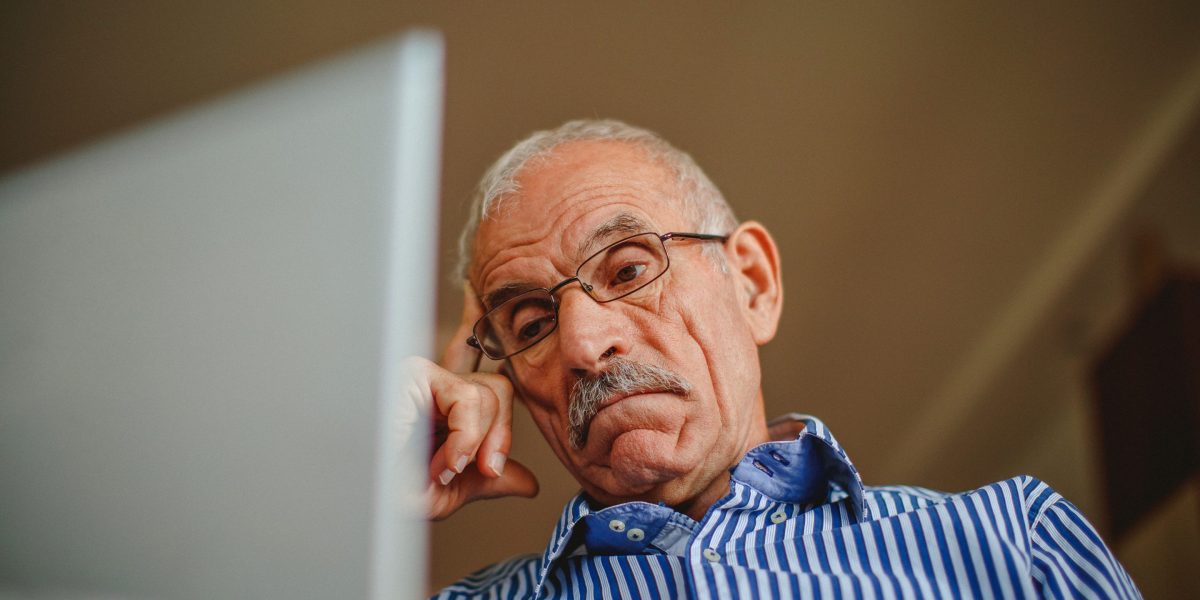

Scammers stole greater than $3.4 billion from older People final 12 months, in response to an FBI report launched Tuesday that exhibits an increase in losses by means of more and more subtle criminal tactics to trick the susceptible into giving up their life financial savings.

Losses from scams reported by People over the age of 60 final 12 months had been up 11% over the 12 months earlier than, in response to the FBI’s report. Investigators are warning of an increase in brazen schemes to empty financial institution accounts that contain sending couriers in individual to gather money or gold from victims.

“It can be a devastating impact to older Americans who lack the ability to go out and make money,” mentioned Deputy Assistant Director James Barnacle of the FBI’s Prison Investigative Division. “People lose all their money. Some people become destitute.”

The FBI acquired greater than 100,000 complaints by victims of scams over the age of 60 final 12 months, with practically 6,000 folks shedding greater than $100,000. It follows a pointy rise in reported losses by older People within the two years after the 2020 coronavirus pandemic, when folks had been caught at residence and simpler for scammers to succeed in over the cellphone.

Barnacle mentioned investigators are seeing organized, transnational legal enterprises concentrating on older People by means of quite a lot of schemes, like romance scams and investment frauds.

Probably the most generally reported fraud amongst older adults final 12 months was tech assist scams, by which criminals pose over the cellphone as technical or customer support representatives. In a single such rip-off authorities say is rising in reputation, criminals impersonate expertise, banking and authorities officers to persuade victims that international hackers have infiltrated their financial institution accounts and instruct them that to guard their cash they need to transfer it to a brand new account — one secretly managed by the scammers.

Federal investigators noticed an uptick between Might and December of scammers utilizing stay couriers to take cash from victims duped into believing their accounts had been compromised, in response to the FBI. In these circumstances, scammers inform victims that their financial institution accounts have been hacked and that they should liquidate their belongings into money or purchase gold or different valuable metals to guard their funds. Then the fraudsters prepare for a courier to select it up in individual.

“A lot of the the fraud schemes are asking victims to send money via a wire transfer, or a cryptocurrency transfer. When the victim is reluctant to do that, they’re given an alternative,” Barnacle mentioned. “And so the bad guy will use courier services.”

Earlier this month, an 81-year-old Ohio man fatally shot an Uber driver he thought was attempting to rob him after receiving rip-off cellphone calls, in response to authorities.

The person had been receiving calls from somebody pretending to be an officer from the native court docket who demanded cash. The Uber driver had been instructed to retrieve a package deal from the person’s residence, a request authorities say was probably made by the identical rip-off caller or an confederate.

The staggering losses to older People are seemingly an undercount. Solely about half of the greater than 880,000 complaints reported to the FBI’s Internet Crime Complaint Center final 12 months included info on the age of the sufferer.