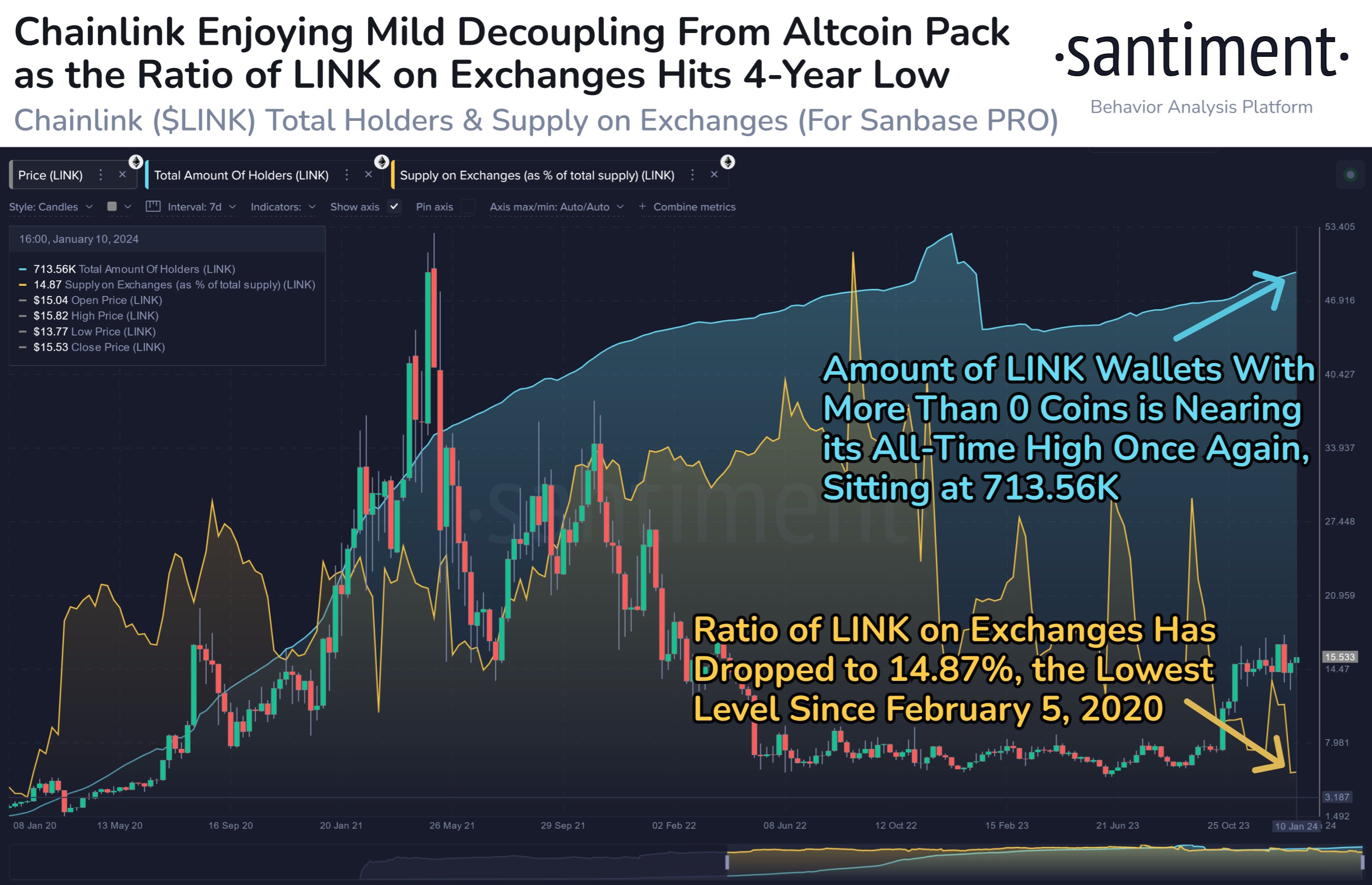

On-chain information reveals the Chainlink provide on exchanges has dropped to the bottom degree in round 4 years, an indication that could possibly be bullish for LINK.

Chainlink Provide On Exchanges Has Seen A Plunge Just lately

In keeping with information from the on-chain analytics agency Santiment, LINK’s newest upward surge has come because the cryptocurrency’s provide on exchanges has dropped to lows.

The “supply on exchanges” refers back to the proportion of the whole circulating Chainlink provide at the moment being saved within the wallets of all centralized exchanges.

When this metric’s worth goes up, the traders are depositing a internet variety of cash to those platforms proper now. As one of many essential causes the holders would switch their LINK to exchanges is for promoting functions, such a development could possibly be bearish for the asset’s value.

Then again, the indicator observing a drop implies a internet quantity of the cryptocurrency is at the moment leaving the exchanges. This type of development could possibly be an indication that the traders are accumulating, which may naturally be bullish for the worth in the long run.

Now, here’s a chart that reveals the development within the Bitcoin provide on exchanges over the previous few years:

Seems like the worth of the metric has been happening in current weeks | Supply: Santiment on X

As displayed within the above graph, the Chainlink provide on exchanges has seen a pointy decline lately. This might counsel that internet asset withdrawals have occurred on the exchanges.

Following this drop, the indicator’s worth has hit simply 14.87%. That is the bottom metric since fifth February 2020, nearly 4 years in the past.

As the provision on exchanges has hit these lows, the worth of LINK has registered some rebound because it has recovered from its crash under the $13 degree. It’s potential the outflows had one thing to do with the current value motion, but it surely’s exhausting to say for positive.

Both method, the indicator dropping to such low ranges is definitely an optimistic growth for Chainlink. And it’s not simply because it implies that many LINK traders are probably serious about HODLing the coin at the moment; there’s additionally one other implication right here.

It’s the truth that the portion of the provision within the custody of the exchanges has been diminished. A push in the direction of self-custody is all the time best for any cryptocurrency, as these central entities will have an effect on the market to a lesser diploma.

In 2022, the sector noticed instances just like the FTX collapse, which ended up destabilizing the complete market. If traders proceed to place their cash inside wallets the keys they personal, then eventualities like these would doubtlessly not repeat.

LINK Value

On the time of writing, Chainlink is buying and selling at round $15.3, up 13% prior to now week.

LINK has seen some surge throughout the previous few days | Supply: LINKUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Santiment.internet