AI image

It’s a big week for central banks as decisions from the BOJ, Fed and BOE come back-to-back-to-back in a 32-hour span starting early Wednesday in Japan (late Tuesday in the US).

Mechanically, the most-uncertain is the Bank of Japan, which hasn’t clearly signaled what it will do. The market is pricing in a 61% chance of a 10 basis point hike and a 39% chance of no move. If the BOJ disappoints, the recent strength in the yen could quickly unwind.

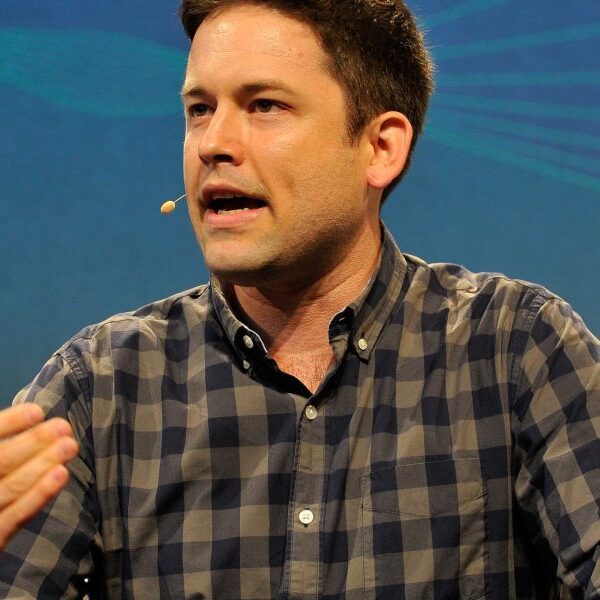

Next will be the Fed at 2 pm ET on Wednesday. The market is down to pricing in just a 5% chance of a cut after briefly flirting with a surprise move earlier this month. The big question is whether the Fed will signal a September move, or how aggressively it will be signalled. I tend to think they will be non-committal given all the data between now and September 18.

Finally, the Bank of England has left the market guessing with pricing now at 59% for a cut and 41% for a hold. It would be the first move of the cycle and run against some recent commentary from Bailey suggesting the UK inflation and wage dynamics are different from other advanced economies.