Current stories knowledgeable of an alleged round launched by the Central Financial institution of Nigeria (CBN). The doc warned monetary establishments that partaking with cryptocurrencies and facilitating operations for crypto exchanges was prohibited.

The information raised alarms as, 4 months in the past, Nigeria lifted the ban that prevented banks and different monetary establishments from working accounts for digital asset service suppliers (VASPs).

Newest Crypto Crackdown Turned Out A Bluff

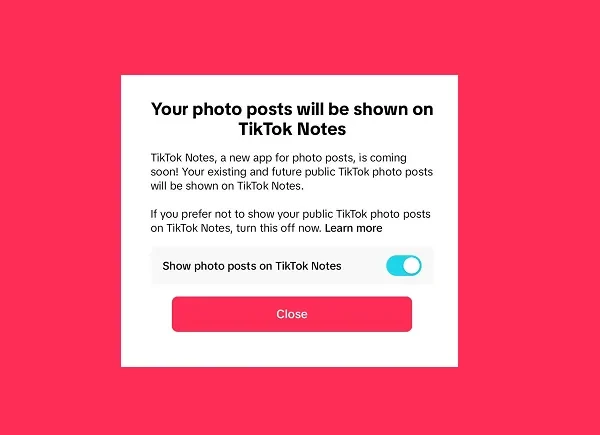

On Tuesday, stories of a CBN’s deal with on monetary establishments that facilitated operations for crypto exchanges in Nigeria began spreading.

The alleged round “cautioned” Deposit Cash Banks (DMBs), Non-Financial institution Monetary Establishments (NBFIs), Different Monetary Establishments (OFIs), and the general public concerning the dangers related to crypto transactions.

Alleged round by the Central Financial institution of Nigeria. Supply: X

The doc “reminded” regulated establishments they had been banned from dealing in cryptocurrencies or facilitating operations for exchanges due “to earlier regulatory directives on the subject.”

Nonetheless, the talked about ban was lifted in December 2023 and was followed by strict tips that permit banks and different establishments to take care of cryptocurrencies below a algorithm.

The alleged round directed DMBs, NBFIs, and OFIs to determine and report all people and entities inside their system that had been “transacting in or operating cryptocurrencies” on exchanges.

Binance, OKX, KuCoin, and Bybit had been listed as prohibited platforms. Per the doc, the listed exchanges and different platforms buying and selling the Nigerian Naira within the Peer-to-Peer (P2P) Market weren’t licensed to function within the nation.

As such, these platforms had been “under investigation” by the CBN and the Financial and Monetary Crimes Fee (EFCC). The round ordered the monetary establishments to make sure that the accounts that handled cryptocurrencies had been “put on PND (Post No Debit) instruction for six months.”

Moreover, it warned that each one suspected brokers that traded “USDT illegally” could possibly be apprehended. The doc acknowledged that any breach of the brand new directive would end in “severe regulatory sanctions” for the concerned events.

Nonetheless, Nigeria’s Central Financial institution clarified on Wednesday that the alleged round was “fake content.” On an X post, CBN acknowledged that the data was unauthentic and didn’t originate from the establishment.

Nigeria’s EFCC Freezes 300 Accounts

Regardless of the CBN round turning out pretend, the EFCC lately froze over 300 unlawful foreign exchange accounts that traded on a P2P platform.

Based on a neighborhood report on Tuesday, EFCC Chair Ola Olukoyede revealed that the fee suspended the accounts on Monday following a courtroom order.

The Chairman defined that the company found a “worse scheme” than Binance’s system, which has been below a regulatory crackdown within the nation. The most important crypto trade on the earth and two of its executives are at the moment dealing with 4 expenses for Tax Evasion in Nigeria.

Per the report, Olukoyede affirmed that “there are people in this country doing worse than Binance.” Consequently, these actions had been taken to “ensure the safety of the foreign exchange market and protect the economy.”

The EFCC considers P2P monetary buying and selling a “scheme” working exterior the official monetary corridors as, within the final yr, over 15 billion Nigerian Naira, price round $11 million, handed by means of one of many foreign exchange platforms.

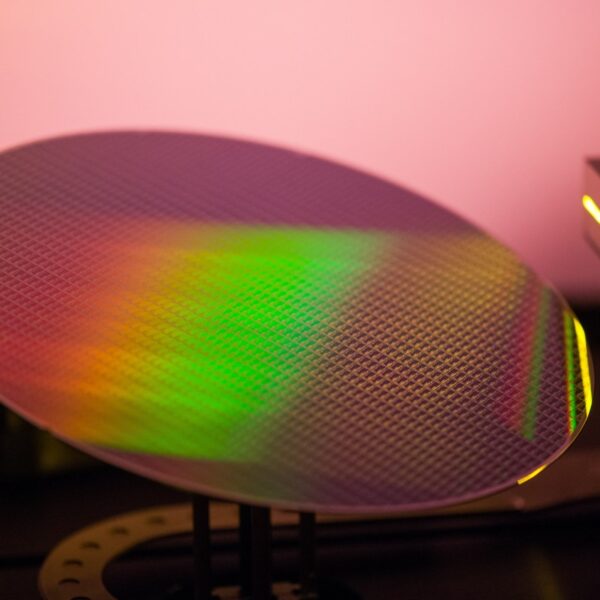

Crypto Complete Market Cap sits at $2.3 trillion. Supply: TOTAL on TradingView

Featured Picture from freepik.com, Chart from TradingView.com