Key Notes

- Cardano’s ecosystem stakeholders put out a joint post-mortem statement on Saturday, detailing events around a partition exploit on the network.

- Cardano (ADA) price moved below $0.40 on Saturday, November 22, spotting another 3% decline in the last 48 hours.

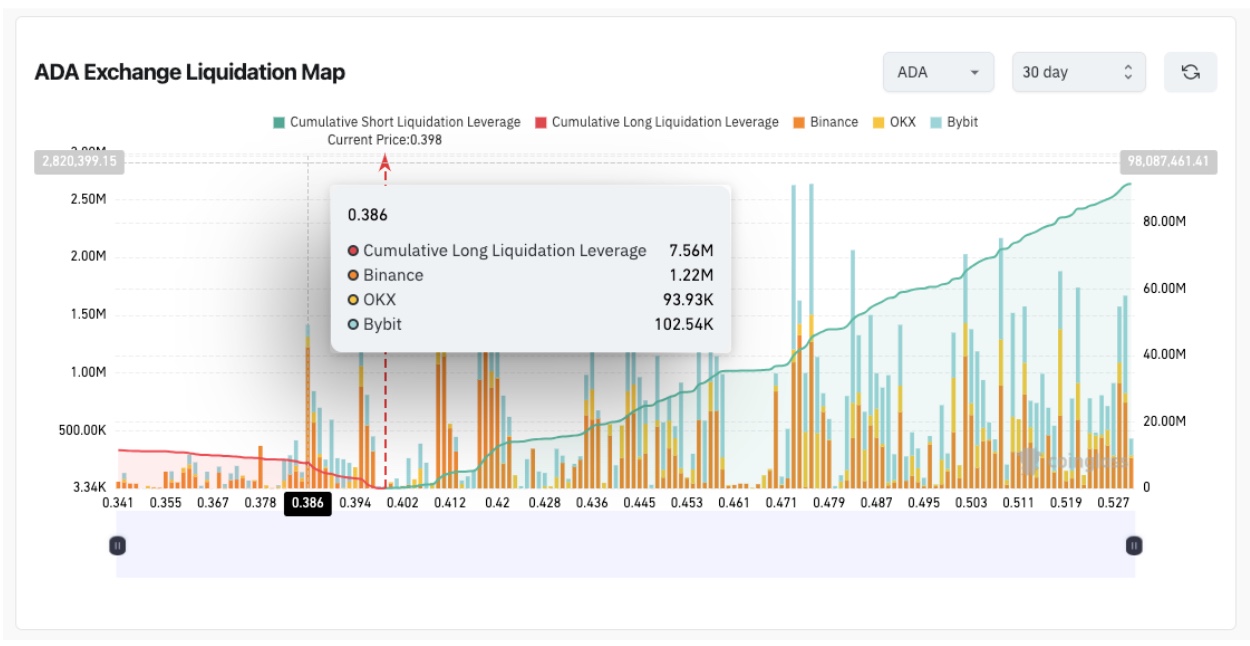

- Cardano liquidation map data shows 91 million short leverage placed on ADA compared to $11 million active long leverage.

Cardano ecosystem teams across Input Output Global (IOG), EMURGO, and Intersect released a detailed incident report on Saturday. It outlined the events behind a controversial partition bug. The report explained that a bug delegation transaction split the chain into two competing histories. The issue was first discovered on November 21 as a malfunction allowed an oversized hash to bypass initial validation, revealing a legacy vulnerability dating back to 2022.

To revert the exploit, Cardano Stake Pool Operators and exchanges are upgrading to node versions 10.5.2 and 10.5.3, as detailed. The teams confirmed no user funds were compromised and said updates of impacted wallets required no user intervention to reconcile inconsistencies. Efforts to restore normalcy are in progress, with exchanges preparing to resume normal operations.

Despite technical upgrades in progress and assurance of users’ funds safety traders sentiment weakened as reactions to recent network disruptions lingered in the Cardano derivatives markets.

Derivatives Markets Reveal $7.5M Long-Side Risk as ADA Drops Below $0.40

Cardano fell below $0.40 on Saturday, extending a 48-hour decline of 3% as traders reassessed the network incident. Coinglass’s 30-day Liquidation Map, a tool that tracks clustered leverage positions across major exchanges, revealed further capitulation risks ahead.

Cardano (ADA) Derivatives Market Analysis | Source: Coinglass

Traders deployed $91 million in cumulative short leverage in the last 30-days, compared to only $11.5 million in active long leverage. More concerning, $7.5 million of those long positions are concentrated near $0.38, forming the largest local liquidation cluster. Limited liquidity support below that level increases the risks of a flash crash to $0.31.

If upgrades complete smoothly and convergence finalizes without anomalies, ADA price may reclaim momentum toward the $0.40 handle. The Cardano team has placed disaster recovery plans based on CIP 135 on standby, in the event of anomalies in transition to the patched chain.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.