the loss of capital perspective than the short-term volatility).

With this in mind, let me now elaborate on two specific picks, which, in my opinion, tackle nicely the first two points reflected above – i.e., dividend yield that already from the start exceeds inflation and has decent prospects for long-term growth in a sustainable or de-risked fashion.

Pick #1: Plains All American (NASDAQ:PAA)

Plains All American is a large MLPs with a market capitalization of roughly $12.3 billion. As most of its peers in the MLP space, PAA owns and operates midstream energy infrastructure that is primarily based in the United States, where in PAA’s case heavier emphasis is put on transportation and storage of crude oil and NGL. This is also captured nicely in the 2024 EBITDA guidance, where the assumption is that crude oil will account for almost 90% of the 2024 result.

Here are several specific reasons why, in my view, PAA’s current yield of 7.2% fits well into any retirement portfolio, where the underlying objective is to earn predictable yield at a level, which materially exceeds inflation.

First of all, we have to start with the fact that currently PAA’s distribution coverage stands at ~ 190%, which in the context of ~7.2% dividend yield is a huge number. From this statistic alone we can right away make a conclusion that PAA indeed carries a notable margin of safety when it comes to distribution sound current income streams in the future.

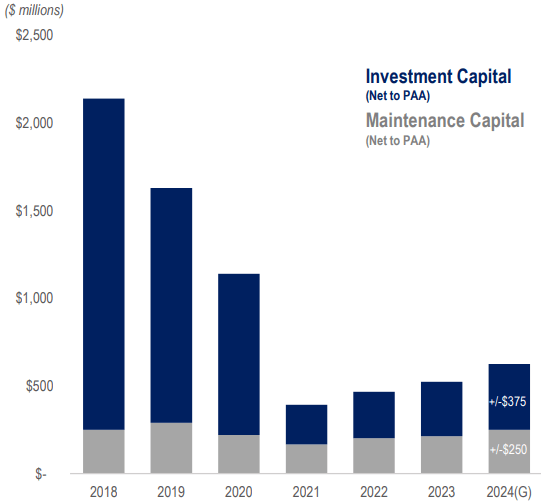

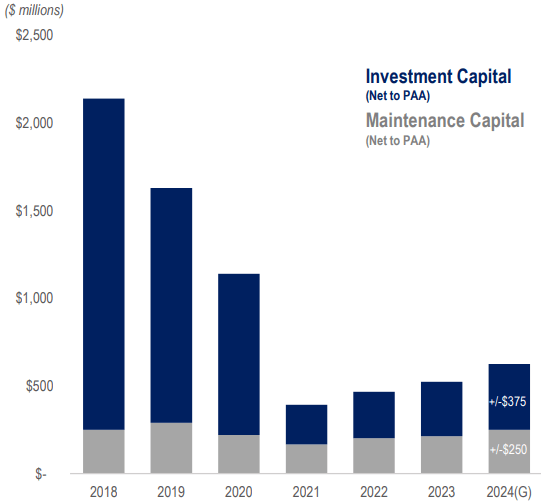

One of the main reasons why PAA has been able to secure so high distribution coverage is its normalized CapEx program, which enables PAA to retain significant amount of internal cash generation at the books. The chart below depicts this dynamic nicely, where it is rather obvious how PAA has over the recent years turned from a CapEx intensive and growth focused business to CapEx light and defensive MLP. For a retirement portfolio this is good news.

PAA Investor Presentation

For example, the projected CapEx spend for 2024 is roughly $600 million, while the estimated EBITDA is about $2.8 billion. Already here we can see how huge sums of capital PAA is able to retain each year to either further de-risk its business or grow the distributions.

Going into the year, Al Swanson – Executive Vice President & Chief Financial Officer – commented on how he sees PAA approaching distributions until 2026:

Well, I think, our current guidance for this year shows 190% coverage. So, we’ve got a bit to go our stated approach will be $0.15 a year until we hit the 160%. And then DCF growth will drive future increases there. So, we haven’t provided guidance for ‘25 or ‘26 yet. But yes, with this 19% or 20% increase we just did, we’re still at 190% coverage.

The message is clear, PAA’s dividend is set to grow.

Final thing to note here is that PAA’s has already landed in a financially sound territory based on how its capital structure is formed. Namely, currently PAA has a leverage of 3.1x and an investment grade credit rating, where both elements clearly indicate a robust financial risk profile.

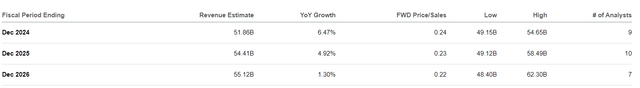

Top-line wise, the market expects a continued growth despite the reduced CapEx spend.

Granted, the growth rate is not huge, but it is still there to provide a slight tailwind for incremental cash generation that is critical to achieve inflation linked distribution streams in the long-run.

Pick #2: Blackstone Secured Lending (NYSE:BXSL)

Blackstone Secured Lending Fund is one of the largest BDCs out there with a market cap of almost exactly $6 billion. From a business focus perspective, it is definitely worth mentioning already in the start that BXSL invests in already cash-flowing and well-established businesses. This distinguishment is important as it separates BXLS from several BDC peers that provide financing to VC-type businesses or invest in very volatile CLO structures.

While BXSL is a riskier business than PAA, I would argue that on a fundamental level the substance of a thesis is very similar. In other words, BXSL provides enticing current income streams that are underpinned by robust cash flows, which are strong enough to seriously mitigate a risk of a dividend cut. As such, in my view, BXSL is also a solid retirement portfolio pick.

As we could expect it, BXSL offers higher yield than PAA – currently yielding ~10.2%.

Let me now elaborate on why I believe BXSL fits nicely into conservative retirement portfolios.

What is rather unique about BXSL is that although it is one of the largest BDCs, the investment portfolio is almost entirely comprised of senior first lien secured assets, which are per definition the highest quality one can get in this space. Moreover, majority of BXSL’s senior first lien secured investments are underwritten to businesses that have a PE sponsor present in their shareholding structure. What this does is it introduces an additional layer of safety in the situations when a company begins to struggle or experience liquidity constraints. The last thing what PEs want is to write down investments without any capital received back. For BXSL this is obviously highly beneficial.

Usually with high quality assets, we get high quality earnings; and this is not an exception. If we look at BXSL’s earning profile, more than 93% of the income generation is comprised of interest payments, leaving very minimal chunk to more volatile and / or non-cash like items such as advisory fees and PIK.

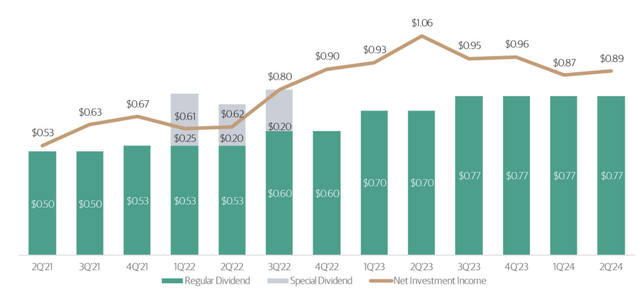

The dividend coverage currently stands at a 113%, which is in line with the sector average, but certainly not the highest statistic in the sector.

However, I would not be worried here due to the following aspects:

- As mentioned before, both the asset and earnings quality is high rendering the current statistic more reliable and safe relative to what we could observe in the BDC space, which is comprised of many players that have lower quality profiles.

- Since BXSL is the fourth largest BDCs, there are several diversification benefits that help de-risk the case even further. For instance, the average investment in a single company accounts for ~ 1% of total portfolio value. In total, there are more than 230 companies, which are spread across multiple different sectors. All of this is beneficial in the context of non-accrual avoidance (and lowered impact in case such situation emerges).

- The portfolio quality in terms of the LTM EBITDA coverage is also solid as it could be implied from the 1.7x coverage metric in Q2, 2024. Plus, the investment portfolio companies have registered a growth in their LTM EBITDA result of around 13%, which again confirms the underlying reslieciney in the BXSL structure.

Given the above, the current dividend that is offered by BXSL could be deemed sustainable for conservative (retirement) income seeking investors.

The bottom line

Conservative retirement income investing does not have to necessarily come with unattractive yields. The current interest rate environment presents many opportunities for investors to lock in enticing income generating vehicles that are underpinned by robust financial and cash generation profiles.

As elaborated above in the article, PAA and BXSL, in my humble opinion, present an opportunity for prudent investors to capture highly attractive and, importantly, sustainable income streams.