Luis Alvarez

Summary

This is a brief update from my last coverage (published in late May this year). Previously, I gave CDW Corporation (NASDAQ:CDW) a buy rating, with my key thesis being that CDW has two strong growth catalysts that can drive growth acceleration post-FY24. I continue to rate CDW as a buy, as the current macro and operating dynamics are moving in the direction I expected previously. It should also be noted that CDW managed to expand gross margin despite a revenue decline, which supports my view that the margin can continue to expand when growth normalizes.

Earnings results update

In the latest quarter (2Q24) reported in late July, CDW revenue was $5.42 billion, down 3.6% y/y but in line with consensus estimates. Gross profit was $1.183 billion, with gross margin coming in at 21.8%, an 80bps expansion vs. 2Q23 of 21%. This resulted in the EBIT margin being flat compared to last year at 9.4%, which led CDW to see adj EPS of $2.50. For FY24, gross profit is now expected to see flat-to-low-single-digit y/y growth, a guide down vs. prior expectations for low-single-digit growth. FY24 adj EPS growth was also revised downwards to see flat-to-low-single-digit growth vs. prior expectation for low-single-digit growth. The main cause for the revision is the industry weakness (management reiterated its expectations to outperform underlying IT spend by 200-300 bps on a constant currency basis).

Near-term weakness, but signs of recovery emerging

As I noted in my risk section previously, the timing of recovery is the risk, as nobody knows when the macroeconomic situation will turn for the better. Hence, I am not surprised that there is still a lingering weakness seen in CDW results. The same impact continues to be seen in that economic uncertainty continues to weigh on customer spend, sales cycles, and pipeline conversion rates in 2Q24. Corporations continue to allocate budget dollars to more mission-critical software solutions (which makes sense, as they have higher priority).

Mentioned in the 2Q24 earnings call: And so what we’re hearing is more focus around mission critical, and I’ll call that more solutions-oriented endeavors right now. So it’s hard to gauge on the PC refresh and when we’ll start to see it come back.”

The good thing is that there are increasing signs that the demand backdrop is improving.

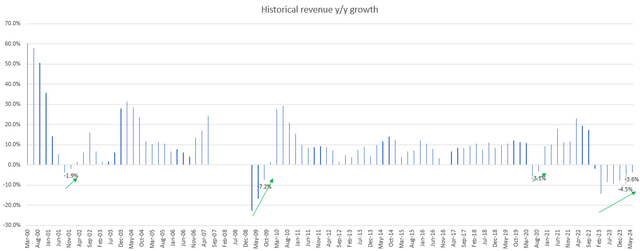

Firstly, throughout CDW’s entire operating history, whenever the business goes into a downcycle, it follows a similar pattern where it sees: (1) easing y/y growth declines; (2) low-single-digits y/y revenue decline before a recovery (subprime was an outlier given it was a major financial crisis). And in 2Q24, CDW is following this exact trend.

Secondly, management noted that customer spend and conversion rates improved in June vs. April and May, indicating an improving trend that bodes well for 2H24 performance. This also aligns with what peers are saying. For instance:

Mentioned in the PC Connection, Inc. 2Q24 earnings call: we believe that device demand will improve modestly for the balance of the year.

Mentioned in TD Synnex Corp. 2Q24 earnings call: The IT spending market continued to improve and after a prolonged period of challenging market conditions and transformation, which we navigated well, we returned to positive year-on-year gross billings growth in the quarter.

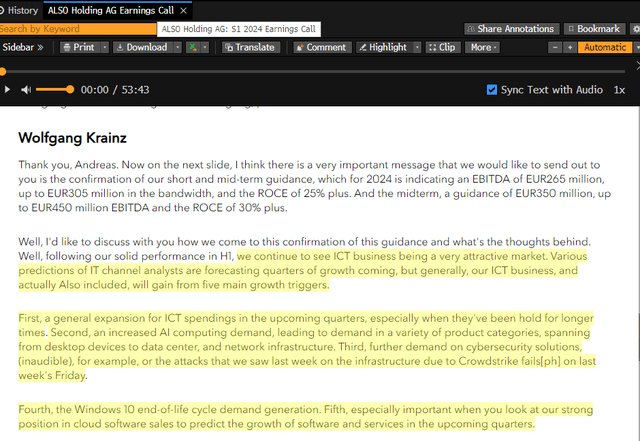

ALSO Holding comments in its calls also painted a similar outlook (as per the snapshot).

Thirdly, data storage & servers saw growth recovered back to 200bps in the quarter, with notable strength in servers within the mid-market. This is a really good sign, especially since it’s coming from the mid-market, as it suggests that the overall spending environment is improving. My view is large enterprises recover spending first, followed by mid-scale companies, then small businesses. I expect this momentum to continue spreading across all parts of the market (small, mid, and large) eventually as demand for AI-related applications drives up overall demand for servers.

Fourth, the inventory glut in the networking vertical appears to be over (according to Cisco’s management comments), which bodes well for a recovery cycle in the coming quarters.

Mentioned in the Cisco’s 4Q24 earnings call: We saw steady demand as we closed the year with total product order growth of 14% and growth of 6% excluding Splunk, indicating that the period of inventory digestion by our customers is now largely behind us as we expected.

As we stated, we think the inventory digestion is complete and we’re now returning to a more normalized demand environment. I’m encouraged by the broad based demand that we saw in the quarter across the — and the continued progress we’re making with our customers around AI and particularly cyber security as well as core networking and beginning to see that it is actually getting a lift from AI in the enterprise space.

Lastly, PCs saw recovery growth (one of my growth catalysts mentioned previously) momentum with high-single-digit y/y growth in client devices. Growth should accelerate from high single-digits to >10% as the growth is driven by the refreshment of aged PCs and not due to a Windows 11 upgrade or AI PC-related demand (these two are the big growth drivers in this aspect).

Hence, while these are very early signs, they are all moving in the right direction – toward the start of a growth cycle. Management also sounded very confident when they spoke about the current pipeline situation, which was very encouraging to know.

Mentioned in the 2Q24 earnings call: Now, as I said, what has been very positive is the rhythm of the business feels — feels more stable, feels a little more firmer footing, and I think that’s a good indicator of moving to more solid footing, which means pipeline converting in the not-too-distant future, which will convert into growth.

And I would also say that our solutions pipeline is really quite strong. It’s been the conversion given the market that is reflecting the appetite to buy, but the pipeline is really quite strong.

Gross margin improvement is positive

In the midst of the transitional period, CDW’s ability to expand gross margin despite revenue decline deserves attention, as it suggests a structurally higher margin profile when growth accelerates. In 2Q24, CDW reported a gross margin of 21.8% (an 80 bps y/y expansion), which is the highest-ever 2Q performance in CDW’s operating history. I believe this gross margin is here to stay because it is driven by a better mix of revenue (higher margin software and services products grew faster than lower margin hardware products). For perspective, hardware as a percentage of total revenue has fallen from 86% in 1Q22 to 75% in 2Q24. With software and services growing faster than hardware (especially in verticals like cloud and cybersecurity services), this mix shift trend should continue (the hardware revenue mix continues to go down), which means margins can potentially go higher.

Mentioned in the 2Q24 earnings call: Robust increases in cloud and security supported profitability with a meaningful increase in gross margin. Client devices increased for the second quarter in a row and posted both year-over-year and sequential sales increases of low-double-digits.

Services increased by 6% driven by cloud and security related services. Once again, cloud was an important performance driver contributing double-digit gross profit growth across software, services, and security.

Second quarter year-over-year margin expansion was primarily driven by the higher mix in sales, where CDW acts as agent, also known as netted down sales. This category grew by 8.7%, once again outpacing overall net sales growth and representing 33.2% of our gross profit, compared to 30.6% in the prior year’s second quarter. Year-over-year expansion came from our teams continuing to successfully serve customers with cloud and SaaS-based solutions.

Valuation

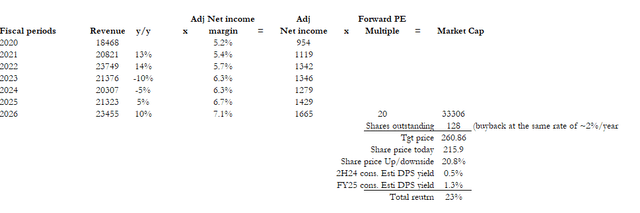

I believe CDW is worth 23% more than the current share price. My target price is based on FY26 ~$1.67 billion in net income and a forward PE multiple of 20.

Earnings bridge: As I have explained in depth previously, FY24 is likely going to be a down year (1H24 revenue growth down mid-single-digits, in line with my FY24 estimates) because of the tough macro backdrop. Growth will only re-accelerate in 2H24; hence, my assumptions stay the same, in that FY25 and FY26 will see growth acceleration (exiting FY26 at 10%, which is the historical growth range). While 2Q24 did not show strong signs of growth recovery, it did provide more evidence that margin can expand, and hence, I think the historical rate of 40 bps/year margin expansion is doable. This leads to ~$1.67 billion of net income in FY26.

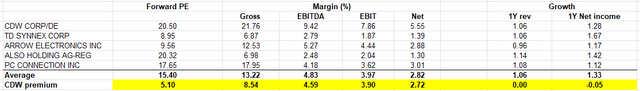

Valuation justification: There are no changes to my valuation expectations here as well. My view is still that CDW will trade back to its historical average multiple of 20x (past 5-year average) as the business conditions normalize. One could argue that CDW deserves a higher multiple because of the higher margin profile, but I will leave that as an additional upside if it comes true. Relative to peers, this premium multiple is also justifiable as it has a much higher margin profile.

Investment risk

On top of the macro risk cited previously (quoted below), an area that could cause CDW growth to see further slowdown is the incremental weakness in CDW’s international operations (UK and Canada). Especially in the UK, which saw the demand environment deteriorate in 2Q24. Given that the Bank of England just cut rates recently, which should drive an overall macro improvement, if the demand situation does not improve, it may imply that CDW is not executing well.

Also, CDW is a pretty much a US-centric business where >90% of its revenue comes. Given the lack of experience operating overseas, execution risk is something to consider as CDW intends to expand overseas.

A big risk is the timing of growth recovery, as the current macro headwinds could last a lot longer, thereby putting more pressure on businesses willingness to increase their budget for tech spending. The bigger implication is that this will likely push back the timeline for the PC refreshment cycle as businesses look to further sweat out current assets.

Conclusion

My positive view on CDW remains. While near-term headwinds persist, this should not come as a surprise, as I have already noted previously. The good thing is that there are emerging signs of growth recovery, and with a robust pipeline, CDW is well-positioned for growth acceleration as macroeconomic conditions improve. The improvement in gross margin is also noteworthy, as it indicates a higher margin profile when growth normalizes.