Daniel Batten, managing companion at CH4 Capital and a famous local weather activist for The Bitcoin ESG Forecast, has delivered to mild new analysis indicating a concerted effort by Central Banks, notably throughout the European Union, to systematically “weaken” BTC’s affect and standing.

In an in depth exposition shared by way of X (previously Twitter), Batten stated: “While we were sleeping, the European Commission (via ESMA & ECB) has been creating a report which they plan to label Bitcoin – environmentally harmful – a threat to EU energy security – a haven for financial criminals. This paves the way for 2025 de facto EU bans on BTC & BTC mining.”

In accordance with Batten, this transfer by the European Fee is a part of a broader technique that has international implications. He highlighted, “ESMA, working closely with the ECB, has signaled that once the report is accepted in the EU, they will push for it to become the standard in other nations.”

Coordinated Assault Towards Bitcoin

Linking the present situation to the aftermath of the Global Financial Crisis (GFC), Batten suggests a deep-seated worry amongst Central Banks concerning the decentralizing potential of Bitcoin. He quotes, “During The GFC, Central Bankers realized the risk people could discover our Central Bank-based financial system had been transferring from the poor to the rich for generations.”

🧵

How 3 EU Central Banks are working collectively to attempt to weaken Bitcoin

What motion every of them has taken

What are their subsequent strikes

What we should do

— Daniel Batten (@DSBatten) January 31, 2024

Batten additional accuses the ECB of shifting their stance from ridicule to lively opposition post-2018. “After this 2018 survey, they moved into fight mode,” he claims. He identifies the ECB, the Financial institution of Worldwide Settlements (BIS), and the DNB (Dutch Central Financial institution) because the main entities on this alleged marketing campaign in opposition to Bitcoin.

The analysis factors out the strategic use of environmental considerations as a major assault vector. Batten asserts, “The prime attack vector has been ‘Bitcoin is bad for the environment.’ It’s a lie, of course, which anyone who has looked into it deeply will know.”

The report additionally brings consideration to particular incidents which have formed public notion and coverage in the direction of BTC. Batten remembers the 2021 episode the place Elon Musk, influenced by media studies, declared Tesla would no longer accept BTC funds. He quotes analyst Willy Woo, saying, “This, more than the China ban, was the event that halted Bitcoin’s 2021 bull run.”

The involvement of Ripple Founder Chris Larsen in anti-Bitcoin campaigns is highlighted as a notable instance of the intertwined pursuits between conventional monetary gamers and digital foreign money insurance policies. Batten factors out, “Larsen’s $5M donation to GreenpeaceUSA for an anti-Bitcoin campaign is a clear conflict of interest, overlooked by mainstream media.”

The Battle Is Far From Over

Regardless of the alleged efforts by Central Banks, BTC has proven resilience. Batten remarks, “Not everything of course went to play. Bitcoin was not supposed to rally 150% after ECB’s ‘Bitcoin’s Last Stand’ obituary late last year.” Furthermore, BTC was not supposed to realize help from establishments like KPMG and BlackRock, contradicting the central banks’ narrative.

In conclusion, Batten emphasizes the vital crossroads at which the way forward for digital currencies stands. He urges help for organizations actively partaking with regulatory our bodies and combating misinformation. “Supporting groups like the Open Dialogue Foundation, Bitcoin Policy UK, and the Satoshi Action Fund is crucial in countering the misinformation and shaping a future where digital currencies can thrive,” he advocates.

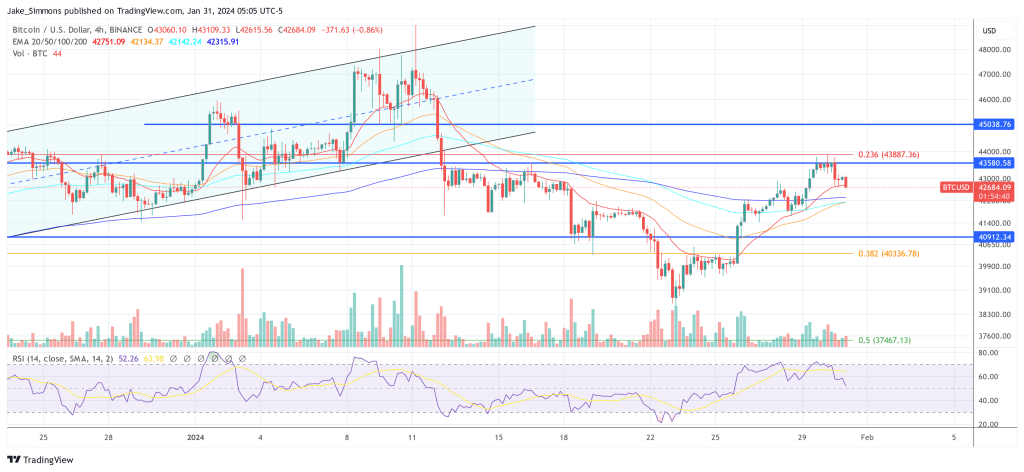

At press time, BTC traded at $42,684 after being rejected on the key resistance at $43,580.

Featured picture created with DALL·E, chart from TradingView.com