Bonnie Cash/Getty Images News

Chair Powell came out swinging when he presented his Semi-Annual Monetary Policy Testimony to the Congress.

In his prepared remarks, submitted to both the Senate Committee on Banking, Housing and Urban Affairs, and to the House Committee on Financial Services, Chair Powell added a new element to his usual review of the Current Economic Situation and Current Monetary Policy.

In closing, he said,

“Congress has entrusted the Federal Reserve with the operational independence that is needed to take a longer-term perspective in pursuit of our dual mandate of maximum employment and stable prices.”

Never before, in the twelve previous times he appeared before congress as Fed Chairman for his Semi-Annual Monetary Policy update, had he highlighted the independence of the Fed.

Chair Powell’s emphasis on Fed independence was also disclosed in the detailed Monetary Policy Report published on July 5th,2024 ahead of Powell’s testimony.

In the newly added subsection “Monetary Policy Independence, Transparency, and Accountability” the Fed reported

“Congress has …given the Federal Reserve operational independence. Under this arrangement, the Federal Reserve, rather than other parts of the government, makes determinations about monetary policy actions that are most appropriate for achieving the dual mandate goals. This arrangement allows monetary policy decisions to be insulated from short-term political influences.”

“There is broad support for the principles underlying independent monetary policy. It is widely understood that the monetary policy actions that deliver maximum employment and price stability in the longer run may involve restraining measures that entail short-run economic costs, while actions that raise output and employment to unsustainable levels have no long-run real benefits and may lead to elevated inflation rates. These considerations highlight the value of monetary policy being carried out by an independent agency whose decisions are based on the congressionally assigned dual mandate. Operational independence of monetary policy has become an international norm, and economic research indicates that economic performance has tended to be better when central banks have such independence.”

Again, in the twelve previously published Monetary Policy Reports released during Powell’s tenure as Fed Chairman, there was no such language justifying the independence of the Fed.

Why The Fed Is Now Emphasizing Its Independence

On April 26, 2024, the Wall Street Journal published an article “Trump Allies Draw Up Plans to Blunt Fed’s Independence” which reported that supporters of the presumptive Republican nominee have drafted a document which outlines how a new administration might want to influence Fed policy.

The article states,

“The group of Trump allies argues that he should be consulted on interest-rate decisions, and the draft document recommends subjecting Fed regulations to White House review and more forcefully using the Treasury Department as a check on the central bank. The group also contends that Trump, if he returns to the White House, would have the authority to oust Jerome Powell as Fed chair before his four-year-term ends in 2026, the people familiar with the matter said, though Powell would likely remain on the Fed’s board of governors.”

These changes, which could be difficult to implement, are such a radical departure from the historical workings of the Fed, that they elicited this strong defense of Fed independence from Chair Powell.

In fact, Senator Catherine Cortez Mastro, D-Nevada, in her questioning of Chair Powell referenced the Wall Street Journal article.

In response to her question about how important independence is to the Fed to achieve its objectives, Powell replied,

“It is essential… That is broadly understood on Capitol Hill, on both sides of the aisle…We need to do our work in a way that is outside the political process to the maximum extent possible… It is an institutional arrangement that has served the public well… There is wide support for it.”

There were several other comments by Chair Powell, again defending Fed independence, over his two days of congressional testimony.

In response to Senator John Tester, D-Montana, on why central bank independence is critically important, Powell replied

“All advanced economies have adopted a policy of central bank operational independence…that just means we make our decisions without taking in extraneous factors, one of which would be politics. The record is pretty clear that that is a good institutional arrangement that serves the public well.”

To Representative Emanuel Cleaver, D-Missouri, Powell said

“Having an independent central bank is essential. If you want to have high and volatile inflation then the quickest road to that is to undermine the independence of the central bank.”

Importance of Central Bank Independence

Chair Powell also made his case for central bank independence recently on the international stage. On July 2, 2024, at the ECB Forum on Central Banking in Portugal, Powell appeared with ECB President Christine Lagarde and Bank of Brazil President Roberto Campos Neto.

Each highlighted the need for central bank independence, particularly the importance of standing up to political pressure. Powell downplayed outside influences, saying, “I am not focused on that at all. And that’s not just a talking point. I really think we just keep doing our jobs.” He was quick to add that “Support for the Fed’s independence is very high where it really matters on Capitol Hill in both political parties.”

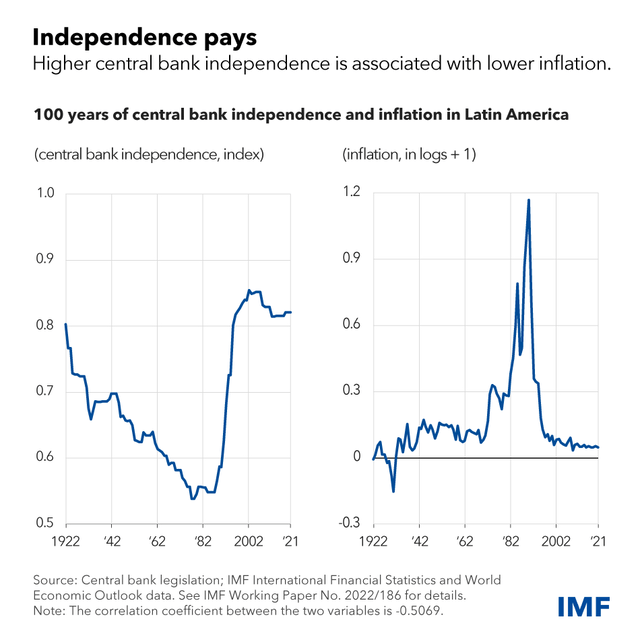

The IMF recently released a report that demonstrates the critical importance of central bank independence. Their study indicated that central banks with high independence ratings produced lower inflation.

Conclusion

In central banking circles, the value of central bank independence is clear. Research shows that those institutions deemed to be independent have better results in achieving their mandates of low inflation and strong economic growth.

Chair Powell, recognizing the potential looming political pressures, has gone on the offensive to fight for Fed independence. By highlighting the need for independence in his Semi-Annual Monetary Policy Report he is taking a proactive position to keep the Fed independent.