Categorical, a onetime millennial favourite that was a staple in malls nationwide, filed for chapter Monday and can search a purchaser. The corporate additionally plans to shut about 100 shops, it stated in court docket filings, together with all 12 UpWorth shops.

Closing gross sales at these areas are set to start Tuesday. Past these closures, Categorical stated that it “expects to conduct business as usual.”

The chain, which additionally owns the Bonobos model, listed $1.2 billion in liabilities and $1.3 billion in belongings.

Additionally on Monday, Categorical announced it obtained a non-binding letter of intent from WHP Group, mall operator Simon Property Group, and Brookfield Properties to buy most of its shops and operations. Categorical stated the chapter submitting would “facilitate the sale process.”

The corporate stated that it had obtained a dedication for $35 million in new financing, which is topic to court docket approval, from some current lenders. That may add to the $49 million in money that Categorical obtained earlier this month from the Inner Income Service associated to the pandemic-era CARES Act.

In a ready assertion, Categorical CEO Stewart Glendinning stated that WHP “has been a strong partner” of the corporate since 2023 — and that the proposed sale would give Categorical further monetary assets and “better position the business for profitable growth” whereas maximizing worth for stakeholders.

In accordance with Categorical’ web site, the corporate at present operates about 530 Categorical retail and Categorical Manufacturing facility Outlet shops in the US and Puerto Rico, along with roughly 60 Bonobos Guideshop areas, 12 UpWest shops in addition to on-line operations for these manufacturers.

The retailer has been struggling for a while because the persistence of distant work made its model of office- and going-out put on much less related, famous Neil Saunders, managing director of GlobalData.

“With the company struggling to gain traction with consumers, it has been obvious for quite some time that bankruptcy was the inevitable destination for Express,” he stated in a be aware.

What’s extra, he wrote, the casualization of style “puts Express firmly on the wrong side of trends and, in our view, the chain made too little effort to adapt.”

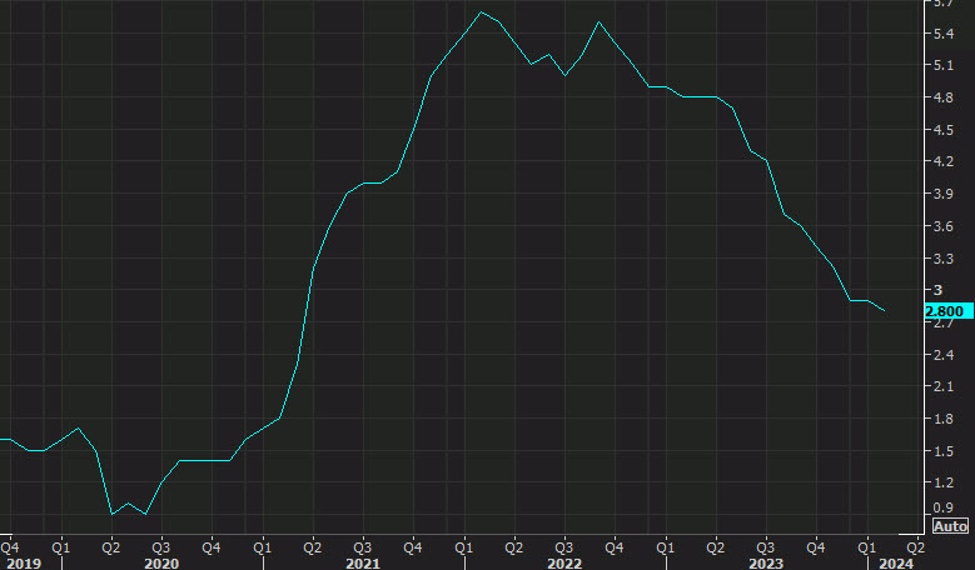

Categorical’ gross sales in the latest quarter have been down practically 10% from 2019, at the same time as client spending has boomed and attire as a class has remained robust. In March, Categorical was delisted from the New York Inventory Change after its share value fell below a dollar.

Glendinning advised traders on a latest name that the corporate had made “missteps” and that its lineup was “out of balance across categories, price points and wearing occasions,” in line with Modern Retail. In Saunders’ phrases, the choice was “overpriced, lacks differentiation, and comes across as very bland,” and consumers have been prepared to forgo it.

Categorical confronted rising competitors from the likes of fast-fashion retailers Shein and Temu in addition to from higher-end manufacturers. The corporate, in some ways, “is the archetypal middle-market mass retailer that consumers are increasingly willing to either cut out of the portfolio of stores they visit, or buy less from, as they look to save money,” Saunders wrote.

Categorical is simply the most recent retailer to file for chapter this yr, after Joann and 99 Cents Solely.