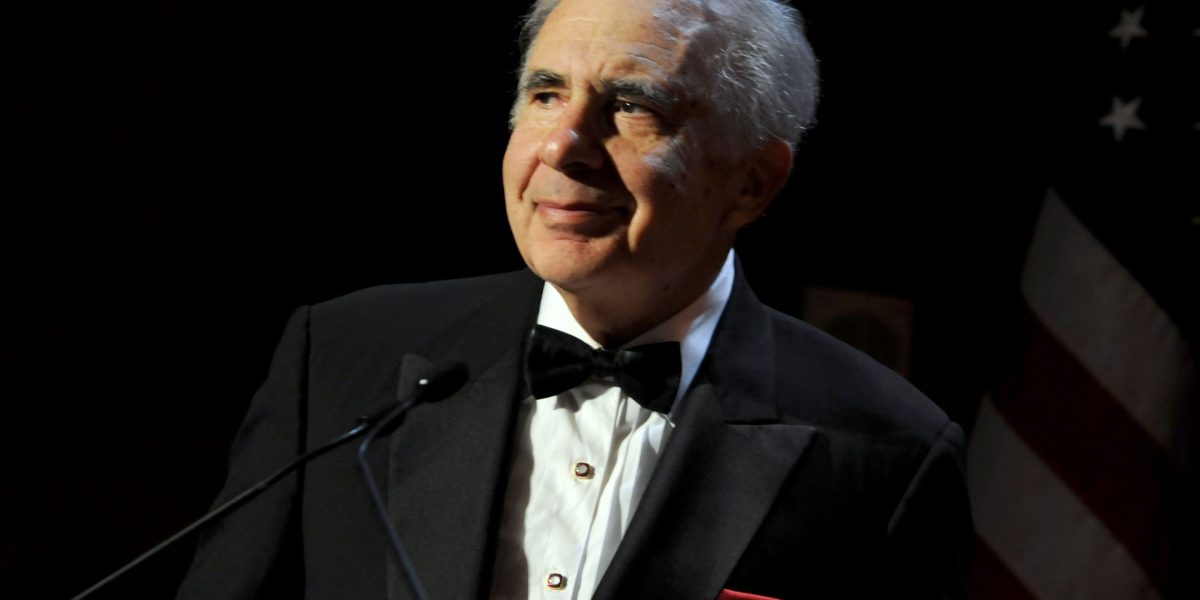

Distress loves firm and after dealing with steep inventory value declines of greater than 50% every, activist investor Carl Icahn and JetBlue would possibly want one another proper now.

Icahn Enterprises disclosed a 9.9% ownership stake in airline JetBlue at the moment, Icahn’s first foray again onto the dance flooring after promising that the agency would “stick to our knitting” after short-seller Hindenburg Analysis revealed a biting criticism of the corporate final 12 months. Shares of Icahn Enterprises are down about 72.2% throughout the previous 5 years, and greater than 60% for the reason that Hindenburg report.

In the meantime, JetBlue has been licking its wounds since a judge’s ruling blocked an estimated $3.8 billion merger with Spirit Airlines. JetBlue’s inventory is down 66% throughout the previous 5 years however rose about 16% after Icahn disclosed his shares within the airline at the moment.

Icahn disclosed within the submitting at the moment that the agency acquired the JetBlue inventory as a result of it believes it’s “undervalued and represented an attractive investment opportunity.” Icahn Enterprises has had discussions with board members and executives about searching for a seat on the JetBlue board and continues to carry talks with the airline, based on the submitting.

In a press release, JetBlue stated it welcomes Icahn’s overtures.

“We are always open to constructive dialogue with our investors as we continue to execute our plan to enhance value for all of our shareholders and stakeholders,” stated the corporate in an e-mail.

Nevertheless, the timing for JetBlue could also be lower than very best on condition that the corporate’s new CEO, Joanna Geraghty, moved to the helm formally at the moment. Geraghty was president and chief working officer since 2018 and beforehand served as govt vice chairman and chief individuals officer. Chief working officer Warren Christie additionally formally began at the moment, after serving as head of safety, security, and fleet operations.

Geraghty changed departing CEO Robin Hayes, who served within the function since February 2015. Hayes will stick round on the 10-person board, which is chaired by Peter Boneparth. Coping with Icahn is perhaps outdated hat for him. Boneparth is a former senior advisor to a division of funding administration agency The Blackstone Group and a former advisor to non-public fairness agency Irving Capital Companions. He additionally chairs the board of Kohl’s, which confronted off with a bunch of activists in 2021.

It was additionally an eventful Monday for Icahn Enterprises.

Utility firm American Electric Power announced at the moment that it had reached an appointment and nomination settlement with Icahn’s funds to nominate two new administrators to the board. Icahn Enterprises senior managing director Hunter Gary joined the AEP board together with Henry Linginfelter, former govt vice chairman of Southern Firm Fuel. Gary’s appointment is topic to regulatory approvals and he received’t have voting rights till the corporate will get them.