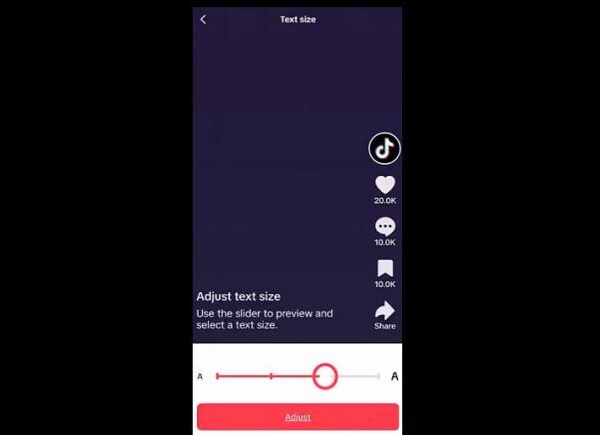

Individuals store for Spring Pageant ornaments at a market in Zixing metropolis, Central China’s Hunan province, Feb 4, 2024.

CFOTO | Future Publishing | Getty Photographs

China’s producer costs declined for a sixteenth month in January, whereas shopper costs slipped for a fourth month. The information underscore the depth of the problem that Beijing faces in reflating the world’s second-largest financial system.

China’s producer worth index fell 2.5% in January from a 12 months earlier, the Nationwide Bureau of Statistics reported Thursday, barely higher than expectations for a 2.6% decline, after a 2.7% drop in December.

The nation’s shopper worth index fell 0.8% in January on an annual foundation, greater than the median estimate for a 0.5% decline in a Reuters ballot. CPI slipped 0.3% in December. On a month-to-month foundation although, CPI climbed 0.3% in January from December, barely weaker than median expectations for 0.4% progress.

NBS mentioned January’s inflation knowledge was influenced by the excessive base impact of Spring Pageant or the Lunar New Yr, which fell in January a 12 months in the past. The pageant falls in February this 12 months.

Core CPI — which excludes power and meals costs — climbed 0.4% in January from a 12 months earlier, the bureau mentioned in a separate statement. On a month-to-month foundation, this translated right into a 0.3% progress in January from December, NBS mentioned.

Thursday’s inflation print emphasize lingering fears China is tethering on the verge of deflation. Tepid costs spotlight what China’s prime leaders labeled as a “tortuous” financial restoration after the nation emerged from its draconian zero-Covid curbs towards the tip of 2022.

China stands as a stark outlier among the many world’s main economies, that are largely battling stubbornly excessive inflation. The most recent official and private surveys of producing exercise confirmed that rising market competitors has restricted the bargaining energy of Chinese language corporations, miserable output costs.

Client confidence and broader progress within the Chinese language financial system have been onerous hit by a property market slump after Beijing cracked down on builders’ excessive reliance on debt for progress in 2020.

It is a growing story. Please test again for extra updates.