Data is here:

Recap (summary of a Reuters report):

-

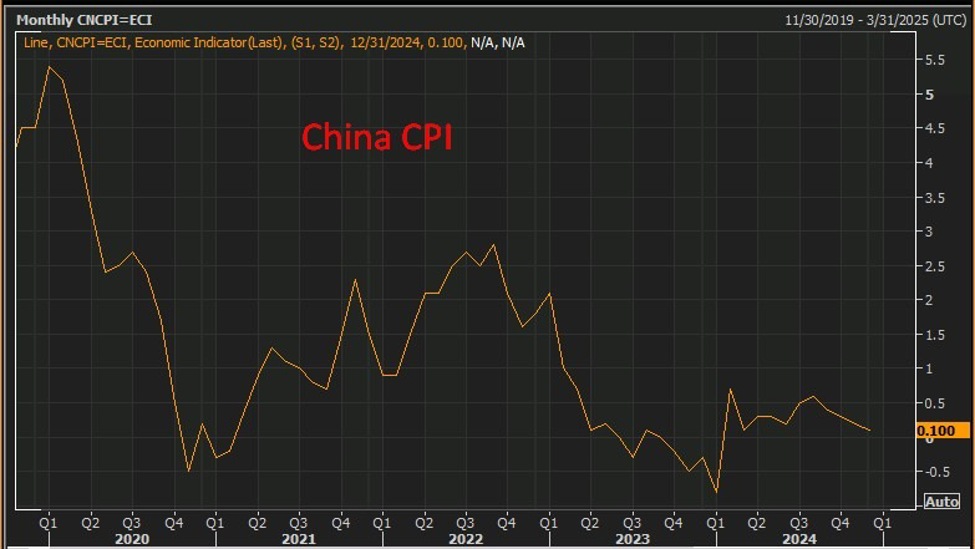

Consumer Price Index:

- China’s CPI rose by 0.2% in 2024, matching the previous year’s growth and falling well below the 3% target.

- December CPI increased by 0.1% year-on-year, slowing from 0.2% in November and marking the weakest pace since April.

- Core inflation, excluding food and fuel, edged up to 0.4% in December, the highest in five months.

-

Producer Price Index:

- Factory-gate prices declined for the 27th consecutive month, with the PPI falling 2.3% in December year-on-year, an improvement from November’s 2.5% decline.

-

Economic Challenges:

- Persistent weak domestic demand is driven by:

- Job insecurity.

- A prolonged housing market downturn.

- High debt levels.

- Uncertainty over U.S. trade policies under President-elect Donald Trump.

- Discounting is widespread across retail sectors, including items like bubble tea and luxury goods, while consumers increasingly rent instead of purchasing discretionary items.

- Persistent weak domestic demand is driven by:

-

Stimulus Measures:

- Policy stimulus has provided temporary support to demand and prices, but analysts expect its effects to fade, with inflation likely to weaken later in 2025.

- Beijing has ramped up fiscal measures, including:

- A record $411 billion in special treasury bond insurance.

- Plans for substantial funding from ultra-long treasury bonds in 2025.

- $41 billion allocated for equipment upgrades and consumer goods trade-ins, including vehicles.

-

Analyst Outlook:

- Economists point to persistent deflationary pressures, with inflation recovery tied to the effectiveness of fiscal policies.

- The property sector downturn continues to drag on consumer confidence.

- While the World Bank has upgraded China’s growth forecast for 2024–2025, subdued household and business sentiment remains a concern.

CPI:

This article was written by Eamonn Sheridan at www.forexlive.com.