Automobiles are seen on a show at a Carvana dealership on February 20, 2023 in Austin, Texas.

Brandon Bell | Getty Pictures

Carvana shares surged 30% Friday morning after posting its first-ever annual revenue and receiving a pair of upgrades by Wall Road analysts.

The used-car retailer has been trimming stock and bills because it rebounds from the fall-off from a pandemic peak. After Covid drove elevated demand for on-line automotive gross sales, the corporate’s inventory soared. However after that demand wore off, Carvana was pressured to start aggressive restructuring and cost-cutting.

In its after-hours earnings report Thursday, the corporate posted its first annual revenue with a internet revenue of $450 million for 2023 in contrast with a lack of $1.59 billion in 2022.

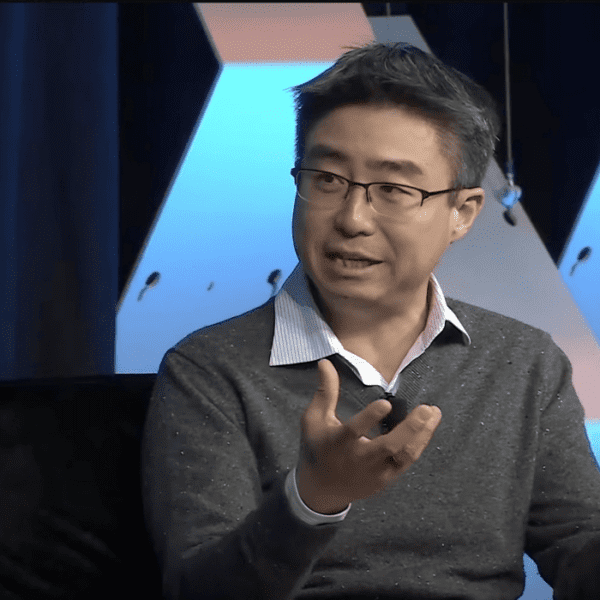

CEO Ernie Garcia advised CNBC’s Cash Movers Friday morning that the corporate is in an “incredible competitive position.”

The corporate is presently in step two of a three-step restructuring plan, which incorporates breaking even on an adjusted EBITDA foundation, driving the enterprise to vital optimistic unit economics and returning to progress.

Its whole gross revenue per unit greater than doubled to $5,283, up from $2,219 within the year-ago interval, in response to the quarterly report.

The corporate famous in its earnings report that the macroeconomic automotive promoting surroundings stays unsure, although it expects to develop retail models bought in the course of the first quarter and for 2024.

Analysts at Raymond James upgraded their score on the inventory to “market perform” on Friday, highlighting the encouraging GPU tendencies. The analysts wrote that investor sentiment is “aligning more closely with the narrative of Carvana’s long-term market potential.”

The corporate’s inventory surged final yr and now trades for about $70 per share, nonetheless effectively off its pandemic excessive of $370 per share, notched in 2021. The inventory misplaced practically all of its worth in 2022, prompting chapter issues which have since been abated by indicators of restoration.

William Blair analysts additionally upgraded Carvana’s score, to “outperform,” due to the revenue will increase and unit progress, noting that they consider the corporate is “now poised for a further breakout” with the encouraging 2024 forecast.

Garcia mentioned on CNBC that Carvana, with its 1% market share, continues to be centered on its present stock regardless of the final yr’s progress and revenue.

“I think we’ve got to see through what we’re currently working on,” Garcia mentioned. “There’s no question that in the medium run, growing our inventory to give our customers even more selection is going to be a big part of our strategy. I think our goal is to be in a place where customers come to get the simplest experience, to get the best price and the best selection.”