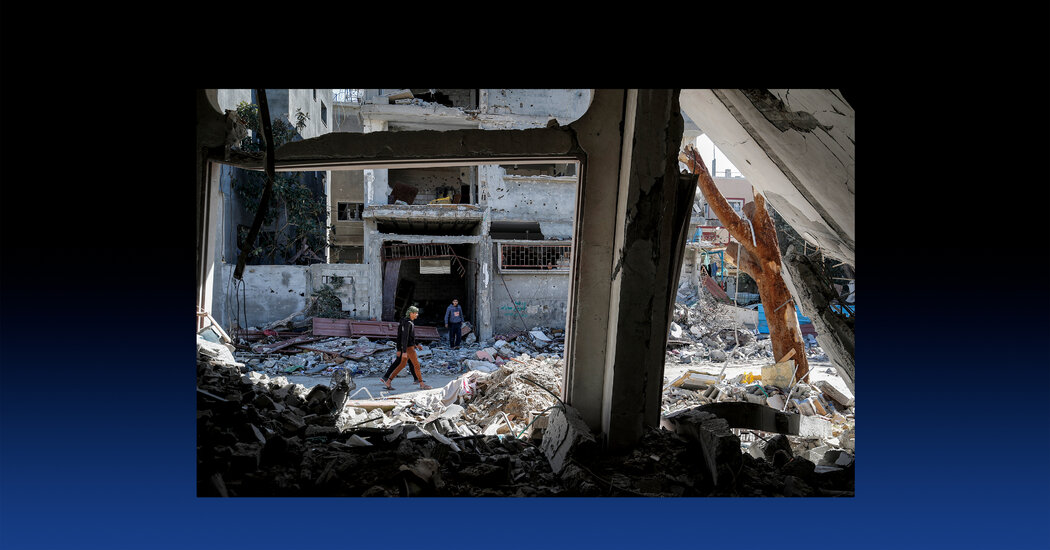

A Carvana signal and signature merchandising machine in Tempe, Ariz.

Michael Wayland/CNBC

PHOENIX – As layoffs and price cuts roil Wall Road, from retail and delivery to tech and media, embattled on-line used automotive gross sales big Carvana says its personal restructuring is within the rear view.

Carvana over the past 18 months aggressively restructured its operations and debt amid chapter considerations to pivot from progress to cost-cutting. They had been essential strikes for the corporate and its largest shareholders, together with CEO and Chairman Ernie Garcia III and his father, Ernie Garcia II. The 2 management 88% of Carvana by way of particular voting shares.

The efforts so far have been profitable, propelling Carvana’s inventory final 12 months from lower than $5 per share to greater than $55 to start 2024 – marking a major turnaround for the corporate, however nonetheless a far cry from the inventory’s all-time excessive of greater than $370 per share reached in the course of the coronavirus pandemic in 2021. Shares closed Thursday at $42.53.

“We have every intention of continuing to make progress and don’t expect to return to a situation like that,” the youthful Garcia informed CNBC in regards to the firm’s dire circumstances. “I think the pressure of the last two years caused us to really focus on the most important things.”

The Tempe, Arizona-based firm has taken $1.1 billion of annualized bills out of the enterprise; decreased headcounts by greater than 4,000 folks; and launched a brand new proprietary “Carli” software program platform for end-to-end processing of car reconditioning in addition to different “AI,” or machine studying, techniques for pricing and gross sales. The techniques changed earlier processes that concerned manually inputting information into separate techniques or spreadsheets.

The consequence, Carvana hopes, is healthier footing to navigate an automotive business that is shifting and normalizing from a supply-constrained setting to 1 with much less favorable pricing energy for sellers.

Return to progress

Carvana has been a progress story since its preliminary public providing in 2017. It posted rising gross sales yearly from its 2012 founding by way of 2022, when restructuring started.

The enterprise idea of Carvana is straightforward: purchase and promote used automobiles. However the course of behind this can be very sophisticated, labor-intensive and costly.

Carvana places every car it intends to promote by way of a prolonged inspection, restore and sale preparation course of. It ranges from fixing scratches, dents and different imperfections to engine and powertrain elements. There’s additionally important logistical prices and processes for delivering automobiles to shoppers’ houses and the corporate’s signature automotive merchandising machines throughout the nation.

A Ford F-150 is prepped for a portray sales space at Carvana’s car reconditing middle outdoors Phoenix. The car is wrapped so solely the spot wanted to be repainted is exhibiting.

Michael Wayland / CNBC

In 2022, retail gross sales declined roughly 3%. Headed into the fourth quarter of final 12 months, they had been down an extra 27%.

Carvana is at the moment within the “middle of step two” of a three-step restructuring that Garcia initially laid out to buyers roughly a 12 months in the past.

Step 1: Drive the enterprise to interrupt even on an adjusted EBITDA foundation. Step 2: Drive the enterprise to important optimistic unit economics, together with optimistic free money circulate. Step 3: Return to progress.

“We’re trying to stay really focused on just building the business as best we can,” Garcia stated throughout a uncommon, wide-ranging interview at a Carvana car reconditioning middle close to Phoenix in mid-January.

The CEO, sitting below a “Don’t be a Richard” poster that includes former President Richard “Dick” Nixon (it is considered one of Carvana’s six core values), says the corporate is basically performed with taking fastened prices out of the enterprise, however he believes there’s extra room for reductions in variable prices to extend income earlier than returning to a growth-focused firm once more.

Wall Road largely agrees.

Carvana CEO and cofounder Ernie Garcia III

Screenshot

“We walked away confident that CVNA has room to further improve its cost structure and drive additional operational efficiencies. These efficiencies would come from three main areas: the further development of internal software, standardized processes, and improved training and career pathing,” stated JPMorgan analyst Rajat Gupta in a December analyst word following an investor briefing and tour of a Carvana reconditioning middle in Florida.

On the finish of the third quarter, Carvana had $544 million in money and money equivalents available, up $228 million from the top of the earlier 12 months. The corporate reported complete liquidity, together with further secured debt capability and different components, of $3.18 billion.

It recorded a report third-quarter gross revenue per unit offered of $5,952, whereas chopping promoting, basic, and administrative bills by greater than $400 per unit offered in comparison with the prior quarter.

The corporate reviews its fourth-quarter outcomes on Feb. 22.

New period, new tech

On the middle of a lot of Carvana’s value reductions is new tech to optimize operations.

The corporate launched Carli, a bunch of software program “solutions” or apps for every a part of reconditioning a car. The suite of instruments information inspections and reconditioning of inbound automobiles step-by-step, together with worth checks and benchmarking prices for components and general bills per car. It is adopted by different techniques to evaluate market worth and gross sales costs for every car.

The techniques helped contribute to $900 in value financial savings per unit in retail reconditioning and inbound transport prices over previous 12 months.

“We rolled Carli out across all sites. It’s a single, consistent, much more granular inventory management system,” stated Doug Guan, Carvana senior director of stock analytics, who previously led enlargement for Instacart. “That’s what we’ve been focused on for the last year and a half.”

Every car that enters Carvana’s reconditioning middle has a barcode sticker to help in monitoring the car by way of its course of because it prepares to be offered.

Michael Wayland / CNBC

Guan, who began at Carvana in 2020, is amongst a brand new group of hires from quite a lot of backgrounds that vary from Silicon Valley tech startups to extra conventional car operations resembling CarMax, Ford Motor and Nissan Motor.

Carvana’s workplaces, the place it shares a campus with State Farm, really feel quite a bit like a startup. On a ground housing buyer assist, music blares – the likes of Coldplay to Neil Diamond. A black-and-gold gong sits close by to rejoice when costumer service reps, internally known as “advocates,” help prospects in a sale, amongst different milestones.

Apart from Carli, Carvana has constructed customized instruments to assist its inbound and outbound logistics actions which have pushed down prices by about $200 per unit. These embody mapping, route optimization, driver schedule administration, and pickup/drop-off window availability, together with same-day supply, which the corporate lately launched in sure markets.

The client care crew has additionally lately begun piloting generative synthetic intelligence for some requests, together with mechanically summarizing buyer calls, coaching AI to behave as an “advocate” and incorporate the corporate’s values: be courageous; zag ahead; do not be a Richard; your subsequent buyer could also be your mother; there are not any sidelines; we’re all on this collectively.

A black-and-gold gong sits close by to rejoice when costumer service reps, internally known as “advocates,” help prospects in a sale, amongst different milestones.

Michael Wayland / CNBC

“Customer experience has been No. 1 at the heart of everything that we do, which I think after being here all these years, it’s amazing to say that still very, very true statement,” stated Teresa Aragon, Carvana vp of buyer expertise and the corporate’s first worker outdoors of its three cofounders.

In 2023, Carvana’s buyer care crew below Aragon dealt with 1.3 million calls and one other 1.3 million chats and texts, in accordance with stats posted on a rest room flier known as “Learning on the Loo” that the corporate confirmed.

The generative AI pilot, which is separate from Carli, has helped Carvana to scale back headcount within the division by 1,400 folks whereas decreasing processing instances.

‘By no means one thing that we thought of’

Many buyers are again on the Carvana bandwagon after the corporate managed by way of the final two years, however some considerations stay.

The Garcia household and its management of the corporate have been a goal of some buyers, together with a lawsuit final 12 months introduced by two massive North American pension funds that invested in Carvana alleging the Garcias ran a “pump-and-dump” scheme to complement themselves. Its considered one of a number of lawsuits which have been introduced towards the the father-son duo lately, largely involving the household’s companies.

Usually, CEO Garcia stated he makes an attempt to make use of criticism as motivation in his “march” to guide Carvana, invoking a phrase he has frequently ended investor calls with for a number of years: “The march continues.”

Household ties

Carvana went public three years after spinning off from a Garcia-owned firm known as DriveTime, a non-public firm owned by the elder Garcia, who stays the controlling shareholder of Carvana. DriveTime was previously a bankrupt rental-car enterprise often called Ugly Duckling that Garcia II, who pled responsible to financial institution fraud in 1990 in connection to Charles Keating’s Lincoln Financial savings & Mortgage scandal, grew right into a dealership community.

Carvana has separated itself from the corporate however nonetheless shares many processes with DriveTime. The shut hyperlink between Caravan and different Garcia-owned or -controlled corporations has given some buyers pause.

The Wall Road Journal in December 2021 detailed a community of Garcia corporations that do enterprise with DriveTime, Carvana or each.

Most notably, Carvana nonetheless depends on servicing and collections on automotive car financing and shares revenues generated by the loans. The companies additionally, at instances, promote automobiles to 1 one other and Carvana leases a number of services from DriveTime along with profit-sharing agreements.

For instance, throughout 2022, 2021, and 2020, Carvana acknowledged $176 million, $186 million and $94 million, respectively, of commissions earned on car service contracts, or VSC, also called warranties, offered to its prospects and administered by DriveTime.

Carvana sells such warranties or different service-related protections to prospects, and DriveTime takes them over, giving Carvana a fee. It is considered one of a number of multimillion-dollar transactions between the family-controlled corporations.

The youthful Garcia, who began Carvana whereas serving as treasurer at DriveTime, says fully separating from Drivetime isn’t a primary precedence at the moment, because it makes use of already established techniques such because the financing and servicing that are not core to Carvana’s operations.

Carvana’s march hasn’t at all times been in a straight line: The corporate was a darling inventory of the coronavirus pandemic, because it was lightyears forward of conventional auto retailers in promoting automobiles on-line – a course of that surged in the course of the international well being disaster and, in some states, turned the one approach companies might function as a consequence of stay-at-home orders.

However it could not sustain with demand, pushing Carvana to speculate billions in progress alternatives, together with an acquisition of used automotive public sale enterprise ADESA.

Then the used car market shifted and Carvana’s aggressive progress plans — which included shopping for 1000’s of automobiles from auctions and shoppers at hefty premiums in comparison with conventional auto sellers to construct stock — turned a serious legal responsibility when costs declined.

Carvana’s debt grew, together with the debt-funded ADESA deal, and its inventory turned essentially the most shorted within the nation as fears of chapter and a creditor combat grew. The inventory misplaced almost all of its worth in 2022, inflicting some to take a position chapter could also be forward.

Garcia is adamant that he by no means believed chapter would occur, saying “absolutely not” when requested about it. His confidence was fueled by a perception that the service Carvana affords – promoting and shopping for used automobiles on-line and streamlining the tedious strategy of automotive buying is one thing shoppers want and need.

He additionally stated taking the corporate non-public – which scared some stakeholders and buyers – was by no means a viable choice: “I would say it was a thought in the sense that other people thought about it. It was never something that we considered,” Garcia stated.

The within of a Carvana signal merchandising machine in Tempe, Ariz.

Michael Wayland / CNBC

However Carvana’s debt load remains to be very a lot an element.

A deal between Carvana and a gaggle of buyers who collectively owned $5.2 billion of its excellent unsecured bonds decreased the used automotive retailer’s complete debt excellent by greater than $1.2 billion but in addition kicked a lot of the debt to later this decade, at largely increased rates of interest.

Marc Spizzirri, a senior managing director of B. Riley Advisory Providers, stated each restructuring is exclusive however basically corporations have to take motion rapidly after taking up debt to make sure they do not land in the identical circumstances that drove the debt within the first place.

“They have to be able to service that debt,” stated Spizzirri, a former franchised seller. “It’s a classic pre-bankruptcy process and in [many companies’] minds that’s not an option for them … But they can’t keep repeating what they’ve done before.”

Carvana’s new notes will mature in 2028; the outdated notes, which carry rates of interest starting from just below 5% to greater than 10%, are due between 2025 and 2030. The outdated and new notes make up roughly 78% of Carvana’s almost $6 billion complete debt.

For now, the march continues for Carvana.