Key Notes

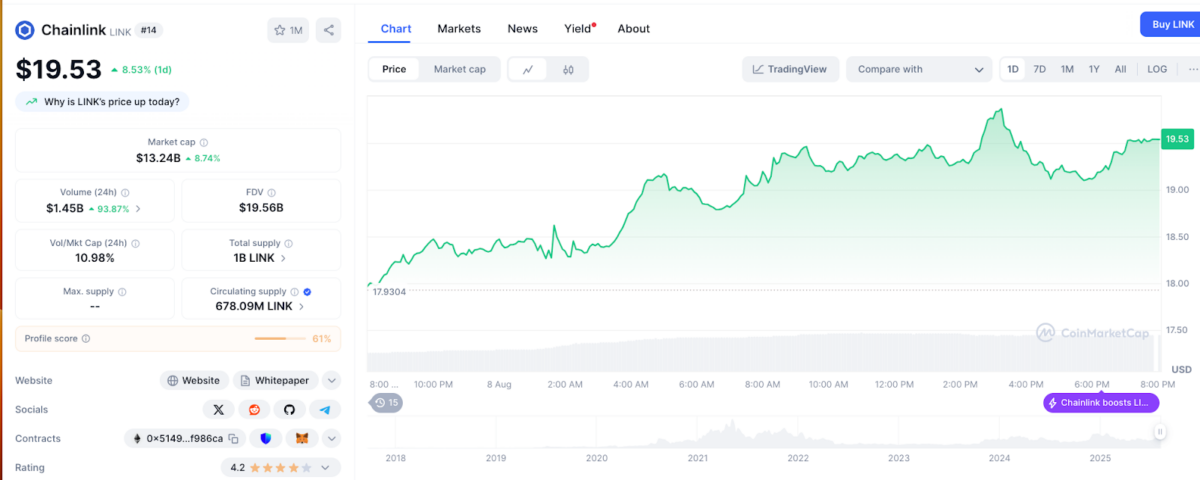

- LINK breaks above 20-day moving average at $17.02, targeting $20 resistance with RSI at comfortable 64.15 levels.

- The new Chainlink Reserve automatically converts enterprise payments into LINK tokens with over $1 million already accumulated.

- Payment Abstraction layer upgrade enables seamless conversion of stablecoins and assets into LINK, boosting token demand.

Chainlink

LINK

$19.70

24h volatility:

7.4%

Market cap:

$13.36 B

Vol. 24h:

$1.36 B

emerged as one of the best-performing mega-cap cryptocurrencies on Friday, Aug. 8, posting a 9% daily gain that pushed its price above $18.1 at press time. The surge follows a bullish announcement from the team that has driven strong momentum for the token.

The rally was catalyzed by two key factors: improving sentiment across risk asset markets following comments from Donald Trump suggesting potential tariff relief for select imported tech components, and more directly, the launch of Chainlink’s new strategic on-chain LINK reserve.

According to the official announcement, the Chainlink Reserve will be funded through both on-chain and off-chain revenues, including enterprise payments and fees collected via Chainlink’s Payment Abstraction system.

This revenue is now being programmatically converted into LINK and stored on-chain, with no near-term plans for withdrawal. The launch coincided with the Reserve already having amassed over $1 million in LINK tokens, emphasizing the speed of adoption.

We’re excited to announce the launch of the Chainlink Reserve, a new upgrade centered on the creation of a strategic onchain reserve of LINK tokens.https://t.co/ENs52Qjnn2

The Chainlink Reserve is designed to support the long-term growth and sustainability of the Chainlink… pic.twitter.com/vUElyovvYs

— Chainlink (@chainlink) August 7, 2025

The upgraded Payment Abstraction layer now accommodates both off-chain and on-chain revenues, enabling seamless conversion of stablecoins and other assets into LINK, potentially boosting token demand.

LINK Eyes $20 Resistance as Rally Clears 20-Day Moving Average

Chainlink surged 5.67% on Thursday to close at $19.52, decisively breaking above the 20-day simple moving average (SMA), now positioned at $17.02.

This rally comes after LINK consolidated for over a week near the $16 support level. The breakout past the three key SMAs (5, 8, and 13) now positions LINK in an accelerated recovery mode, with upside pressure building toward the $20 zone last tested in mid-July.

Chainlink price forecast | LINKUSDT

The Relative Strength Index (RSI) reads 64.15, comfortably below the extreme overbought threshold of 70. This positioning suggests that LINK still has ample room to climb before facing exhaustion, especially if daily volume continues rising.

Beyond speculative price action, the establishment of the Chainlink Reserve and its token lockup mechanisms could further tighten supply and accelerate the rally.

In summary, the combination of dwindling short-term supply and bullish market sentiment may create conditions for a breakout above $20, with a potential target near $21.50, June’s local high.

Solaxy Presale Heats Up as Chainlink Catalyzes Layer-2 Hype

While Chainlink grabs headlines for its on-chain reserve innovation, attention in the Layer-2 space is quickly shifting to Solaxy, Solana’s first native Layer-2 protocol.

Solaxy Presale

With over $14 million already raised, Solaxy’s presale promises up to 70% APY for early stakers of its native $SOLX token. As the Solaxy team prepares for major CEX listings and the next phase of its roadmap, early buyers are already eyeing the next price tier unlock with optimism. At the time of writing, Solaxy’s official presale website still offers early access to staking incentives and ecosystem rewards.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.