China’s CSI 1000 index grabbed some uncommon consideration yesterday because it briefly plunged 8.7%. It is a rarely-talked-about index that is largely pushed by derivatives on small shares so I would not take it as an indicator of a crash.

That stated, it’s actually indicative of the broader ache in Chinese language equities, which can be close to a breaking level.

The principle China inventory market indexes fell round 1% however had earlier fallen by double that earlier than some sturdy late bids which will have been proof that Beijing stepped in for the second day.

Let’s zoom out to see simply how unhealthy it has gotten.

Dangle Seng Index:

Hong Kong Dangle Seng

It could take an additional 5.8% decline to interrupt the October low however beneath that we’re into monetary crisis-era ranges. Hong Kong has been triply hit by covid, China’s takeover of Hong Kong and the newest rout. It is actually an ideal storm and it has the index buying and selling the place it first did in 1997.

Shanghai Composite:

Shanghai Composite month-to-month

This to me is one of the best measure of ‘China shares’ and it isn’t as unhealthy as Hong Kong however it’s actually not a fairly image. The 2020 lows broke this week and it seems that’s what introduced the Nationwide Crew into the combo. If the 2646 stage is damaged, that clears the way in which to a visit to 2018 lows, which is a 9.6% decline from right here. On the upside, you may draw a messy uptrend from the 2005 lows to point some help close to right here. Would I try this? Completely not.

CSI 300:

CSI 300 month-to-month

This index is on monitor for a seventh straight month of losses, in a reminder of simply how unhealthy it is gotten in China. If there is a silver lining, the 2016 and 2019 lows begin 8.2% decrease and will show to be a sturdy base. If not, the 2014 lows are practically 40% decrease.

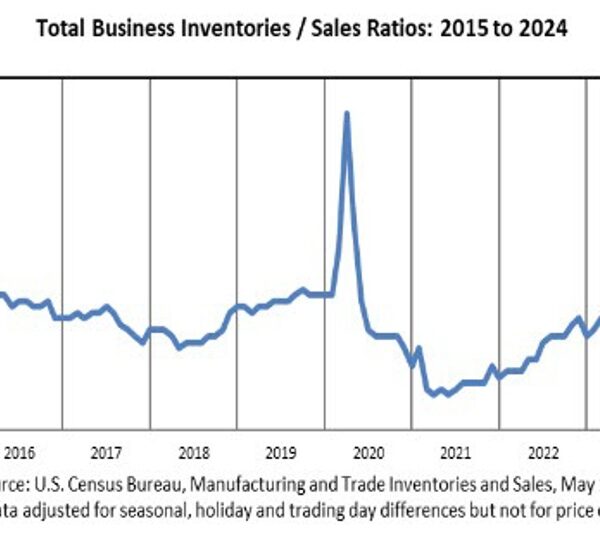

Including all of it up

One of the best technical guess for the bulls proper now could be that the Nationwide Crew will not let the Shanghai Composite shut beneath the 2020 lows. However I do not see how that is a sustainable resolution. What these three markets really want is for a concerted effort from Beijing to spice up the economic system through fee cuts, fiscal stimulus and a few type of clean-up within the monetary sector. That is inevitably coming with inflation zeroed out in China and the economic system sagging however that is extra of a case of ‘I am going to consider it once I see it” because these indexes could still fall deeply form here (and quickly).

Note that a week of holidays starts this weekend (Friday if we’re being realistic) so time is running out. One specific stock that’s getting plenty of chatter is Alibaba, which reports earnings on February 7. If that stock can bottom, perhaps the rest of the market can too? If you look at its P/E net of cash or its free cashflow yield, it’s compelling.

But it surely’s greatest to not be this man.