MOZCO Mateusz Szymanski

Suggestion

We advocate a Lengthy Place for CD Projekt S.A. (OTCPK:OTGLY). This suggestion is directed in the direction of a consumer searching for publicity to a pacesetter within the Futuristic RPG and Fantasy RPG area, a agency with lowered improvement danger from restructuring, and a inventory that’s deeply undervalued as the worth has not integrated its future initiatives.

Firm Background

CD Projekt S.A. is a Mid-Cap European firm that’s primarily based in Poland, Warsaw. They function within the Digital Leisure business as a video video games firm.

The Firm has 2 most important divisions:

The primary division, CD Projekt Pink, produces and distributes video video games. CD Projekt Pink owns 2 Triple-A online game IPs: The Witcher, which offered 75 million copies, and Cyberpunk 2077, which offered 25 million copies. The Witcher is CD Projekt Pink’s most esteemed IP as in phrases of recognition, it’s the 37th highest-selling gaming identify ever.

The second division, GOG, simply totally distributes video video games by its on-line storefront, just like Steam or the Epic Video games Retailer. This division helps diversify its income streams past the event of proprietary titles.

In our thesis, we’ll consider the primary division, particularly CD Projekt Pink, because it generates 80% of its revenues. We provide a high-conviction lengthy suggestion for CD Projekt S.A., supported by causes outlined within the thesis and valuation sections.

Funding Thesis

Leaders in Futuristic RPG and Fantasy RPG House

One cause for this suggestion lies of their aggressive benefit to provide acclaimed titles inside the Futuristic RPG and Fantasy RPG House, all whereas sustaining decrease improvement prices. This benefit has fostered a loyal fan base, evident in the place The Witcher 3 offered as much as 50 million models, and Cyberpunk 2077, regardless of controversies, achieved 13 million models offered inside 14 days of its launch and subsequently reached 25 million copies so far. Return on Fairness stands at 17.7%, Return on Belongings at 11.5%, Return on Invested Capital at 30% and Web Revenue Margins at 36.4%, highlighting CD Projekt Pink’s operational effectivity. These figures outshine opponents like EA and Ubisoft, as proven within the valuation part.

Evaluating CD Projekt Pink to its competitor, Ubisoft (OTCPK:UBSFY), we observe that Ubisoft’s RPG IP Murderer’s Creed could appear to be a contender in opposition to CD Projekt Pink’s RPGs. Nevertheless, Ubisoft’s IPs, notably Murderer’s Creed, have seen a decline over time, characterised by fixed stagnation in concepts, clunky controls and satisfactory tales which have left customers un-enthused, evident as their current instalment, Murderer’s Creed Mirage, is estimated to solely have offered 5 million copies. One other competitor, Digital Arts (EA), holds RPG IPs equivalent to Dragon Age and Mass Impact, nonetheless, these franchises haven’t seen new releases since 2014 and 2017 respectively. Additionally, although that they had occasional vital acclaim, they’ve did not garner business enchantment, equivalent to Mass Impact Andromeda solely promoting 3 million copies in three years, and it acquired a 71/100 from critics. In distinction, CD Projekt Pink stands out with its critically and commercially-successful titles.

Attributable to rising improvement prices, triple-A sport improvement has grow to be tougher with larger danger. Nevertheless, CD Projekt Pink has saved its working bills decrease, relative to opponents by creating video games in Poland, the place the price of dwelling is much lower than in international locations like the US the place EA operates, and France the place Ubisoft operates.

Decreased Improvement Danger from Restructuring

The discharge of Cyberpunk in a Damaged State might be attributed to a few most important elements: their segmented sport improvement construction, reliance on their proprietary engine, and the challenges posed by COVID-19, which necessitated distant work, making suggestions and collaboration much less environment friendly.

CD Projekt S.A. solved these difficulties with intensive restructuring initiatives.

First, they modified their angle towards workforce collaboration. Earlier than the discharge of Cyberpunk 2077, specialist departments had been remoted from each other. Communication was primarily by the pc, stopping clean progress. With the restructure happening months following Cyberpunk, they developed strike groups made up of specialists from a number of disciplines like artists, programmers and designers, who might then work collectively throughout complete ranges. This enchancment promotes a extra pure implementation of the suggestions loop, which improves effectivity.

Secondly, as a substitute of utilizing their proprietary REDengine, they’ve moved onto the Unreal Engine as their main engine. The REDengine was unstable when making Cyberpunk 2077, and the corporate invested vital money and time in refining the engine with every sport launch. So transitioning to the Unreal Engine supplies 3 most important advantages: First is that it is an open engine that allows builders to entry pre-made property, decreasing asset era time and rising cost-efficiency. Second, it attracts engine-proficient builders, therefore increasing CD Projekt Pink’s expertise pool. Third, the Unreal Engine is dependable and has an excellent assist infrastructure by way of Epic Video games sustaining it, which reduces delays and permits for speedy challenge decision by contacting Epic Video games. This permits them to commit all of their efforts to creating the product quite than bettering the engine.

These restructuring initiatives aimed to streamline CD Projekt’s pipeline, cut back improvement dangers, and make sure the supply of high-quality video games that enchantment critically and financially. We really feel that these modifications have successfully addressed earlier issues and positioned the organisation for achievement.

Unpriced Worth from Future Initiatives Attributable to Myopic Market

When CD Projekt S.A. introduced on October 4th, 2022, their forthcoming 5 initiatives spanning roughly the subsequent decade, the market didn’t rally, nor did it mirror this information within the share value or EV/Gross sales. The market seems cautious in regards to the firm’s future initiatives, regardless of being blockbusters from their flagship Witcher and Cyberpunk franchises. These initiatives embody:

-

Witcher Polaris 2026, is the primary in a trilogy of video games anticipated to be launched each 3 years. The final within the Witcher collection offered 50 million copies.

-

Witcher Polaris Sequel 2029.

-

Witcher Polaris’ Finale 2032.

-

Witcher Canis Majoris, i.e., Witcher Remake is being made by Fools Principle.

-

Witcher Sirius, a multiplayer sport.

After the discharge of Cyberpunk 2077, because it was a damaged launch and marred with controversy, CD Projekt S.A. share value fell by 65%. Whereas the market considers it a failure, particularly after its non permanent removal from the PlayStation digital market, it did nonetheless obtain monetary success. The sport offered an astonishing 13 million copies in simply two weeks, however after extra effort by CD Projekt Pink, Cyberpunk grew to become a success, promoting 25 million copies in three years. Moreover, its growth, Phantom Liberty gained vital reward and secured a spot among the many prime 12 PC video games of 2023, in accordance with Metacritic.

The market has but to cost within the new buyer sentiment made doable by Cyberpunk 2077’s current growth and Netflix present. Subsequently, we additionally consider that we’re presently on the lowest level the inventory is prone to attain, particularly contemplating we’re within the downcycle of the agency with advertising and marketing gearing up quickly for the promotion of any of those 5 titles.

Valuation

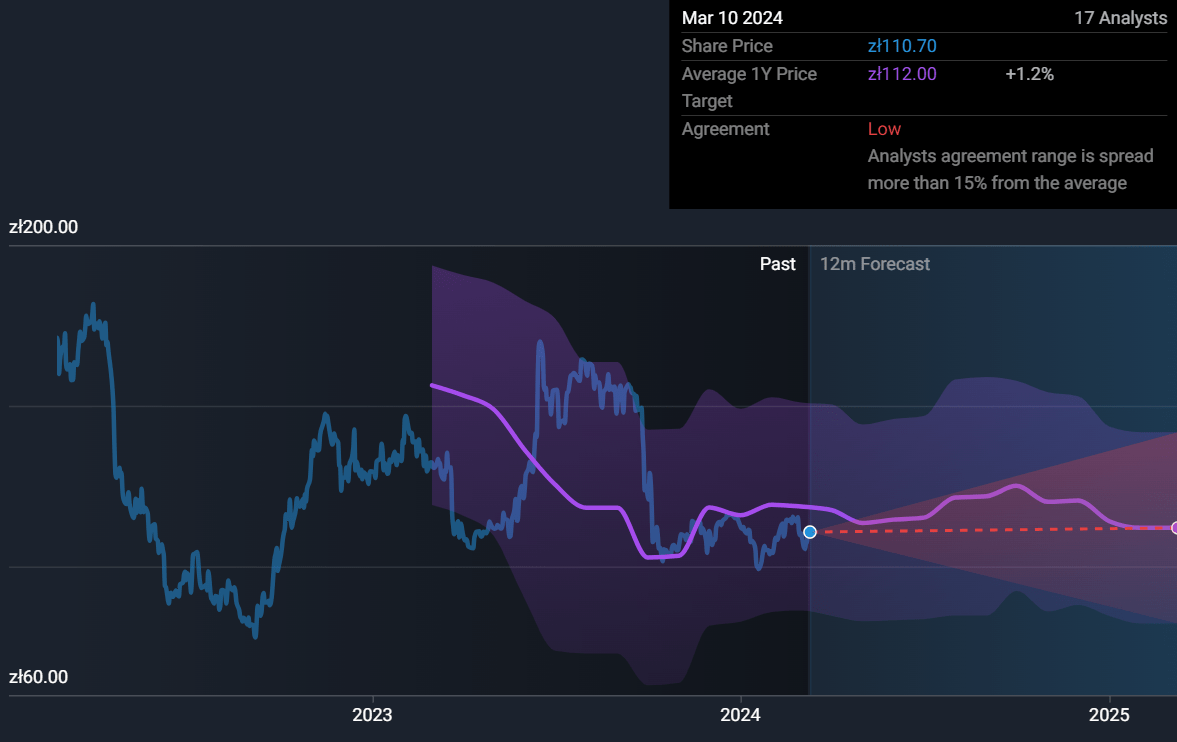

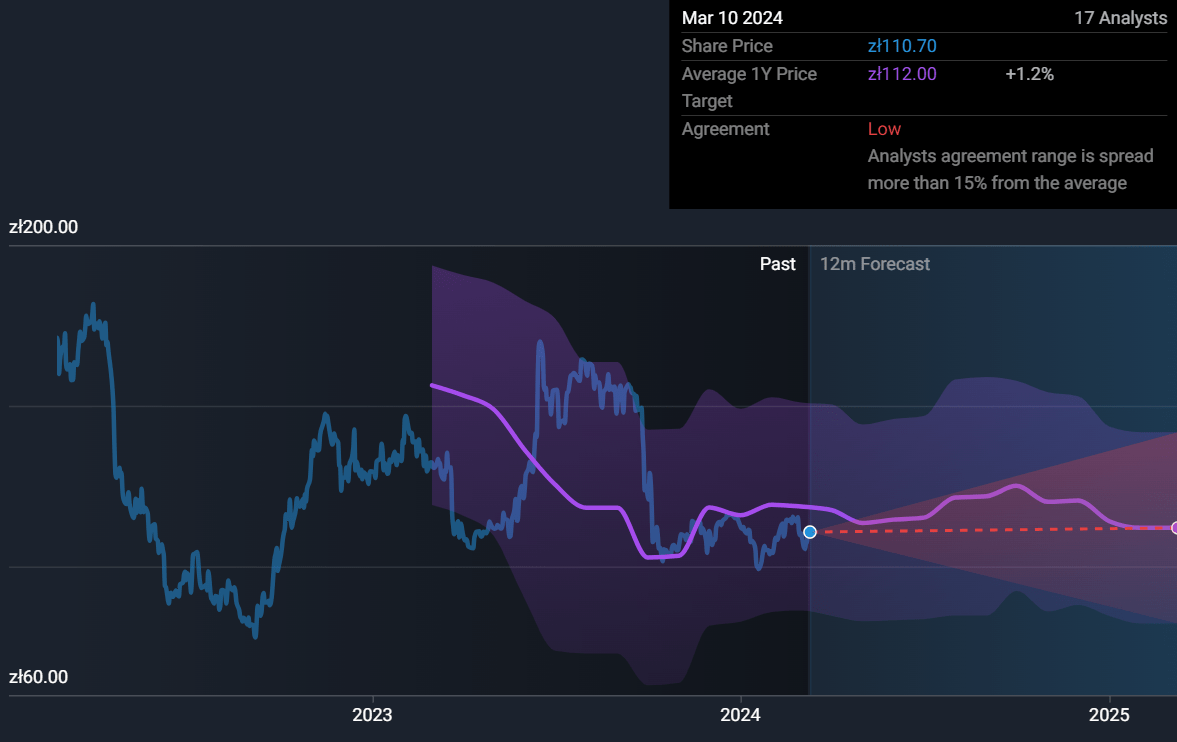

Analyst Consensus and Value Forecast

Analyst Consensus and Value Forecast (Simplywall.st)

In our thesis, we consider (OTGLY), however the above forecast is for CD Projekt S.A.’s (CDR) inventory on the Warsaw Inventory Change; as (OTGLY) has no analysts and is on the OTC Market.

|

Intrinsic Valuation (OTGLY) |

Analyst Forecast (CDR) |

|

Value Goal: $15.96 Present Value: $6.91 The Upside: 131% Derived from multiples |

Consensus Goal: 112 zloti (+1.2%) Excessive Finish: 178 zloti (+59%) Low Finish: 80 zloti (-27%) |

The present EV/Gross sales ratio is 10 with the current EV standing at $2.6 billion. Looking forward to the subsequent 10 years, with the discharge of 5 new video games, we will utilise EV/Gross sales to estimate the corporate’s intrinsic worth.

Contemplating that Cyberpunk 2077 offered 13 million copies inside two weeks, let’s estimate that the upcoming sport slated for an early 2026 launch (Witcher Polaris) will promote 10 million copies priced at $60 every all year long. This is able to end in $600 million in gross sales. If we assume that the EV/Gross sales ratio stays regular at 10 by the shut of 2026 (because it has been for 3 years) it could suggest an EV of $6 billion (10 * $0.6 billion). This means a rise of 131% contemplating that the corporate’s present EV is $2.6 billion. It is essential to notice that this valuation assumes that income from the Witcher sport cannibalises all previous revenues, which is not true for a gaming firm as gamers typically proceed partaking with older content material. Moreover, this evaluation doesn’t bear in mind any income generated from the GOG enterprise. The preliminary two assumptions are employed to simplify and set up a conservative projection of features. Moreover, it presumes that the Market Worth of Debt stays constant that means any rise in EV straight interprets to an increase within the Market Worth of Fairness.

Sensitivity Evaluation:

Unit gross sales, EV/Gross sales. Assumes video games promote for $60.

|

2.5 |

5 |

10 |

15 |

|

|

5 million |

-71% |

-42% |

15% |

73% |

|

7 million |

-60% |

-19% |

62% |

142% |

|

10 million |

-42% |

15% |

131% |

246% |

|

13 million |

-25% |

50% |

200% |

350% |

For contextualizing the above EV/Gross sales ranges, earlier than the discharge of Cyberpunk 2077 in November 2020, CD Projekt S.A.’s EV/Gross sales ratio was quite a bit increased, the place it used to hover between 50-60. However after its launch, the market grew to become much less keen to pay at such excessive premiums and now the ratio averages to about 10. The sensitivity evaluation above highlights low draw back danger with a considerable upside potential.

Compared, corporations equivalent to EA have had their EV/Gross sales ratio sink to as little as 4 in recent times, whereas Ubisoft’s comparable ratio has been round 1.7. Nevertheless, it’s value noting that Ubisoft has most definitely reached its peak by way of sport innovation, and the market recognises this, they lack any blockbuster initiatives in its future pipeline. CD Projekt S.A. is well-known for its high-quality AAA titles and dependable fan base, whereas EA has a extra various portfolio that features each AAA titles and different video games. Subsequently, it is unlikely for CD Projekt S.A.’s ratio to fall to EA’s stage both. CD Projekt S.A.’s upcoming initiatives equivalent to Witcher Polaris and Cyberpunk Orion might even push their EV/Gross sales ratio increased.

Multiples in contrast with opponents:

|

Ubisoft |

CD Projekt |

Digital Arts |

|

|

EV($billion) |

4 |

2.6 |

35 |

|

Ahead EV/Gross sales |

1.6 |

11.3 |

4.6 |

|

EV/Gross sales |

1.9 |

10 |

4.6 |

|

Web Debt/EBITDA |

-2.3% |

-2.1% |

-0.3% |

|

D/E |

157% |

1.53% |

29.4% |

|

ROE |

-30% |

17.7% |

10.8% |

|

ROA |

-6.3% |

11.5% |

6.8% |

|

ROIC |

-11.8% |

30% |

7.6% |

|

Web Revenue Margin |

-27% |

36.4% |

10% |

*ALL Multiples discovered from Stratosphere.io, whereas D/E from Yahoo Finance

Dangers

One danger to contemplate is CD Projekt Pink’s lack of diversification in IP franchises, as they solely concentrate on two IPs: The Witcher and Cyberpunk. If their subsequent title had been to fail to be commercially or critically acclaimed, then there’s a danger of decreasing the longer term free money flows of the corporate because the few IPs they’ve could now appear overvalued, thus the inventory can be shorted. Nevertheless, this danger is mitigated by the factors outlined in thesis level 2.

One other danger to the inventory value is from geopolitical issues, the place the creating struggle between Ukraine and Russia might worsen, and Poland could get roped in, contemplating Poland’s proximity to the area. If Poland faces macroeconomic points on account of the battle, we may even see panic promoting. CD Projekt S.A.’s place as one of many nation’s prime 13 companies by market capitalization implies that it is susceptible to systematic dangers that put downward strain on its inventory value.

Moreover, there’s a chance that CD Projekt S.A. would possibly prioritise short-term money move over high quality by producing substandard video games on a yearly or biannual foundation. This tactic, just like these utilized by corporations like Ubisoft and EA, has the potential to undermine client goodwill and hinder future free money flows from blockbuster initiatives. Nevertheless, CD Projekt S.A. is unlikely to undertake this method as a result of administration has not indicated a metamorphosis in its enterprise philosophy.

Catalysts

One catalyst we consider can rally the inventory value to its intrinsic worth is the discharge of its subsequent sport. It is anticipated to be launched in early 2026. We consider rallies are anticipated within the run-up to the sport’s launch, fueled by advertising and marketing campaigns. And as soon as the sport releases, then we anticipate extra rallies from its capability to provide vital free money flows for the corporate and maybe with the corporate beating earnings projections. On the very newest, the inventory would possibly rebound to its intrinsic worth in early 2027, which accounts for any delays within the sport’s launch, which is frequent within the business.

One other catalyst may be steady business consolidation, notably following the Activision-Xbox merger. On this scenario, bulletins of CD Projekt S.A.’s acquisition could additional improve the inventory.

Conclusion

To conclude, CD Projekt S.A. is a pacesetter within the Futuristic RPG and Fantasy RPG House, as proven by their business and important success in current titles. Nevertheless, a danger is that since they solely have 2 main IPs, if any of them falter, then the free money move potential of the corporate diminishes. However this appears unlikely as they lowered improvement danger by way of their restructuring efforts to alter how groups talk and by transferring to the Unreal Engine. The market additionally hasn’t priced the longer term initiatives within the pipeline on account of their warning, so it appears the upside-to-downside ratio is beneficial.

Transferring ahead, there can be some noise dealer danger within the quick time period, since catalysts are far out and we will count on advertising and marketing round early 2025. Plus, since one other sport hasn’t been launched, there’s a danger of lacking expectations and the worth falling additional, however this needs to be restricted given a current Q2 2023 miss led to a 40% decline in share value, so one other miss should not be as drastic as it has been priced in.

An investor ought to make investments no later than at the beginning of 2025, as throughout 2025 we should always see the worth rally as advertising and marketing ramps up. To remain risk-averse, it is best to promote after earnings on Witcher Polaris’s launch. So, if Witcher Polaris is to launch early in 2026, then anticipate the earnings announcement after its launch after which promote, as it might take a while for the subsequent product to be launched, thus the share value will fall if there may be one other earnings miss after, provided that the business is cyclical. But when an investor is keen to tackle extra danger and see the corporate develop additional, because it’s basically a robust firm, holding for the long run is possible, however we do want extra proof that they’ll launch their upcoming titles inside a 3-year window on the very newest, which would scale back the impression of the corporate’s cyclicality.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.